The Brick Breakdown

Hello Brick Brief readers,

Happy Monday. In recent news, we’re seeing a selective CRE recovery, multifamily rent growth remain constrained by oversupply, a $3T digital infrastructure investment cycle, and Fed Chair Jerome Powell subpoenaed by the DOJ.

🏗️ CRE Recovery Is Selective, Not Broad

According to Hines, U.S. real estate has stabilized and entered a selective recovery phase, led by multifamily and supported by niche improvements in office; returns will depend on income growth and asset quality rather than cap rate compression. Trepp sees 2026 as a sorting year, as capital flows toward high-quality assets while weaker properties face refinancing pressure; workouts or liquidation remain more likely than a broad-based rebound.

🏢 Multifamily Is Stabilizing With Constraints

U.S. multifamily rents ended 2025 up just 0.7%, as oversupply capped national growth; the Midwest and Northeast outperformed, while rents declined across much of the South and West. Looking into 2026, labor softness, cautious consumer sentiment, slower migration, and student loan drag should restrain pricing power even as new deliveries fall; CoStar expects rent growth to modestly reaccelerate toward ~1% by year end.

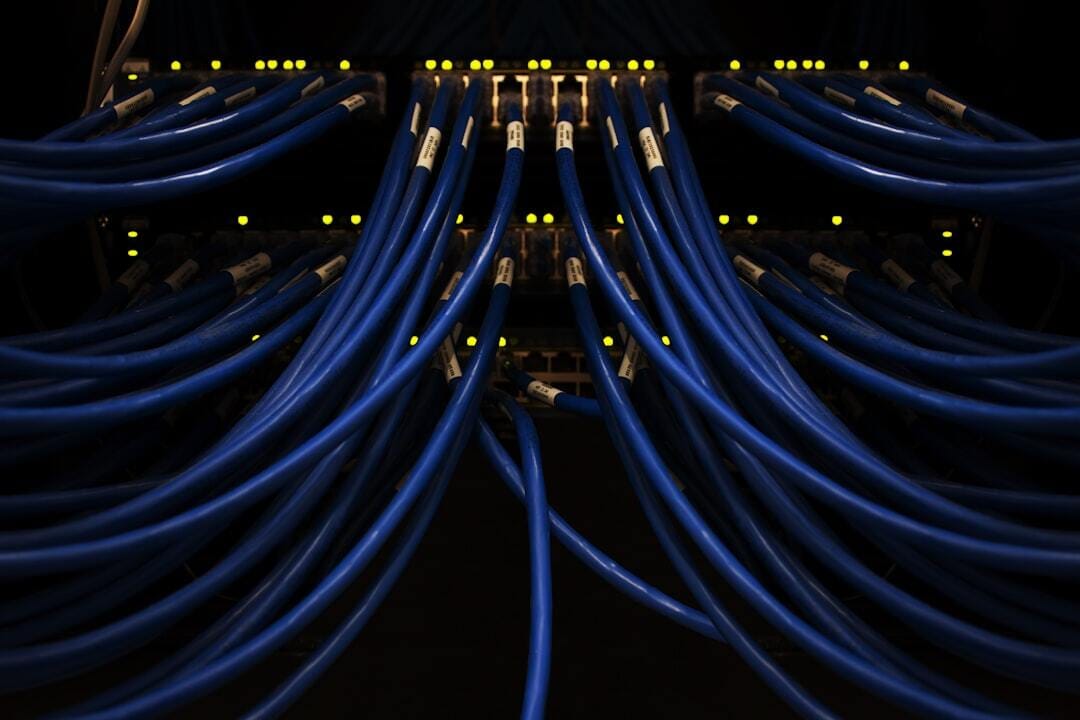

⚡ Data Centers Are Driving the Next Cycle

JLL anticipates global data center capacity will roughly double by 2030, with nearly 100 GW of new supply growing at a 14% CAGR, fueled by a ~$3T digital infrastructure investment cycle. In recent data center developments, xAI is targeting up to $20B for a Mississippi expansion approaching ~2GW of compute capacity, while data center power equipment maker Forgent filed for a U.S. IPO after posting 84% YoY revenue growth driven by AI-related power demand.

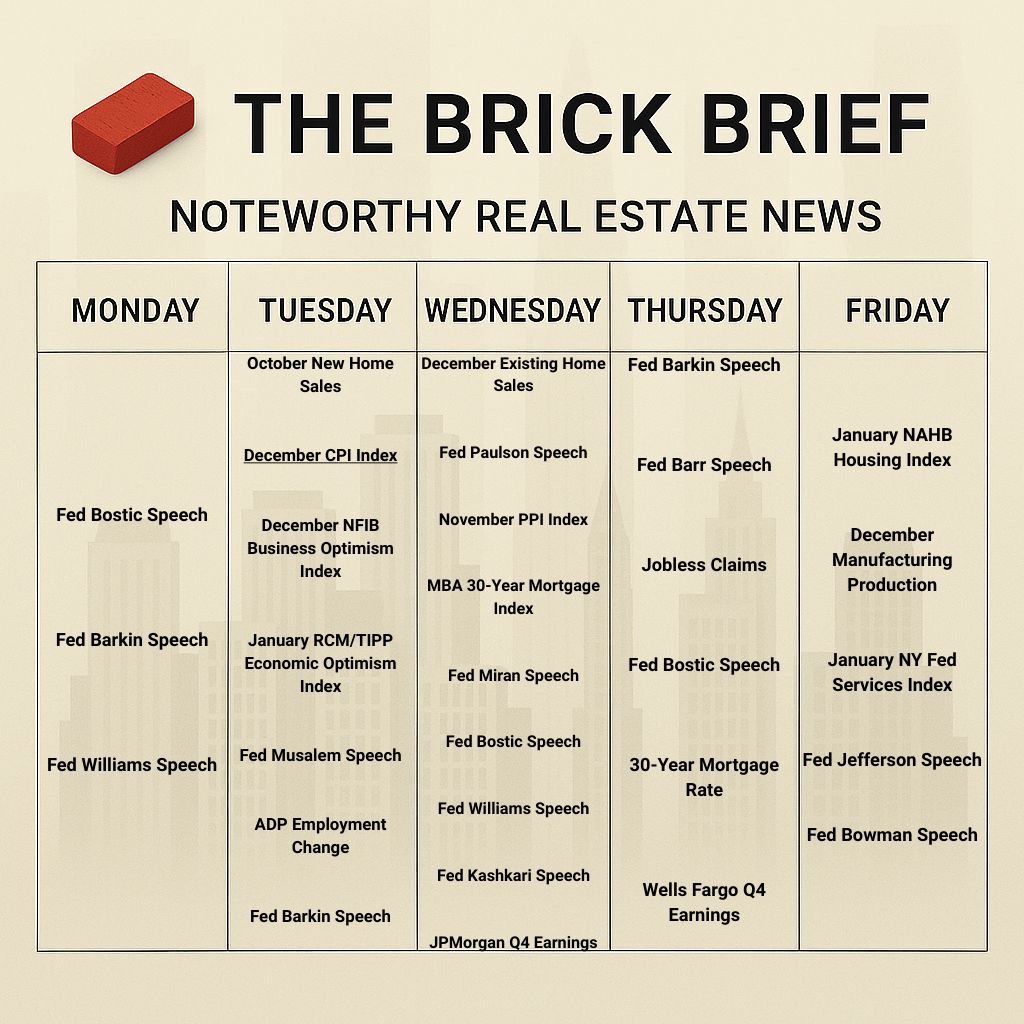

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.06% (-15 bps)

10Y Treasury Yield: 4.17% (-1 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 758.68 (+0.97%)

30-day SOFR Average: 3.73%

Market Pulse & Rate Watch

Powell served with DOJ subpoenas tied to June testimony on Fed HQ renovations – The grand jury probe centers on alleged inconsistencies over project costs that rose to $2.5B from $1.9B (Bloomberg)

Core inflation likely ticked higher to 2.7% YoY in December – A 0.3% monthly gain is expected, as November’s data understated price pressures (Bloomberg)

Labor’s share of US GDP fell to a record low of 53.8% in Q3 – Wages continue to lag corporate profits as productivity rose at the fastest pace in two years, partly driven by increased AI adoption (Bloomberg)

Fed’s Barkin flags continued low-hiring environment – December payrolls rose just 50,000 while the unemployment rate edged down to 4.4% (Bloomberg)

Fed’s Bostic says inflation remains the Fed’s top challenge – The Atlanta Fed chief said price pressures remain more concerning than labor market conditions (Reuters)

U.S. consumer sentiment rose to 54.0 from 52.9 in early January – One-year inflation expectations held steady at 4.2% (Reuters)

Market Mix

Hines says U.S. real estate is stabilizing and entering a recovery phase – Multifamily leads and selective office opportunities are emerging; returns depend on income growth and fundamentals rather than cap rate compression (Hines)

Trepp sees 2026 as a sorting year for CRE – Capital will flow to high-quality assets while weaker properties face refinancing, workouts, or liquidation instead of a broad rebound (Trepp)

Trepp expects CMBS issuance to approach ~$130B in 2026 – Heavy maturities and sponsor-backed SASB deals will keep securitization central to refinancing activity (Trepp)

Trepp forecasts CRE stress will persist in 2026 but remain contained – Office delinquencies will stay elevated while property values edge higher on NOI growth rather than cap-rate compression (Trepp)

Bisnow survey sees higher deal volume in 2026 with rate cuts ahead – More than two-thirds of CRE respondents expect activity to rise; ~75% anticipate two or more Fed cuts, while though tariffs, policy uncertainty, and AI remain key risks (Bisnow)

U.S. construction employment fell by 11,000 jobs in December – The sector added just 14,000 jobs in 2025, marking its weakest annual hiring performance since 2011 as policy uncertainty and labor constraints weighed on demand (Bisnow)

Residential

Trump rolls out buyer-focused housing push – The administration is prioritizing lower mortgage rates and near-term buyer incentives while leaving the underlying housing supply shortage largely unaddressed (WSJ)

Fed’s Bostic and Barkin say housing affordability is a supply problem – The two Fed officials downplayed the impact of Trump’s $200B mortgage bond plan, arguing that adding homes matters more than lowering financing costs (Reuters)

Cotality says Trump’s proposed ban on institutional homebuyers would have little impact on affordability – Large investors account for only ~2% of U.S. home purchases, limiting pricing relief while raising risks of tighter rental supply (HousingWire)

Recent buyer-focused housing affordability rhetoric includes $200B in mortgage bond purchases and a proposal to ban large investors from buying single-family homes. The $200B plan would compress spreads between agency MBS and Treasuries and temporarily lower mortgage rates, while banning institutional buyers aims to reduce competition despite their limited share of total purchases.

Jerome Powell, however, stated at the December rate meeting that housing affordability is fundamentally a supply problem, a view echoed by Raphael Bostic and Thomas Barkin, who argue that adding homes matters more than buyer-side interventions.

Housing inventory growth slows to ~10% YoY – Supply momentum cooled sharply from ~33% last year as mortgage rates hover near 6%, price cuts rise to ~35%, and new listings remain below normal heading into 2026 (HousingWire)

The direct correlation between lower mortgage rates and higher housing inventory should be minimal, as lower rates affect buyers. What’s more likely happening is that sellers would need to take price cuts to what they believe their homes are worth based on 2021 peak pricing, but because they’re locked into ultra-low mortgage rates (lock-in effect), they don’t have to sell and instead choose to wait, which is why inventory growth is slowing even without a meaningful demand rebound.

New home construction slowed to a 2025 low in October – Housing starts fell 7.8% YoY, the weakest pace since May 2020, as builders pulled back amid soft demand and excess inventory in the South and West (Realtor.com)

Zillow sees a cautious 2026 housing outlook – Slowing job growth of 50,000 in December could limit buyer and seller activity even as affordability improves and mortgage rates ease (Zillow)

Build-to-rent expands as scrutiny on single-family rentals rises – BTR accounts for roughly 7% of single-family starts with about 71,000 units delivered over the past year, concentrated in the South (Bisnow)

Multifamily

U.S. multifamily rents ended 2025 up just 0.7% – Oversupply capped national growth despite a 0.1% December uptick; Midwest and Northeast outperformed while rents fell in the South and West (Apartments.com)

Key 2026 apartment headwinds include: labor, sentiment, migration, debt, and supply – Slower job growth, cautious consumers, reduced migration, student loan drag, and delayed absorption from prior supply are expected to cap rent growth even as new deliveries ease (RealPage)

CoStar’s 2026 multifamily outlook sees rent growth reaccelerating modestly – National rent growth is expected to rise toward ~1% by year-end as supply additions fall sharply, though pricing power remains limited (Apartments.com)

CoStar’s 2026 multifamily outlook sees supply easing without vacancy tightening – New deliveries are expected to drop more than 40% YoY while vacancy remains near ~8.5%, delaying a true tightening cycle (Apartments.com)

CoStar’s 2026 multifamily outlook sees continued regional divergence – Bay Area markets are expected to lead rent growth on tech-driven demand and limited supply, while Sun Belt metros remain pressured by lingering oversupply (Apartments.com)

Office

Leasing

OpenAI in talks to sublease ~250K SF of former Dropbox HQ offices at 1800 Owens Street in San Francisco, CA -- Deal would push OpenAI’s Mission Bay footprint past ~1M SF as the firm continues expanding in the district (TheRealDeal)

CRC Group signs 49K SF lease at Lakeside Square at 12377 Merit Drive in North Dallas, TX -- Acram Group’s 409K SF office building rises to ~85% occupancy (TheRealDeal)

Industrial

U.S. factory employment keeps falling despite tariff push – Manufacturing lost another 8,000 jobs in December and is down more than 70,000 since April, extending an eight-month decline (Reuters)

Truck transportation jobs stagnate at 2021 lows – U.S. trucking employment held flat in December at ~1.51M jobs while warehouse payrolls fell again, reinforcing a slow freight recovery and keeping pressure on logistics capacity into early 2026 (FreightWaves)

Pre-tariff front-loading pulled production and freight activity forward earlier in the year. Reshoring and an anticipated manufacturing rebound remain tied to pharmaceutical investments and newly announced factories that are still in the planning and construction phase and have yet to translate into sustained job growth.

Retail

Bob’s Discount Furniture files for IPO with revenue up ~20% YoY – Store expansion and value-focused demand lifted revenue to $1.72B over the first nine months of 2025 (Bloomberg)

Qdoba Mexican Eats is planning a U.S. expansion with a Chicago-area push – The chain targets ~100 openings annually by 2027 and aims to double its ~840-store footprint by 2032 through franchise growth (CoStar)

Massachusetts approves cannabis lounges statewide – Regulators cleared social consumption permits but expect 12–18 months before the first lounges open as municipalities decide whether to opt in (Bisnow)

Data Centers

Global data center capacity set to double by 2030 – JLL forecasts nearly 100 GW of new supply growing at a 14% CAGR, underpinning a $3T digital infrastructure investment cycle (Bisnow)

xAI plans up to $20B Mississippi data center expansion – The project targets ~2GW of compute capacity for its Colossus supercomputer (Bisnow)

Data center power equipment maker Forgent files for US IPO – Revenue surged 84% YoY to $283M in the September quarter as AI-driven data center power demand accelerates (Bloomberg)

Financings

Refinancings

Wells Fargo provides $250M bridge loan refinancing for newly completed multifamily development AtlanticBK in Brooklyn, NY - The financing backs Douglaston Development’s 456-unit mixed-income project at 1057 Atlantic Avenue in Bedford-Stuyvesant (CommercialObserver)

Rialto Capital provides a $113M refinancing for Harman-leased mixed-use campus known as The Mix in Los Angeles, CA - The financing backs Pendulum Property Partners and Affinius Capital’s ~470K SF three-building complex in Northridge following an office-to-industrial conversion (CommercialObserver)

Apollo and CenterSquare Investment Management provide $106M bridge loan refinancing for newly constructed industrial warehouse in Hudson Valley, NY - The financing backs Lincoln Equities Group’s Building B at Interstate Crossings in Brewster with future funding through lease-up (CommercialObserver)

Banco Santander provides $65M bridge loan on Brickell development site in Miami, FL under contract to sell – Claudio Fischer is using the loan to carry the 1-acre site until it sells, with repayment expected at closing (TheRealDeal)

M&A

Company M&A

MCB Real Estate acquires Epic Real Estate Partners for $575M, adding 2.2M SF of grocery-anchored retail across 15 shopping centers in 10 states – The deal expands MCB’s retail footprint and lifts firmwide AUM to ~$4B; acquired portfolio is ~92% leased (Bisnow)

Epic Real Estate’s portfolio is concentrated in Sun Belt growth markets such as Texas, Florida, and Arizona.

There’s been a flood of recent headlines on grocery-anchored retail due to rising investor interest in the asset. Grocery stores drive repeat, necessity-based visits that create a reliable base of foot traffic for surrounding tenants, which helps grocery-anchored centers outperform other retail formats across economic cycles.

$1.6B Compass–Anywhere merger clears without full antitrust probe – Senior Justice Department officials overruled staff objections; Compass and Anywhere Real Estate will control nearly 20% of U.S. home sales volume (WSJ)

Building & Portfolio M&A

Multifamily

TruAmerica acquires 179-unit multifamily property The Stō at 1779 Central Street in Stoughton, MA from John M. Corcoran & Co. for $63M - The deal prices the Boston-area asset at ~$352K per unit as TruAmerica expands deeper into supply-constrained Greater Boston markets (TheRealDeal)

Distress Watch

Starwood Capital Group takes back mixed-use tower The National at 1401 Elm Street in Dallas, TX via foreclosure from Todd Interests – Elevated interest rates, falling downtown values, and sub-80% apartment occupancy wiped out remaining equity on the ~$230M loan tied to the ~$460M redevelopment (TheRealDeal)

Summit Properties USA set to acquire ~5,000 mostly rent-stabilized NYC apartments from Pinnacle Group via bankruptcy auction with $451M stalking-horse bid -- Judge cleared the sale despite city objections as rent-stabilized distress deepens (TheRealDeal)