The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing institutional capital flood into industrial outdoor storage, Atlanta push back on corporate single-family landlords, and the San Francisco Fed argue that income growth is the main driver of metro housing price gaps.

🏠 Income Growth Explains The Sharpest Housing Price Gaps

A study from the San Francisco Fed argues that housing affordability differences across metro areas are driven more by income and labor market demand than uniquely binding housing supply constraints. As high end wage growth rises, buyers bid up scarce desirable locations and home prices move almost one for one with average incomes even when housing units keep pace with modest population growth.

📦 Capital Continues To Flood Into Industrial Outdoor Storage

Capital is continuing to flood into industrial outdoor storage as institutional investors scale into the sector; Steel Peak and Tarsadia Investments announced an IOS JV targeting a $500M Western U.S. portfolio. Recent IOS capital flows also include Brookfield’s expansion through its $1.2B acquisition of Peakstone Realty Trust and Catalyst Investment Partners, which closed an oversubscribed $400M third IOS fund above its hard cap.

🏘️ Atlanta Pushes Back On Corporate Single Family Landlords

Atlanta is pushing back on institutional single family landlords as investor ownership has climbed above 30% of single-family rentals in the metro, raising local concerns about housing costs and neighborhood stability. Local governments are tightening rules on build-to-rent subdivisions and Georgia lawmakers are proposing caps that would block businesses from owning interests in more than 500 single-family homes.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.11% (-5 bps)

10Y Treasury Yield: 4.14% (-6 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 805.03 (+1.45%)

30-day SOFR Average: 3.66%

Market Pulse & Rate Watch

January CPI could print hotter than expected despite cooling trend – Residual seasonality and tariff-linked postholiday price resets may lift goods prices, keeping the Fed cautious on rate cuts (WSJ)

Market Mix

CRE debt maturities fall 9% YoY to $875B as refinancing wave eases – MBA expects loan originations to jump 27% to $805B in 2026 even with $167B of office loans still maturing (Bisnow)

Policy & Industry Shifts

FHFA rolls back 2024 fair housing oversight rules for Fannie and Freddie – Agency cites new federal limits on equity-focused mandates as advocates warn weaker accountability for underserved borrowers (Bisnow)

Atlanta pushes back on corporate single-family landlords as investor ownership tops 30% of rentals – Local governments are tightening rules on build-to-rent subdivisions and considering caps on large investors (Bloomberg)

Institutional single family rental owners, such as Blackstone, Progress Residential, and Amherst, own over 30% of single-family rentals in the Atlanta area. When concentration is that high, local affordability effects in specific submarkets can become noticeable. Bloomberg argues that investors can outcompete households with cash offers and cluster ownership in certain ZIP codes, tightening the supply of homes for sale even if institutions remain only ~3% of owners nationally.

Residential

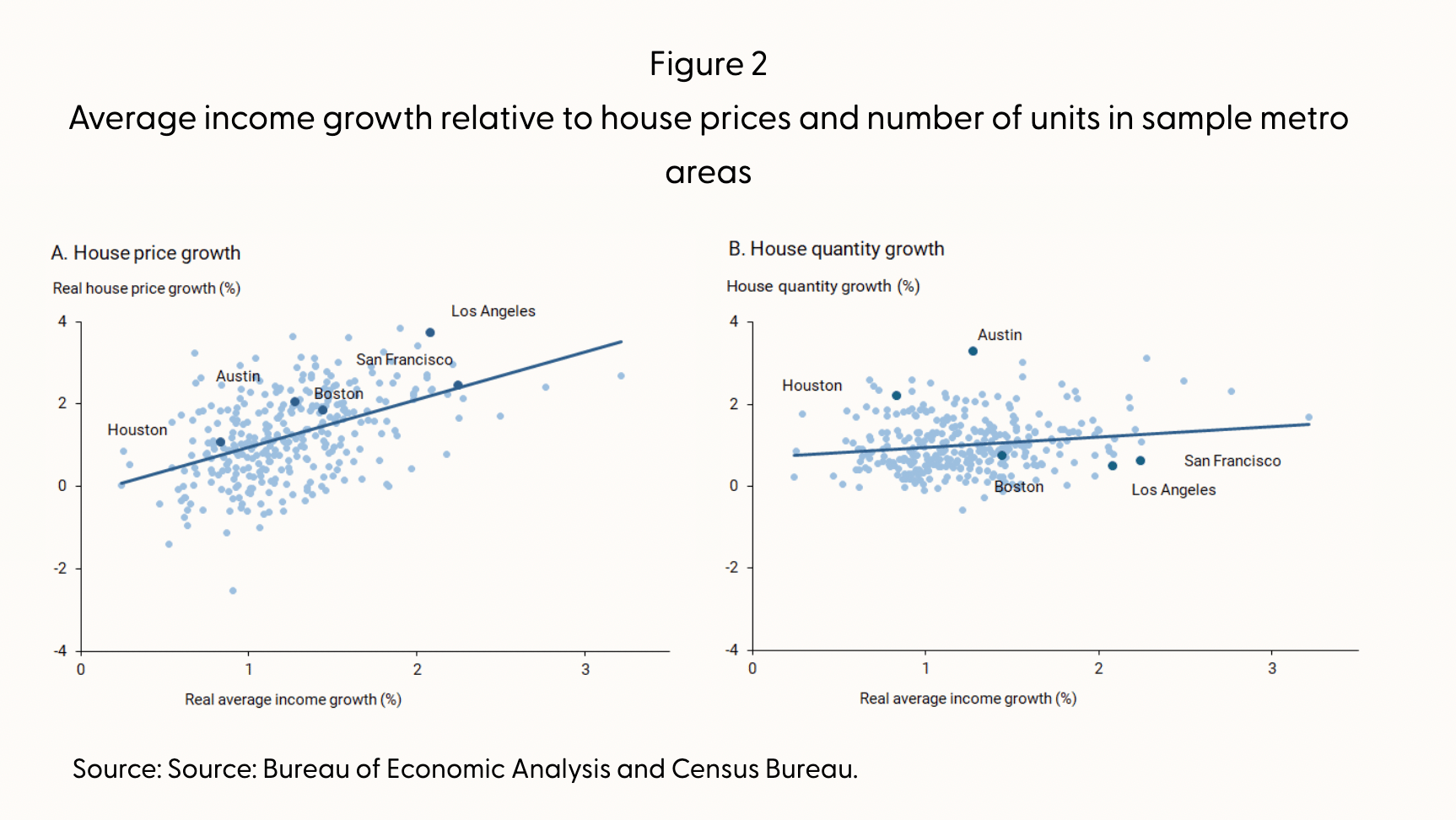

Home prices are tracking income growth more than housing shortages – Researchers show prices move one-for-one with average incomes while housing supply responds mainly to population growth (FRBSF)

The San Francisco Federal Reserve Bank argues that housing affordability differences across metro areas reflect demand driven by income and labor market dynamics rather than uniquely binding housing supply constraints. As high-income wage growth drives demand for limited housing in the most desirable locations, prices can surge even if the number of housing units does not. Because these specialized jobs attract fewer total new residents than broad-based job growth, population growth stays modest and housing supply largely keeps pace, leaving prices to absorb the demand pressure.

San Francisco and coastal California may be a good case study of what they describe here - high income growth and modest population growth.

Movers are leaving hot, expensive metros for cooler and more affordable markets since 2022 – Zillow migration data shows flows flipped toward lower-heat metros as mortgage rates surged and affordability became the dominant driver (Zillow)

Refinance locks jumped 50% in January as mortgage rates dipped below 6% – Optimal Blue data shows rate-and-term refis surged, while purchase demand stayed muted despite improving affordability (HousingWire)

Multifamily

Banks are loosening multifamily lending standards for the 11th straight quarter as credit rebounds – Trepp-i spreads tightened to 160.7 bps, near the February 2022 record, signaling lenders are actively deploying apartment debt (Trepp)

Industrial

Saint-Gobain invests $7B in North America to expand prefab building systems and U.S. manufacturing footprint – Company says factory-built panels can cut homebuilding cycle times 30% to 50% while reducing tariff exposure through local production (CNBC)

Battery manufacturers pivot from EV demand to AI-driven energy storage buildout as data centers surge – CRU says 10 North American plants are being retooled for storage cells as ESS revenues jump and policy support for EVs weakens (FT)

Retail

Core US retail sales fell 0.1% in December as consumer spending cooled – Softer wage growth and weaker big-ticket demand signaled fatigue heading into 2026 (Reuters)

Kering CEO says Saks Global crisis shows department store model needs reinvention – Gucci owner is cutting reliance on wholesale as traditional retail distribution weakens (Reuters)

Dollar Tree pushes into affluent ZIP codes to capture higher-income shoppers – Households earning $100K+ drove 60% of its 3M new customers as the chain targets faster growth and bigger baskets (Bisnow)

CAVA traffic rose 16.6% YoY in Q4 2025 as expansion and loyalty upgrades sustained fast-casual momentum – Brand is re-engaging younger urban diners while broadening into more resilient suburban segments (Placerai)

Sweetgreen visits grew 4.4% YoY in Q4 2025 as value promos like the $10 Harvest Bowl and refreshed loyalty helped offset softer same-store trends – Chain is recapturing Gen Z traffic while gaining share among wealthier suburban families (Placerai)

Data Centers

Microsoft is testing high-temperature superconductor cables to boost data center power density – Technology could shrink transmission infrastructure as data centers are projected to consume 12% of US electricity by 2028 (Reuters)

Duke Energy signs deals with Microsoft and Compass to power North Carolina data center buildout – Utility’s contracted data center load rises to 4.5 GW as AI demand surges (Bloomberg)

Financings

Alphabet sells $32B global bond package to fund $185B AI capex plan in 2026 – Record sterling and Swiss franc sales included rare 100-year note as hyperscalers ramp borrowing (Bloomberg)

Loans

Madison Realty Capital and KSL Capital Partners provide $371.5M construction loan for Nashville Edition Hotel & Residences luxury hotel project in Nashville, TN – Financing backs Tidal Real Estate Partners’ 28-story Gulch tower featuring 261 rooms and 64 branded residences (CommercialObserver)

BDT & MSD Partners and Apollo Global Management provide $86M construction loan for Phase I of The District mixed-use development in Round Rock, TX – Financing backs Mark IV Capital’s 316-unit multifamily and 23K SF retail build near Dell headquarters (TheRealDeal)

Bushburg secures $78M financing package from Oak Funding and OakNorth Bank for 100 William Street office-to-residential conversion in Manhattan, NY – Loan supports Financial District redevelopment into 400 apartments as capital accelerates Lower Manhattan housing supply pipeline (GlobeSt)

Willco secures $64M permanent financing package for Elle high-rise residential conversion project in Washington, DC – Financing supports 163-unit redevelopment of former Peace Corps HQ in Golden Triangle with 8,000 SF retail (ConnectCRE)

Refinancings

Affinius Capital provides $115M refinancing loan for 162 East 36th Street luxury rental development in Manhattan, NY – Financing backs Ranco Capital and Gilar Realty’s 160-unit Murray Hill tower expected to complete construction in 2026 (TheRealDeal)

MF1 Capital and Pearlmark provide $50.5M refinancing package for Crosby Hills Apartments multifamily property in Wilmington, DE – Financing backs Buccini Pollin Group’s 203-unit Downtown Wilmington asset, which was delivered in 2023 (CommercialObserver)

Structured Finance

Ares provides $2.4B debt package to Vantage Data Centers to fund AI-linked buildout – Financing supports 17-campus portfolio tied to major cloud tenants and potentially Oracle’s OpenAI infrastructure push (Bloomberg)

Brookfield’s Compass securitizes 6 fully leased hyperscale data centers to raise $830M – $3.6B portfolio spans 198 MW; data center ABS issuance is accelerating toward a projected $50B in 2026 (Bisnow)

M&A

Building & Portfolio M&A

Life Science

Kilroy Realty buys 230K SF life sciences campus in Torrey Pines from undisclosed seller in San Diego, CA for $192M – Purchase adds four-building lab portfolio near La Jolla as Kilroy upgrades its San Diego footprint (TheRealDeal)

Multifamily

Intercontinental Real Estate and Magellan buy 322-unit apartment tower at 73 East Lake Street from M&R Development in Chicago, IL for $126M – Deal marks priciest Chicago multifamily trade of 2026 at ~$380K per unit as downtown supply pipelines dry up (TheRealDeal)

Office

Kilroy Realty sells 430K SF office campus on Evening Creek Drive North to undisclosed buyer in San Diego, CA for $124.5M – Disposition trims under-occupied I-15 Corridor space as Kilroy continues shedding non-core offices (TheRealDeal)

CoreSite buys three-building office portfolio at 2805 and 2855 Bowers Avenue and 2710 Walsh Avenue from GI Partners in Santa Clara, CA for $100M – Deal positions 2021-vintage South Bay assets for potential data center redevelopment (TheRealDeal)

Land

Tavros buys development site at 250 Water Street in Manhattan, NY from undisclosed seller for $143M – Deal positions Seaport District block for planned 600-unit mixed-use residential project (IREI)

Institutional Fundraising

Arselle and Amoroso launch Amonte Living to target $500M West Coast multifamily buys – Venture is betting apartment values remain below peak and pressure on overleveraged owners will drive discounted acquisitions (CoStar)

Steel Peak and Tarsadia Investments launch Industrial Outdoor Storage JV targeting $500M+ portfolio across Western U.S. markets – Partners plan to deploy $150M in 2026 as IOS attracts institutional capital and standardized pricing (GlobeSt)

Additional recent IOS news include:

Catalyst Investment Partners closed an oversubscribed $400M third IOS fund, exceeding the fund’s hard cap

Brookfield Asset Management recently agreed to acquire IOS-focused REIT Peakstone Realty Trust for $1.2B