The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing homebuyers stay cautious despite lower September mortgage rates, multifamily construction hold steady at high levels, and banks ramp up branch expansion to compete for deposits.

🏠 Housing Market Stalls Despite Lower Rates

Buyers remain discouraged despite a 50-basis-point drop in mortgage rates because home prices have barely moved, keeping affordability tight. High costs and inspection issues pushed 15.1% of home-purchase contracts to fall through in August, marking the highest August cancellation rate since 2017.

🏢 Multifamily Supply Outpaces Rent Growth

Developers delivered 105,525 new apartments in Q3, keeping supply elevated for the tenth straight quarter while rents fell 0.3%, the first third-quarter decline since 2009. Oversupply in the South and West continues to weigh on pricing even as new starts drop to decade lows and demand absorbs existing units.

🏦 Banks Return to Main Street for Deposits

After a decade of branch closures driven by digital banking, higher rates are pushing banks to rebuild their retail footprint to secure deposits. Fifth Third’s $10.9B Comerica deal and JPMorgan’s 500-branch expansion show how major lenders are using physical branches to strengthen local ties and stabilize funding.

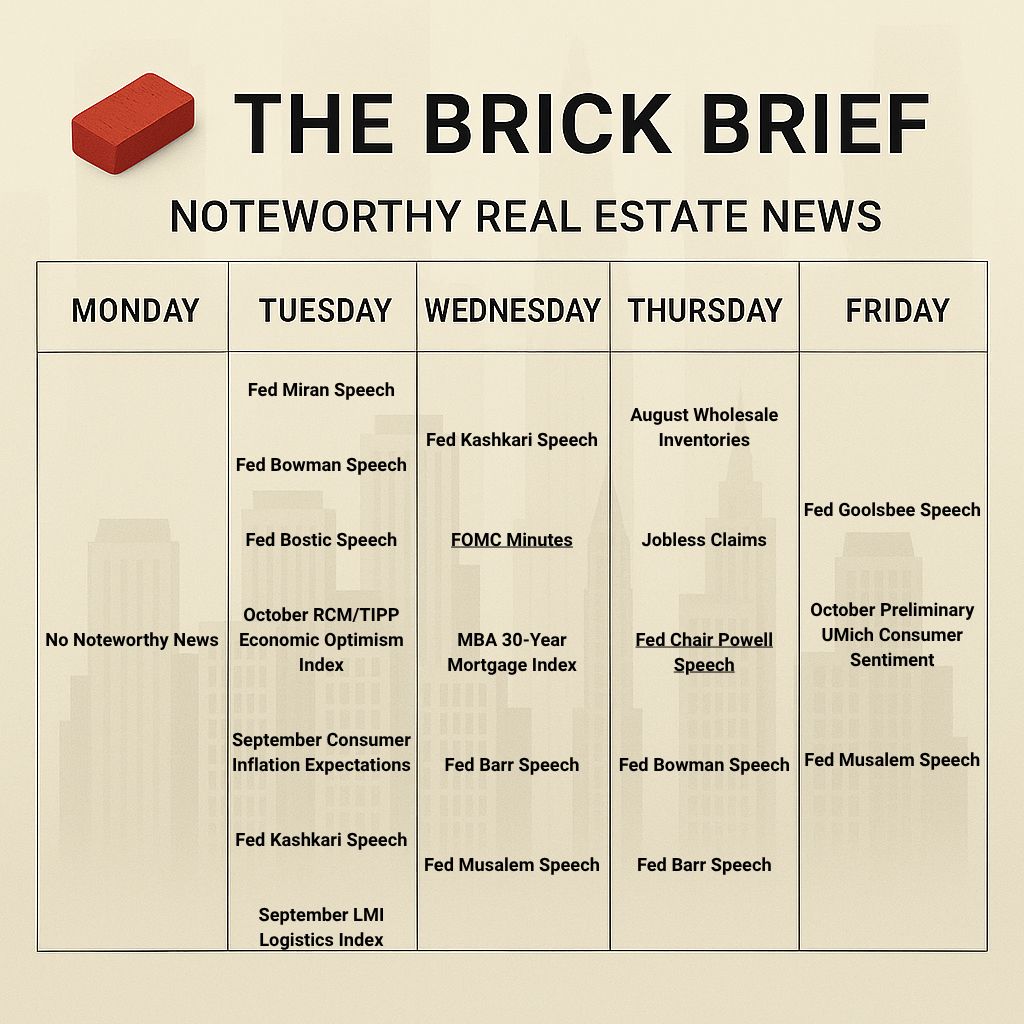

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.38%

10Y Treasury Yield: 4.13% (-3 bps)

WSJ Prime Rate: 7.50%

FTSE NAREIT Index: 767.09 (-0.32%)

30-day SOFR Average: 4.26%

Market Pulse & Rate Watch

Americans grow more worried about the job market in September – NY Fed survey shows rising unemployment expectations and weaker household outlook (Reuters)

Carlyle reports weak U.S. hiring during shutdown – The firm estimates just 17K jobs added in September despite solid GDP growth and an AI-driven investment boom widening the gap between output and employment (Reuters)

Fed’s Kashkari says AI isn’t replacing workers yet – Minneapolis Fed president warns massive AI data center investment could keep borrowing costs elevated even as rates fall (Reuters)

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Brick by Brick: Banks Rebuild Their Retail Footprint

For more than a decade, banks have closed branches to cut costs and move customers online. Low rates and abundant liquidity made digital banking efficient, but it weakened their physical ties to communities. The National Community Reinvestment Coalition reports that banks shut down over 13,400 branches between 2008 and 2020, a 14% decline, while the Philadelphia Fed finds another 5.6% drop from 2019 to 2023 that created 217 new banking deserts.

🧱 Why Banks Are Expanding Again

In the low-rate era, banks could gather deposits cheaply without maintaining large branch networks, but that dynamic has shifted. Higher rates have made deposits both scarce and valuable, as customers move money into higher-yield accounts outside traditional banks. To compete, banks are expanding again using physical branches to secure stable, relationship-based deposits that strengthen funding and sustain lending margins.

🧱 Big Banks Lead the Expansion Cycle

JPMorgan is planning 500 new branches by 2027, Bank of America is targeting 150, and PNC is aiming for 220 by 2030. Each bank is doubling down on high-growth regions like Texas, Florida, and the Carolinas, where rising populations and business formation offer rich opportunities for deposit growth and lending expansion.

🧱 Fifth Third’s $10.9 Billion Comerica Deal Highlights the Trend

Fifth Third’s merger with Comerica centers on one core objective: expanding its retail footprint in the country’s fastest-growing markets. Executives identified branch presence as the key to deposit growth, citing Comerica’s 355 locations across Texas and California as the deal’s strategic foundation. CEO Timothy Spence called Comerica’s network “No. 1 among regional peers,” emphasizing that its reach across 17 of the 20 fastest-growing U.S. markets positions Fifth Third for long-term growth. The bank plans 150 additional branches in Texas by 2029, building on a model that already sees new locations average $25 million in deposits within their first year.

🧱 Branches Anchor Modern Banking Models

Even in a digital-first era, customers still value personal contact when making financial decisions. Small-business owners, mortgage borrowers, and wealth clients often start relationships face-to-face before transitioning online. Branches remain the foundation for winning deposits, building trust, and maintaining client loyalty through economic cycles.

Takeaway: After years of closures due to the growth of digital banking, banks are returning to Main Street. The Fifth Third–Comerica merger and the new branch programs from the nation’s largest lenders reveal a renewed focus on community presence. In an age of digital convenience, banking maybe pivoting back to human connections, where relationships and local trust drive deposits, stability, and long-term growth.

Policy & Industry Shifts

Government shutdown’s direct CRE impact seen as limited – Marcus & Millichap said most operations remain unaffected, though a prolonged closure could disrupt HUD rent payments and weaken business confidence (ConnectCRE)

Residential

15.1% of home-purchase contracts fell through in August – Redfin reports 56K cancellations, the highest August rate since 2017, as high costs and inspection issues drive buyer pullbacks (Redfin)

Home prices are at least 5x higher than incomes in one-third of U.S. metros – Harvard found 39 markets where single-family prices far exceed earnings, led by San Jose at 12x income, as low inventory and weak construction drive affordability strains (Homes.com)

CPI rent to slow from 3% to 1.7% by 2026 – Zillow forecasts shelter inflation to cool as owners’ equivalent rent eases from 3.5% to 2.2% amid weakening market rents (Zillow)

Fannie Mae’s Home Purchase Sentiment Index stayed flat at 71.4 in September – Falling mortgage rates failed to lift confidence as only 27% of respondents said it’s a good time to buy (Realtor.com)

Insight: Despite a 50-basis-point drop in mortgage rates, buyers remain discouraged as home prices have barely moved in recent months, keeping affordability tight.

All-cash sales made up 32.8% of home purchases in H1 2025 – Down 0.6% from last year but still far above pre-pandemic levels, as wealthy and investor buyers continue to dominate amid high mortgage rates (Realtor.com)

Multifamily

U.S. apartment completions stay above 100K units for 10th straight quarter – Developers delivered 105,525 units in Q3 2025, led by 53,410 in the South as national supply remains elevated despite a slowdown from 2024’s peak (RealPage)

Apartment rents fall 0.3% in Q3 2025 – The first third-quarter rent cut since 2009 followed weaker leasing demand and 637K units absorbed nationwide, as oversupply in the South and West continued to pressure pricing (RealPage)

Apartment demand outpaces construction nearly 3 to 1 – Developers started just 234,900 units in the year-ending Q3 2025, the lowest in over a decade, while renters absorbed 637,100 units as new starts continue to decline (RealPage)

Office

Manhattan office leasing rises 51% above average in Q3 – Activity reached 8.36M SF with availability down to 16.6% and net absorption positive 3.73M SF, while average asking rent held flat at $77.45 per SF (CBRE)

Leasing

FINRA sublets 78K-SF office at Valo Park in Tysons, VA – The agency took over part of Gannett’s former headquarters at 7950 Jones Branch Drive, expanding its Northern Virginia footprint as Gannett downsized to New York City (CommercialObserver)

WNET Group signs 32K-SF office lease at 437 Madison Avenue in New York, NY – The PBS parent will relocate from Hell’s Kitchen to Sage’s Midtown East tower in 2026 (CommercialObserver)

Industrial

Large logistics sites drive U.S. industrial sublease boom – Tenants are capitalizing on discounted space as firms like Ceva Logistics sublease 1.3M SF at Arizona’s Elwood Logistics Center vacated by Home Depot amid tariff and economic uncertainty (CoStar)

Industrial leasing slows nationwide – Q3 leasing volume fell 7% as vacancy held at 7.1%, with rents rising in the South and Midwest but slipping in the West and Northeast amid tariff and immigration headwinds (Bisnow)

Retail

Premium home retailers see divergent growth paths – RH, Sur La Table, and Le Creuset attract distinct audiences with contrasting strategies, from experiential showrooms to sales-driven activations, highlighting multiple playbooks for luxury retail success (Placer.ai)

Data Centers

OpenAI has signed $1T in computing deals – Agreements with Nvidia, AMD, Oracle and CoreWeave secure 20GW of AI capacity while fueling concerns over how it will finance the expansion (FT)

xAI nears $20B fundraise backed by Nvidia – Elon Musk’s AI firm is raising $7.5B in equity and $12.5B in debt, including a $2B Nvidia investment tied to its Colossus 2 data center in Memphis (Bloomberg)

JPMorgan’s AI cost savings now match its $2B annual spend – CEO Jamie Dimon said the bank’s AI investments are delivering billions in savings across trading, research, and customer service, calling it “the tip of the iceberg” (Bloomberg)

Insight: Anytime Jamie Dimon speaks, I think it’s worth paying attention. There’s a real question right now about whether the efficiencies AI delivers can truly justify the trillions pouring into AI infrastructure over the next few years. Although it may be too early to tell, Dimon offers some early proof points, saying JPMorgan’s AI investments are already generating billions in savings across trading, research, and customer service.

U.S. power demand to hit record highs in 2025–26 – EIA cites surging electricity use from AI data centers, crypto mining, and electrification as renewables gain share (Reuters)

Apollo to buy hydroelectric firm Eagle Creek – The 85-plant, 700MW portfolio spans 18 states and will support Apollo’s $59B push into clean energy for data centers amid surging AI-driven power demand (Bisnow)

Oracle’s Nvidia cloud unit posts 14% gross margin, far below its 70% average – Shares fell 3% after reports showed high chip costs and aggressive pricing are squeezing profitability in its AI cloud business (CNBC)

Hospitality

U.S. hotel sales reach $4.3B in Q3, down 33% YoY – Transaction volume stayed $1B below Q2 levels but showed signs of recovery as Blackstone remained active with acquisitions of EAST Miami and Sunseeker Resort (CoStar)

Market Mix

Construction openings plunge 115K in August – Despite fewer postings, contractors still face labor shortages as new project starts slow under tariff, inflation, and recession fears (Bisnow)

Financings

Refinancings

M&T Realty Capital lends $76M to refinance 886-unit multifamily portfolio across Detroit, MI; Fayetteville, NC; Groton, CT; and Warwick, RI – GoodHomes Communities and Pilot Real Estate Group secured the bridge loan to complete lease-up of hotel-to-multifamily conversion projects and stabilize operations (CommercialObserver)

LoanCore Capital provides $56M refinance for Long Beach Marketplace retail center in Long Beach, CA – Mamo Company secured the loan to recapitalize the 18.5-acre property anchored by Trader Joe’s and plans to redevelop vacant parcels into apartments (TheRealDeal)

Structured Finance

RXR secures $1.45B recapitalization for 2M-SF 1211 Avenue of the Americas in Manhattan, NY – Apollo extended $1.04B in debt to 2028 as Baupost, King Street, Criterion, Abrams, and Liberty Mutual injected up to $400M in equity for tenant and re-leasing upgrades (CommercialObserver)

M&A

Company M&A

Fifth Third to buy Comerica in $10.9B all-stock deal – CEO Timothy Spence emphasized the importance of retail branches for deposit growth, announcing plans to open 150 new Texas locations as Fifth Third becomes Michigan’s largest bank (CoStar)

Building & Portfolio M&A

Hospitality

MCM sells four-hotel portfolio in Manhattan, NY for $490M – The Rhode Island-based investor sold Hilton Garden Inn, Motto by Hilton, DoubleTree, and Fairfield Inn properties to institutional buyers while retaining a minority stake in the city’s largest hotel sale since the Safe Hotels Act (TheRealDeal)

Multifamily

Virtú Investments acquires 336-unit Mural and Link multifamily properties in West Seattle, WA for $111M – American Realty Advisors sold the mixed-use assets featuring 18K SF of retail space as Virtú expands its Seattle portfolio amid a slowing development pipeline (TheRealDeal)

Morgan Properties acquires 300-unit Visions at Willow Pond in West Palm Beach, FL for $70M – Bar Invest Group sold the 347K-SF complex at 4860 Sand Stone Lane, with Newmark providing a $49.9M Freddie Mac acquisition loan maturing in 2030 (CommercialObserver)

Retail

CenterCal Properties and DRA Advisors acquire 870K-SF Long Beach Towne Center in Long Beach, CA for $145M – Vestar sold the 1999-built shopping center as the new owners plan upgrades including new restaurants, outdoor gathering spaces, and improved pedestrian areas (TheRealDeal)

Institutional Fundraising

Private fundraises surge 16% YoY as institutions reenter CRE – Brookfield, Carlyle, and Blackstone lead $86B in 2025 capital raises targeting single-asset and core-sector deals amid stabilizing values and improving liquidity (CommercialObserver)

Continuation vehicles drive $9.3B in GP-led real estate deals in 2024 – Funds led by sponsors like Blackstone and KKR are helping extend hold periods amid high rates and limited refinancing options, offering liquidity while delaying asset sales (CommercialObserver)

Proptech & Innovation

OpenAI enables ChatGPT users to access Zillow within the app – The new integration lets users search property listings and carry out housing-related tasks directly through ChatGPT (NationalMortgageNews)

Dealpath survey finds 96% of institutional investors plan to increase AI investment – Despite widespread adoption efforts, 93% cite barriers like limited in-house expertise, compliance risks, and fragmented data as key challenges to effective implementation (CommercialObserver)