The Brick Breakdown

Hello Brick Brief readers,

Happy Monday. Let’s crush it out there today. In recent news, AI automation is reshaping hiring and influencing Fed rate decisions, BlackRock’s GIP is targeting twin $40B acquisitions across data centers and energy, and major institutions are deepening their presence in the net-lease market.

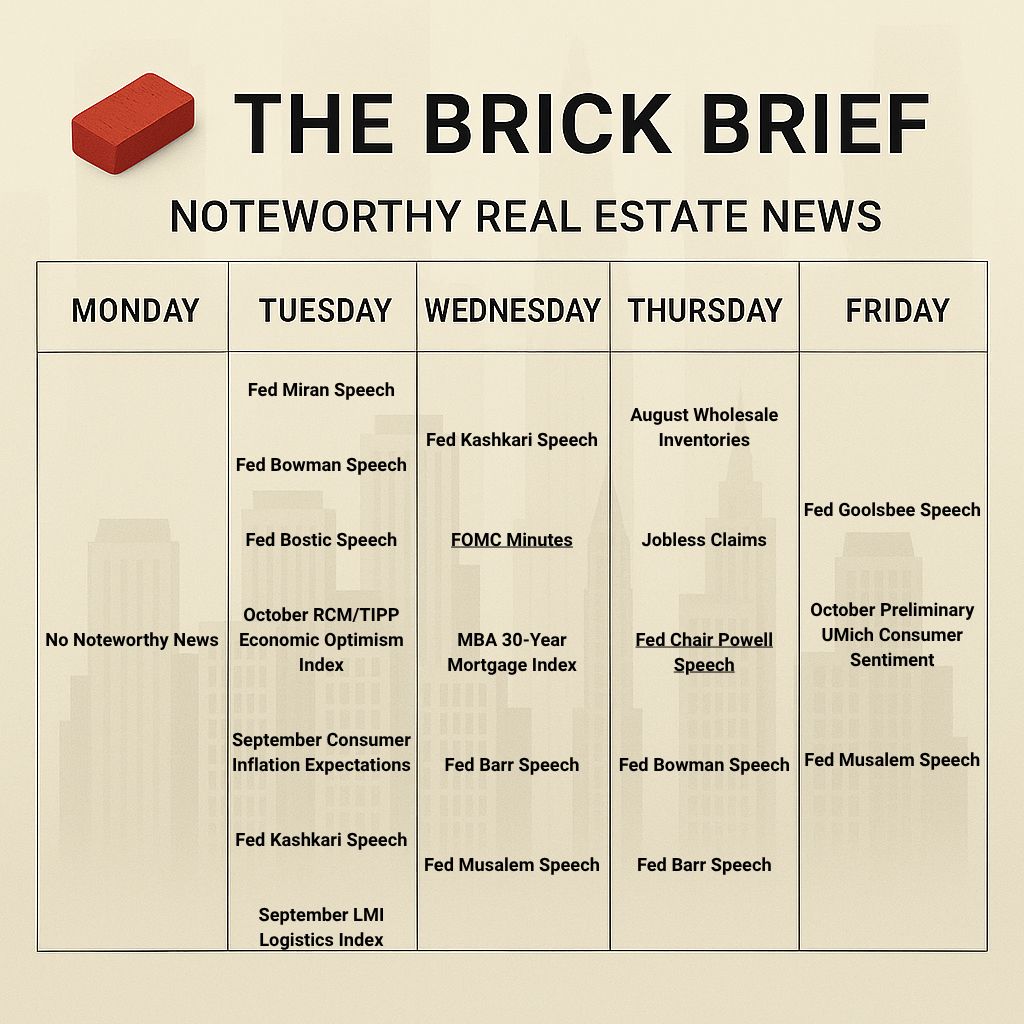

Although the government remains shut down, this week’s FOMC minutes, Chair Powell’s speech, and consumer sentiment data will offer us fresh clarity on the Fed’s view of the economy and household outlook.

💼 AI Reshapes Labor and Rate Dynamics

The labor market remains in a holding pattern as companies delay new hiring while assessing which roles automation could replace. The Fed may find that rate cuts have limited effect on employment if AI uncertainty keeps firms from expanding payrolls.

⚡ BlackRock’s GIP Builds the AI Power Chain

BlackRock’s Global Infrastructure Partners is pursuing two $40B acquisitions: Aligned Data Centers in Texas and utility giant AES, which operates 36,000 megawatts of generation capacity across the U.S. Together, the assets could form a vertically integrated platform linking power supply with compute demand as AI workloads push grids to capacity.

🏢 Institutions Accelerate Net-Lease Expansion

Leste Group’s plan to triple originations through triple-net loans reflects a broader institutional pivot into stable, income-oriented real estate. Starwood, BlackRock, and other large players are rapidly building exposure through recent acquisitions of Fundamental Income and ElmTree Funds, intensifying competition across the sector.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.34% (-2 bps)

10Y Treasury Yield: 4.12% (+3 bps)

WSJ Prime Rate: 7.50%

FTSE NAREIT Index: 776.10 (+0.33%)

30-day SOFR Average: 4.29%

Market Pulse & Rate Watch

U.S. labor market stuck in “low-hire, low-fire” cycle – Job growth nearly stalled over the summer as companies paused hiring amid AI disruption and Trump’s trade war, keeping unemployment low but mobility weak (FT)

AI may be driving a U.S. productivity revival – The surge in automation and investment mirrors the 1990s tech boom, with early signs that AI adoption is boosting efficiency despite broader job market weakness (WSJ)

Insight: This is likely already visible in the data, but the labor market slowdown may reflect an AI-driven hiring pause rather than just economic weakness, as companies hold off on new entry-level hires while evaluating which roles automation could replace. The Fed may need to consider that rate cuts could have limited impact on hiring if AI uncertainty is keeping firms from adding workers.

U.S. services sector stalls in September – ISM index fell to 50 as new orders slowed and hiring remained weak, with tariffs and AI uncertainty weighing on sentiment while inflation pressures stayed high (Reuters)

Fed’s Goolsbee cautious on rate cuts – The Chicago Fed president warned against front-loading easing as services inflation stays firm, even with job growth slowing and data releases halted by the government shutdown (Reuters)

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Spending is holding up at the high and low ends, but mid-tier retail, hospitality, and service businesses are falling behind in the current environment (barbell effect).

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Brick by Brick: BlackRock’s GIP Targets the Power Behind AI

Hyperscalers are driving a $400B U.S. data center buildout in 2025 that strains power grids and accelerates utility consolidation. As energy becomes the foundation of AI infrastructure, BlackRock’s Global Infrastructure Partners (GIP) is positioning itself through two potential $40B deals to control both computing capacity and the electricity that fuels it.

🧱 GIP is in advanced talks to acquire Aligned Data Centers from Macquarie in a transaction valued near $40B. The Texas-based operator runs nearly 80 data centers with more than 5 gigawatts of capacity serving hyperscale clients such as Lambda. Aligned has raised over $12B this year to expand its AI-focused footprint, and GIP’s pursuit signals how private capital is racing to secure the infrastructure behind model training and deployment.

🧱 At the same time, GIP is negotiating another $38B EV acquisition for U.S. utility AES. The deal would give GIP access to 36,000 megawatts of generation capacity and a rapidly growing renewables business that supports surging AI-driven power demand. By targeting both a data center platform and a major electricity provider, GIP aims to integrate the two bottlenecks defining AI growth: compute and power.

🧱 The two potential acquisitions create clear synergies. AES operates power generation and transmission assets across many of the same regions where Aligned is expanding, including Texas and the Midwest. Aligning ownership of both assets would let GIP channel energy directly to data center campuses, reduce transmission losses, and secure long-term supply at stable rates. This integration could turn power reliability into a competitive advantage as AI workloads push grid capacity to its limits.

🧱 Together, these moves reveal how energy security has become the core of digital expansion. Firms that can generate and distribute electricity while operating large-scale compute centers hold an edge as AI adoption accelerates and national power demand climbs to record highs.

Takeaway: GIP’s pursuit of Aligned Data Centers and AES captures how private capital is merging energy and technology to gain leverage in the AI buildout. The firm’s twin $40B targets create a vertically integrated model that connects generation to computation, marking a new phase where power supply determines the pace of innovation.

Policy & Industry Shifts

Cities push rental registries to improve housing safety – Pittsburgh, Oakland, and others are adopting inspection programs to track landlords and address aging housing, despite landlord lawsuits and state-level resistance (Bloomberg)

27 landlords settle in RealPage rent-fixing case for $141M – Greystar, Brookfield, and others agreed to restrict data sharing after allegations that RealPage’s AI software enabled rent collusion, while RealPage continues to fight the claims (Bisnow)

HUD drafts add work rules and time limits – Up to ~4M renters could lose assistance under proposals tying aid to employment, term limits, and stricter immigration verification (GlobeSt)

Florida tenants save $900M annually as state repeals commercial lease sales tax – The new law removes state and county levies on business leases, encouraging expansions and new deals across the state (CoStar)

California limits hedge fund bets on wildfire claims – A new law voids subrogation trades unless utilities can settle on equal terms, tightening oversight of speculative insurance deals and stabilizing the state’s wildfire fund (Bloomberg)

Residential

30-year mortgage rate climbs to 6.34% – Second straight weekly increase slows buyer activity as the federal shutdown delays data and adds uncertainty to Fed decisions (Bloomberg)

Federal shutdown delays key housing data – Realtor.com’s Danielle Hale says the lack of federal reports clouds visibility as home sales stay low, mortgage rates hold near 6%, and price cuts rise across lower-tier listings (Realtor.com)

Federal shutdown threatens housing and insurance markets – FHA and VA loans face delays, flood insurance pauses block Florida home sales, and rental subsidies risk lapsing as Treasury yields fall and mortgage rates ease (TheRealDeal)

Regional

Shutdown pressures D.C. housing market – Federal buyouts and halted pay for thousands of workers threaten local demand, marking the region’s toughest housing test since layoffs began earlier this year (WSJ)

NYC housing market cools entering fall – Agents say buyer activity depends on mortgage rates, now at 6.34%, and November’s three-way mayoral race that could reshape property taxes and rent policy (Homes.com)

Office

AI firms expand NYC office footprint – Manhattan leasing by AI companies hit 486K SF through Q3, surpassing 2024 levels as well-funded startups and West Coast tech players drive demand in Midtown South (Bisnow)

NYC office-to-residential conversions surge to 17-year high – Cushman & Wakefield reports 4.1M SF of conversions started through August 2025, driven by new tax incentives and rezoning policies amid 22.3% office vacancy (CommercialObserver)

Retail

Dollar General gains grocery share from traditional chains – The retailer’s short “in-and-out” trips and expanded essentials have boosted grocery visits nationwide, especially in the Midwest and Northeast (Placer.ai)

Hospitality

U.S. hotel RevPAR falls 6.6% YoY for week of 21–27 September 2025 – STR attributes declines to Rosh Hashanah timing and weaker group demand, with occupancy down 2.8 ppts and ADR down 2.5% (STR)

Market Mix

Tariffs raise CRE construction costs 9% YoY – Cushman & Wakefield estimates total project costs up 4.6% as trade policy pressures imported materials and drives developers toward prefabrication and alternative sourcing (CushmanWakefield)

NCREIF adds nontraditional sectors to core benchmarks – Data centers, self-storage, and SFRs join core portfolios, reshaping diversification in institutional real estate (IREI)

JLL Global Bid Intensity Index rises in July 2025 – Ben Breslau says investor sentiment is turning “risk-on” as bidder activity and competition show first month-over-month improvement since late 2024 (IREI)

Financings

Leste Group targets $3B in annual real estate lending – The Miami-based firm plans to triple originations through triple-net lease deals offering low-teens returns to institutional investors (Bloomberg)

Insight: Leste’s expansion in triple-net lending comes as major institutions move deeper into the net-lease space. Recent activity includes Starwood’s $2.2B acquisition of Fundamental Income from Brookfield and BlackRock’s purchase of $7.3B-AUM ElmTree Funds earlier this year.

Loans

PGIM Real Estate provides $260M loan for 10-property retail portfolio in FL and SC – Bain Capital Real Estate and 11North Partners acquired the 1.1M-SF grocery-anchored portfolio from PGIM’s equity arm for $395M (CommercialObserver)

S3 Capital provides $255M construction loan for 381-unit rental tower in Edgewater, NJ – The Maxal Group is developing the 25-story building at 615 River Road, the first phase of a $1B Hudson River project (TheRealDeal)

Refinancings

Treo Group secures $132M refinancing for 262-unit VOX I & II student housing in Miami, FL – Ocean Bank provided the loan for the fully leased 726-bed complex near the University of Miami (TheRealDeal)

M&A

Company M&A

BlackRock’s GIP in talks to buy U.S. data center operator Aligned for $40B – Firm is nearing a deal with Macquarie and Abu Dhabi’s MGX to acquire the Texas company, which runs nearly 80 AI-focused facilities nationwide (Reuters)

Building & Portfolio M&A

Multifamily

Tishman Speyer acquires 270-unit Bell at Broken Sound apartments in Boca Raton, FL for $124.5M – Bell Partners sold the property with a $78.7M acquisition loan from CBRE Multifamily Capital (CommercialObserver)

Bonjour Capital acquires 180-unit Avalon Brooklyn Bay apartments in Brooklyn, NY for $75M – AvalonBay sold the residential portion of the 28-story tower at 1501 Voorhies Avenue in Sheepshead Bay (CommercialObserver)

Retail

Asana Partners acquires 93.9K-SF Red Bird Center retail complex in Miami, FL for $62.1M – Red Bird Associates sold the grocery-anchored property leased to Milam’s Market, Walgreens, and Ace Hardware (CommercialObserver)

Proptech & Innovation

Zach Witkoff plans to tokenize Trump real estate portfolio – The move would let investors buy blockchain-based shares of Trump properties as the family expands its crypto ventures (Bloomberg)

Robinhood CEO Vlad Tenev says tokenization will transform real estate finance – Expects blockchain-linked assets to expand from trillions to tens of trillions, widening access to property investment (Bloomberg)

Insight: So what does real estate tokenization actually look like in practice? Properties are divided into digital tokens that represent fractional ownership, with asset values typically tied to third-party appraisals or income models used to price each token. In theory this could make trading and valuation more transparent, but adoption still depends on regulation, platform security, and institutional trust.