The Brick Breakdown

Hello Brick Brief readers,

Happy Friday. In recent news, the condo market experienced its worst downturn in over a decade, AI is driving some leasing gains, and Brookfield is bullish on compute demand.

🏢 Condo Market Weakens

Condo prices fell 1.9% YoY in late 2025, the steepest decline since 2012, as rising HOA dues, higher insurance costs, and mounting maintenance expenses weighed on affordability and demand. Florida condos are under particular pressure as new safety laws require inspections and higher reserves, driving large assessments that are dragging on prices and sales across major metros.

🏢 Office Recovery Concentrates Around AI

The U.S. office construction pipeline shrank 44% YoY to just over 32M SF underway; planned and active projects represent only 1.7% of total office stock. In 2025, AI firms drove roughly 20% of U.S. office leasing, helping support occupancy gains even as overall vacancy remains elevated.

⚡ Brookfield Signals Conviction In Data Centers

Brookfield is planning to launch a cloud business tied to a $10B AI fund that will lease data center capacity and power directly to customers. This move reflects Brookfield’s expectation that AI compute demand will continue to outpace data center construction and available supply, despite recent concerns around speculative data cetner deals and an AI bubble.

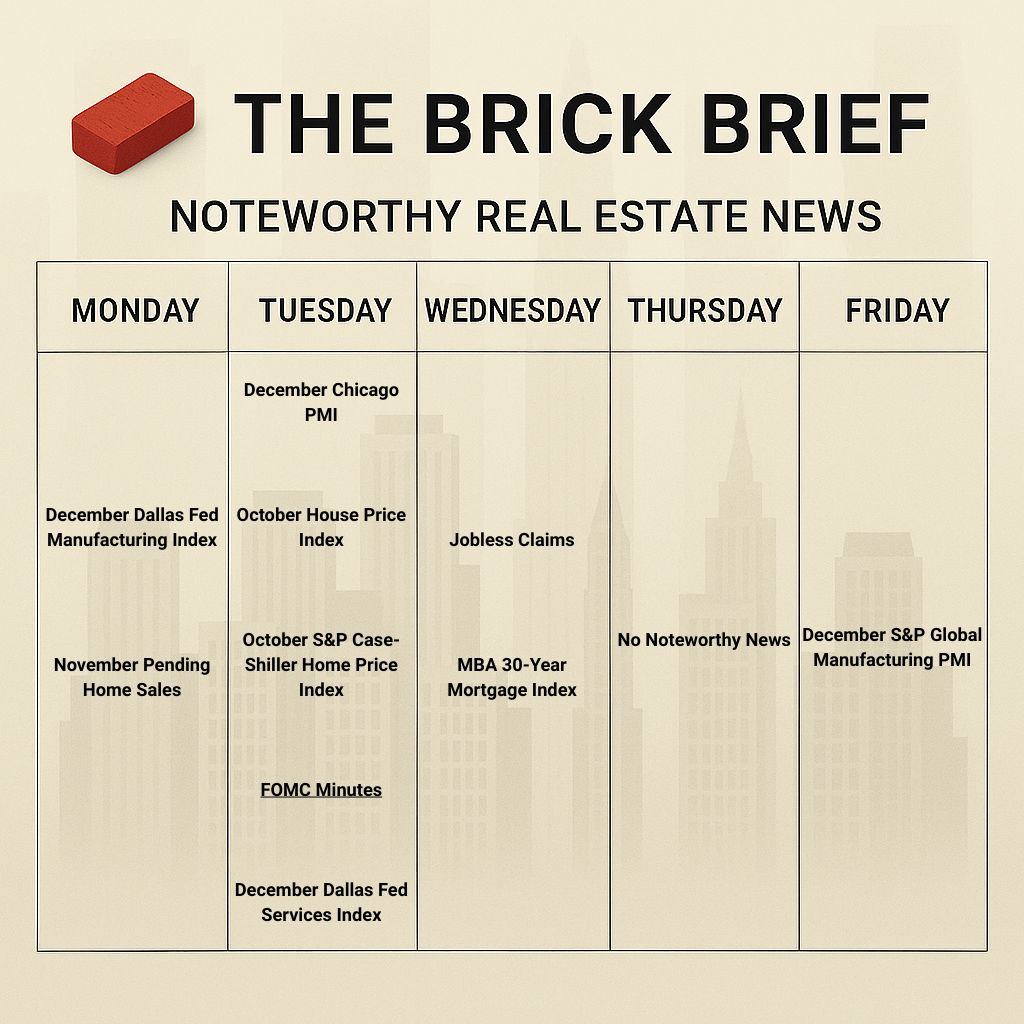

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.20%

10Y Treasury Yield: 4.18%

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 752.64

30-day SOFR Average: 3.79%

Market Pulse & Rate Watch

State-owned investors poured $132B into the U.S. in 2025 – The U.S. captured 48% of global sovereign and pension fund investment as capital shifted toward AI and digital infrastructure (Reuters)

U.S. dollar posts its worst year since 2017 with an ~8% drop in 2025 – Markets are pricing in deeper Fed rate cuts and a more dovish post-Powell chair, keeping pressure on the greenback into 2026 (Bloomberg)

U.S. jobless claims fall to 199,000 in late December – Hiring remains stalled in a no hire no fire labor market, leaving the Fed divided on further rate cuts as unemployment holds at 4.6% (Reuters)

Policy & Industry Shifts

Trump delays tariff hikes on upholstered furniture and kitchen cabinets until Jan. 1, 2027 – The move keeps existing 25% duties in place and eases near-term price pressure as trade talks continue amid voter frustration over inflation (Bloomberg)

Residential

30-year mortgage rates hit a 2025 low at 6.15% – Lower borrowing costs are lifting buyer momentum into 2026 as pending home sales reach their highest level since early 2023 (Bloomberg)

U.S. condo prices fall 1.9% YoY in late 2025, the steepest drop since 2012 – Rising HOA dues, higher insurance and maintenance costs, and weaker urban demand have pushed the condo market to its worst conditions in over a decade (WSJ)

Florida condo safety law continues to hit the market – Mandatory inspections and higher reserve requirements are driving steep assessments and insurance costs, pressuring condo prices and sales across major Florida metros (Homes.com)

$46B of Los Angeles housing sat inside 2025 wildfire zones – Zillow data shows home values near the Palisades and Eaton fires largely tracked metro trends one year later, while for-sale inventory and rents saw more lasting disruption (Zillow)

Office

AI firms drove roughly 20% of U.S. office leases in 2025 – Large deals from tenants like Nvidia, OpenAI, Databricks, and Anthropic helped lift occupancy growth to its highest level since 2019 and supported a tentative office recovery despite record vacancy (CoStar)

U.S. office construction pipeline shrinks 44% YoY to just over 32M SF underway – Planned and active projects now represent only 1.7% of total office stock; Boston and Manhattan stand out as rare markets still seeing pipeline growth (TheRealDeal)

Retail

Shopping center prices poised for record highs in 2026 – Average pricing rose to $142 per SF in 2025; investor demand surged as 28 retail-focused funds raised $4.5B while only 767 centers over 50K SF were listed for sale nationwide (CoStar)

Retail continues to outperform. Grocery-anchored retail in particular has drawn significant investor interest, especially from Blackstone.

7 Brew Coffee grows from 14 to roughly 500 U.S. locations since 2022 – Rising visits per store and a modular drive-thru model are helping the Blackstone-backed chain outpace peers as consumers favor convenience-led coffee (Placerai)

Interestingly, Starbucks recently pivoted away from its convenience-driven grab-and-go model to prioritize its cafe-oriented experiences

Data Centers

U.S. data center construction spending could reach $360B–$930B annually by 2027 – Federal Reserve scenarios show AI-driven investment accelerating from ~$100B in early 2024 but diverging sharply depending on grid, labor, and supply constraints (CoStar)

The Fed’s conservative and aggressive data center investment estimates are modeling execution risk and timing friction rather than a collapse in AI demand. If power delivery, land availability, and construction capacity constrain follow-through, announced projects will slip and spending may slow. In the upside scenario, hyperscalers convert today’s pipeline into builds on schedule and annual investment accelerates to roughly $930B by 2027, which is mind-boggling.

Brookfield launches a cloud business tied to a new $10B AI fund – The move gives Brookfield end-to-end control across chips, data centers, energy, and real estate as AI infrastructure demand strains utilities and traditional cloud economics (Reuters)

From this move, we can interpret that Brookfield sees AI compute demand continuing to outpace both data center delivery and supply. To capitalize on that imbalance, it plans to lease GPUs and sell contracted compute capacity rather than relying solely on traditional data center rents, a model that resembles the neocloud approach (CoreWeave).

Brookfield already operates in the physical bottlenecks of the AI buildout through Brookfield Renewable, which owns and develops large-scale hydro, solar, wind, and nuclear assets across North America and Europe, and through Brookfield Infrastructure Partners, which controls global transmission, fiber networks, data infrastructure, and regulated utilities. Together, those platforms give Brookfield direct exposure to the hardest inputs to scale data centers: power generation, grid access, and long-duration infrastructure capital.

By combining BEP, BIP, and its new cloud platform, Brookfield is positioned to integrate across energy, data center infrastructure, and compute. The advantages are speed, economics, and most importantly power access, which remains the critical bottleneck for data center construction. If Brookfield is willing to own or finance GPUs and provide compute capacity directly, it implies a belief that AI workloads remain durable and that utilization risk is outweighed by persistent infrastructure scarcity.

We discussed a similar vertical integration move last week after Alphabet agreed to acquire Intersect Power for $4.75B, a Texas-focused utility-scale solar and battery storage developer, to bring power development expertise in-house and better align generation with data center construction timelines.

Financings

Loans

Wells Fargo provides a $57M acquisition loan for the Orange City Square office campus in Orange, CA – The financing backs MGR Real Estate’s $89M purchase of the three-building 383,558-SF Class A property from Granite Properties (CommercialObserver)

Refinancings

Greystone provides an $84M Freddie Mac-backed refinancing for GAIA Real Estate’s 478-unit Winchester Park & Woods multifamily property in East Providence, RI – The agency loan replaces a 2018 Fannie Mae mortgage on the 1978-built Rhode Island asset (CommercialObserver)

Square Mile Capital Management and PCCP provide a $77M refinancing for Circle F Capital’s One Park Row luxury condo building in Manhattan, NY – The deal recapitalizes the Lower Manhattan condominium through a refinance and equity reset (CommercialObserver)

M&A

Building & Portfolio M&A

Land

Millrose Properties of Florida acquires a 20-acre development site at 777 Isle of Capri Circle near Harrah’s Pompano Beach casino in Pompano Beach, FL for $50M – The parcel will support a planned 426-unit condo and townhome community developed by Lennar (TheRealDeal)

Multifamily

Belveron Partners and Las Palmas Housing buy 114-unit Montecito Apartments at 3760 and 3765 Tamarack Lane in Santa Clara, CA from Pacific Urban Investors for $51.7M – The deal prices the 55-year-old Silicon Valley asset at ~$453K per unit, slightly below the county’s recent multifamily average (TheRealDeal)

Distress Watch

Saks Global prepares for a Chapter 11 filing after missing an interest payment tied to its Neiman Marcus acquisition – Heavy leverage has strained vendor payments and weakened merchandise and sales (WSJ)

CMBS delinquency rate rises 4 bps to 7.30% in December – Office delinquencies fell 37 bps to 11.31% for a second straight month while lodging, retail, and industrial stress ticked higher despite a lower total delinquent balance (Trepp)

Brookfield Properties’ $835M CMBS loan on One New York Plaza in Manhattan’s Financial District enters special servicing – The loan is seeking a modification ahead of its January 2026 maturity as net cash flow and occupancy declined from peak levels (CommercialObserver)

Walker & Dunlop reports $100M of exposure to potential multifamily mortgage fraud tied to Freddie Mac-backed loans – The firm may be required to repurchase two loan portfolios after alleged borrower fraud triggered repurchase requests and ongoing federal scrutiny (TheRealDeal)