The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing home prices cool as affordability bites, large employers push returns to office, and industrial demand softens under tariff pressure.

Slightly shorter version today because I’m getting sick 😟

🏠 Home Prices Show Fatigue

U.S. home prices fell 0.3% MoM in August as stretched affordability and weak confidence keep buyers on the sidelines. Despite a 50-basis-point drop in mortgage rates, only 27% of buyers say it’s a good time to purchase, suggesting demand will likely stay soft and prices could continue to cool in the next few months.

🏢 Office Occupancy Climbs on Return Push

Top-tier occupancy hit 98.1% as large employers reinforce return-to-office mandates and hybrid work normalizes. Tenants now prioritize offices near transit and housing to reduce commute times and boost attendance, concentrating demand in connected, flexible buildings.

🚛 Industrial Outlook Softens Amid Tariffs

Frontloading ahead of Trump’s 25% tariffs on furniture and cabinets is forecasted to push imports below 2M TEUs through year-end, with Q4 volumes projected to fall up to 19% YoY. The slowdown signals weaker warehouse absorption and shifting supply chains as firms weigh nearshoring in 2026.

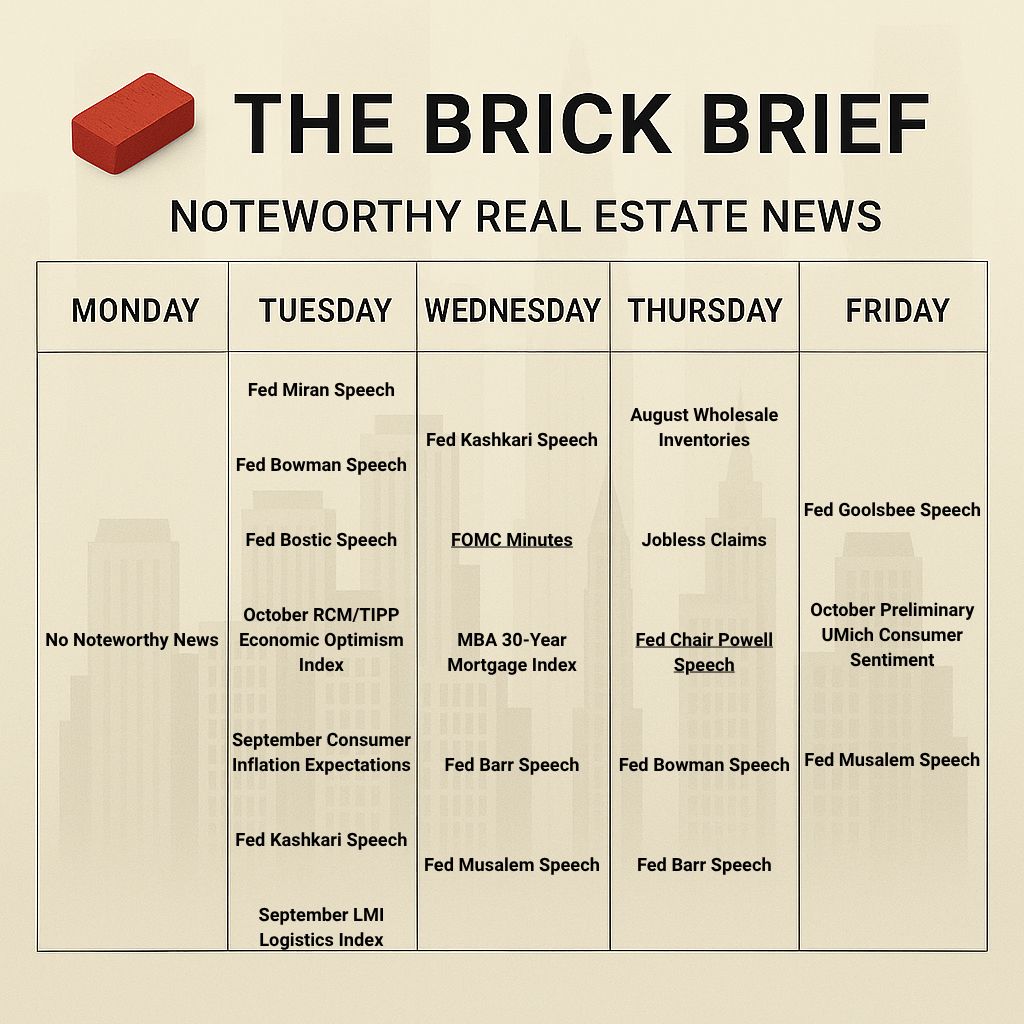

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.36% (-2 bps)

10Y Treasury Yield: 4.11% (-2 bps)

WSJ Prime Rate: 7.25%

FTSE NAREIT Index: 763.91 (-0.41%)

30-day SOFR Average: 4.25%

Market Pulse & Rate Watch

Fed minutes reveal split on rate cuts – Some officials warned inflation progress had stalled at 2.7%, though most backed easing amid labor market weakness (FT)

Markets are still pricing in a 94% probability of a 25 bps rate cut in October.

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Hybrid work has become the default, and tenants now favor offices near housing and transit for convenience and time savings as long commutes and daily hassles deter full-time returns. This shift, along with other economic factors, has pushed U.S. office construction to its lowest level since the financial crisis.

Life science offices remain under pressure as pandemic-era overbuilding flooded the market with new supply, and AI’s shift toward virtual drug discovery will add another headwind that could further shrink future lab demand.

Residential

U.S. home prices rose just 1.3% YoY in August and fell 0.3% MoM – Florida led declines while Northeastern metros like Bridgeport and Rochester saw 6–7% gains, as rising escrow costs and weak confidence keep buyers sidelined (Cotality)

Experts say housing is in a recession – Existing home sales fell 0.2% in August to a 4M annual pace, the lowest since June, as high mortgage rates, limited listings, and job stagnation stall mobility and construction (Homes.com)

Mortgage rates falling to 6.26%, the lowest in 11 months, ignited an 80% spike in refinancing – The surge briefly lifted lenders before demand faded as rates rebounded (WSJ)

Insight: The housing market is showing its more signs of fatigue as prices flatten and rates dip. Refinancing spiked 80% when mortgage rates briefly fell to 6.26%, but with affordability still stretched and confidence weak, buyers remain cautious and sellers are starting to lose leverage. As we discussed yesterday, despite a 50-basis-point drop in rates, only 27% of buyers think it’s a good time to purchase, suggesting demand will likely stay soft and prices could continue to cool in the next few months.

17% of Americans are delaying major purchases due to the shutdown - 7% canceled plans and 65% are unaffected, per an Oct. 3 Redfin/Ipsos survey of 1,005 adults amid broader economic uncertainty (Redfin)

Office

A+ Office Buildings Hit Post-Pandemic Peak of 98.1% Occupancy – Weekly Nationwide Office Occupancy Rose to a New High of 55.3%, Led by NYC’s Record 73.1% Peak-Day and 58.4% Weekly, While Dallas Hit 63.9% and San Jose Slipped to 51.4% (KastleSystems)

AI demand is reviving Bay Area office leasing – Vacancy dipped to 35.4% as AI firms leased nearly 1M SF this year, but deals remain smaller and focused on flexible, transit-accessible space (Bisnow)

Insight: This connects to one of The Brick Brief’s broader themes: hybrid work has generally become the norm, and tenants now favor offices near housing and transit for convenience and time savings as long commutes and daily hassles deter full-time returns. The result is concentrated demand for well-located, flexible space

Industrial

U.S. imports seen well below average for rest of 2025 – NRF said frontloading and Trump’s 25% tariffs on furniture and cabinets will push volumes under 2M TEUs, with October–December imports down 12–19% YoY (FreightWaves)

Tariff turbulence deepens U.S. supply chain uncertainty – Trump’s new 25% import duties strain carriers and manufacturers, driving nearshoring and tighter cost controls amid flat freight growth (FreightWaves)

Retail

U.S. holiday sales growth expected to slow to 2.9–3.4% YoY – Deloitte projects the weakest gain since 2018 as PwC sees spending per shopper falling 5.3% amid trade-driven uncertainty (Reuters)

Beyond Inc. will rebrand 250–275 Kirkland’s stores as Bed Bath & Beyond Home – The move leverages BBB’s brand equity and aims to revive Kirkland’s amid declining traffic and soft home furnishings demand (Placer.ai)

Data Centers

OpenAI and Nvidia’s $100B partnership fuels fears of an AI bubble – The companies’ interlinked $1T web of investments with AMD, Oracle, and CoreWeave is raising concerns that circular financing and unproven profitability are artificially inflating the AI boom (Bloomberg)

Cisco launched its P200 chip to link AI data centers across vast distances – Microsoft and Alibaba will use the chip, which replaces 92 components with one to cut power use by 65% (Reuters)

Hospitality

Hotel executives report weak performance amid economic and political uncertainty – Industry leaders cited soft ADR and RevPAR growth but expect deal activity to rise and AI adoption to help margins (CoStar)

Market Mix

Life Sciences

AI is reshaping life science real estate as lab demand plunges – JLL reports 61M sq. ft. of available U.S. lab space, triple 2021 levels, with nearly 19M sq. ft. expected to convert to other uses by 2030 (CoStar)

Insight: This aligns with what I discussed in Tuesday’s edition of The Brick Brief, where AI-driven drug discovery and lab simulations are reducing demand for wet lab space. Building on that, we could perhaps see a bifurcation similar to traditional offices, as trophy lab properties upgrade into integrated Class A tech spaces to accommodate AI-focused research while older facilities struggle to stay relevant.

Financings

Loans

Madison Realty Capital provides $108.6M construction loan for build-to-rent communities in Parrish and San Antonio, FL – Quinn Residences secured financing for the 244-unit Moccasin Wallow and 169-unit Terra View projects near Tampa slated for late 2025 delivery (CommercialObserver)

Refinancings

Berkadia provides $84.1M refinance for 369-unit multifamily property Meridian at Eisenhower Station in Alexandria, VA – Paradigm Development secured the 10-year loan to retire existing debt and return equity while planning renovations at the mixed-use complex (CommercialObserver)

M&A

Company M&A

Roofing material firm TopBuild acquired insulation maker SPI for $1B after antitrust delays – The deal, excluding SPI’s metal unit, boosts TopBuild’s commercial exposure and is expected to yield up to $40M in cost synergies (Reuters)

Newmark acquired Dallas-based RealFoundations to expand management services – The deal adds a $10T client portfolio and helps Newmark target $2B in recurring revenue by 2029 (Bisnow)

Building & Portfolio M&A

Office

Pontegadea acquires 1M-SF 1111 Brickell office tower in Miami, FL for $274M – KKR and Parkway sold the 30-story Sabadell Financial Center as Zara founder Amancio Ortega expands his Miami portfolio (CommercialObserver)

Distress Watch

CMBS delinquency rate falls for first time since February – September rate dropped 6 bps to 7.23% ($43.5B delinquent balance) as office fell to 11.13%, lodging to 5.81%, and multifamily to 6.59% while retail rose to 6.76% (Trepp)

Partners Group defaults on $400M Wells Fargo loan tied to Concord Technology Center in Concord, CA – Wells Fargo, both lender and largest tenant with a 257K-SF lease, filed foreclosure as receiver Stapleton Group and Newmark market the 477.5K-SF office campus for sale at a steep discount (TheRealDeal)

Proptech & Innovation

Construction firms boost AI spending despite adoption hurdles – 65% still aren’t using AI for planning, but spending is rising as companies deploy tools to cut costs and speed office workflows (Bisnow)