Key Insights

The Federal Reserve's rate decision today will be closely watched as inflation concerns persist and trade tensions escalate. Markets are looking for clarity on future rate cuts, but rising import prices and new tariffs could complicate the Fed’s policy path.

U.S. home prices are rising at a slower pace, with February posting the weakest monthly gain since July and annual growth decelerating for the 10th consecutive month. While housing starts jumped 11.2% after weather disruptions, a 1.2% drop in permits signals potential slowdowns ahead as builders face economic uncertainty.

The office sector remains in a prolonged correction as high-vacancy markets make refinancing increasingly difficult amid a flight to quality. Defaults and foreclosures continue to mount, reflecting shifting office demand dynamics and tighter lending conditions

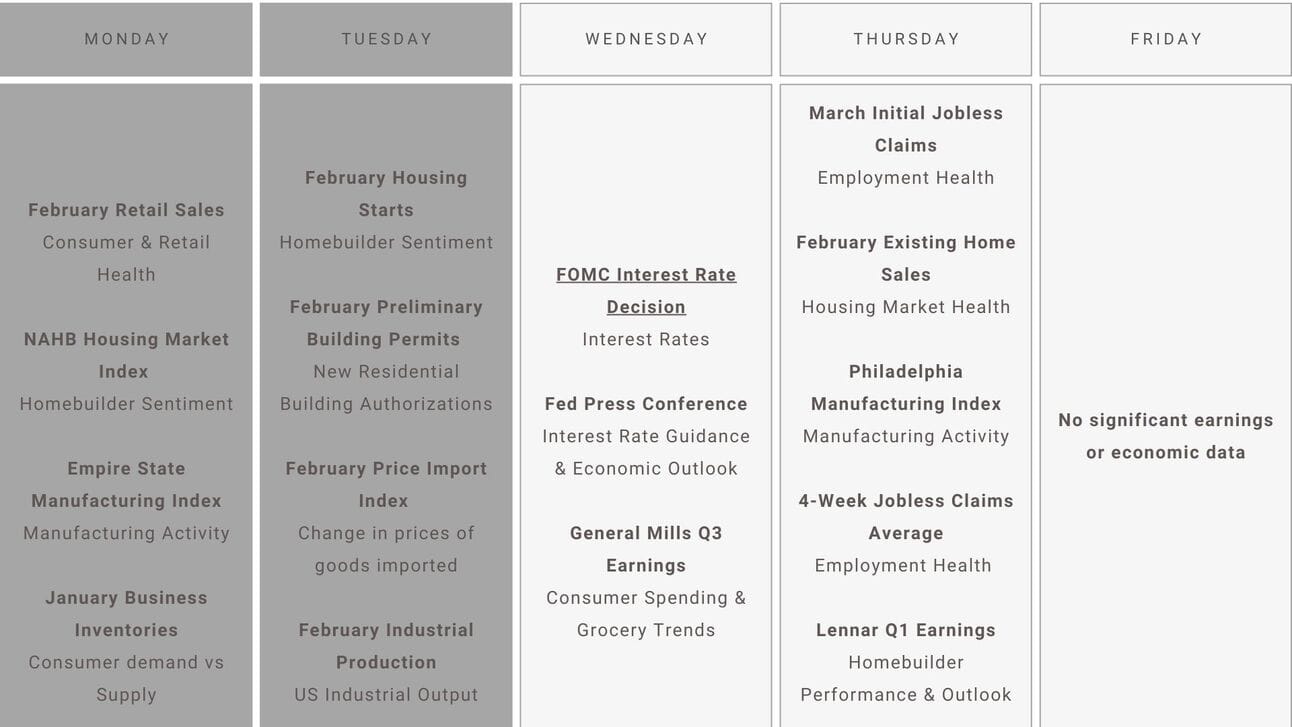

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.81% (+1 bps)

10Y Treasury Yield: 4.30%

FTSE NAREIT Index: 779.74 (-0.46 %)

30-day SOFR Average: 4.34%

Market Pulse

The Fed’s rate decision will be closely watched as inflationary pressures from rising import prices and trade disruptions complicate the path for potential cuts. While manufacturing output rebounded, led by auto production, looming tariffs threaten to undermine the recovery by increasing costs and dampening investment

Fed to Announce Rate Decision Today Amid Inflation, Tariff Concerns – Markets await signals on future cuts as trade disruptions and inflation risks complicate the outlook (WSJ)

US Import Prices Up 0.4% in February – Higher consumer goods costs fueled a second straight monthly increase, raising inflation concerns as the Fed reviews policy (Reuters)

U.S. Manufacturing Output Jumps 0.9% in February – Boosted by an 8.5% surge in auto production, factory output rebounded, though tariffs pose risks to recovery (Reuters)

Policy & Industry Shifts

DOJ Rejects Nosalek Settlement Revisions – The Justice Department says MLS PIN’s $3.95M deal fails to curb broker steering or improve competitiveness (RealEstateNews)

Florida Affordable Housing Law Update – Lawmakers propose bills to accelerate tax credits and limit local restrictions under the Live Local Act to spur workforce housing development (CoStar)

Residential

Slowing home price growth suggests affordability pressures and higher rates are tempering demand, particularly in markets like Tampa and Austin, where prices are declining. While housing starts rebounded from weather disruptions, falling permits and a sharp decline in multifamily construction signal potential supply shortages, which could tighten the rental market and drive up rents in the future

US Home Prices Rose 0.4% in February, Slowest Since July – Annual price growth slowed for the 10th straight month to 5.1%, with declines in Tampa (-6%) and Austin (-3.5%) (Redfin)

US Housing Starts Rebound 11.2% in February – New construction surged after weather disruptions, but permits fell 1.2%, signaling future uncertainty (Bloomberg)

Multifamily Construction Declines – Starts fell 6.6% YoY, permits dropped 15.7%, and completions sank 15.8%, raising concerns of a future rental supply crunch (Realtor.com)

Industrial

ATA Warns CBP Rule May Disrupt Cross-Border Trucking – Proposed regulation on sub-$800 imports risks supply chain delays, prompting ATA to seek a phased rollout (FreightWaves)

Market Mix

Costco Shoppers Stay Longest, Aldi Foot Traffic Climbs – Costco leads in visit duration, while Aldi saw 22.9% foot traffic growth in February (SupermarketNews)

Financings

Lenders remain active in real estate, with major financing deals spanning multifamily construction, rental acquisitions, and REIT refinancing. While new loans signal confidence in select markets, the pullback in broader development suggests a shift toward stabilizing existing assets rather than expanding supply

$1.4B Hines REIT Debt Facility – JPMorgan agreed to extend a $1.4B debt facility to Hines Global Income Trust to refinance a 2021 loan (Bisnow)

$210M Brooklyn Multifamily Construction Loan – S3 Capital will provide a $210M construction loan to Watermark Capital and Rubin Equities to build a 28-story development in Sunset Park (CommercialObserver)

$176M Atlanta Rental Portfolio – Brookfield agreed to provide a $176M credit facility to help finance JPMorgan’s acquisition of 709 single-family rentals in Atlanta (TheRealDeal)

$67.5M Davie, FL Multifamily Construction Loan – Santander Bank will provide a $67.5M construction loan to 13th Floor Investments and JSB Capital Group to build a 383-unit project (CommercialObserver)

$62M Dallas Apartment Refinancing – Kairoi Residential secured a $62M refi for a 352-unit complex in Oak Cliff, as slowing development supports rent growth (TheRealDeal)

M&A

$2.2B California Energy Assets – PE firm Partners Group will buy an energy asset management platform and California natural gas power plants from Avenue Capital Group for $2.2B (Reuters)

Institutional Fundraising

CalSTRS' $1.2B real estate commitment underscores growing institutional interest in data centers and self-storage. As demand for digital infrastructure accelerates, increased allocations to data centers reflect their rising importance in institutional portfolios

CalSTRS $1.2B Real Estate Commitments – CalSTRS allocated $1.2B to real estate in H2 2024, targeting data centers and self-storage (IPERealAssets)

Distress Watch

High office vacancy rates continue to strain refinancing efforts, as lenders favor high-quality assets, contributing to defaults like Martin Selig’s $135M Seattle debt and Tourmaline Capital’s $76M foreclosure acquisition in Florida

$135M Seattle Office Default – Martin Selig defaulted on $135M of debt tied to three downtown Seattle buildings as refinancing challenges persist amid a 33% office vacancy rate (Bloomberg)

$76M Florida Office Foreclosure – Tourmaline Capital acquired the 473K SF Columbus Center in Coral Gables out of foreclosure for $76M (CommercialObserver)