The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! While news remains light during the holidays, we’re seeing housing price growth slow materially, commercial real estate projections reset toward stabilization, and private gas-fired power solutions for data centers emerge.

🏢 Commercial Real Estate Stabilizes In 2026

In 2026, CNBC sees commercial real estate entering a stabilization phase as slower growth and higher unemployment reset expectations. Reduced construction activity in 2025 is expected to ease supply pressure and support normalization rather than a sharp recovery.

🏠 Home Price Growth Slows Meaningfully

U.S. home price growth is decelerating as the Case Shiller national index rose 1.4% YoY while the FHFA House Price Index increased 1.7% YoY, the slowest pace since 2012. Elevated mortgage rates and modest resale inventory gains through October are tightening affordability and limiting buyer demand.

⚡ Power Becomes The Bottleneck For AI Campuses

Large scale data center projects continue to move forward despite concerns around speculative data center construction and financing concerns. Goldman is in talks to co-lead financing for a 5 gigawatt Texas AI power campus; developer GridFree plans to bypass utility grid constraints and deliver gas-powered, behind-the-meter electricity for the campus in under 24 months.

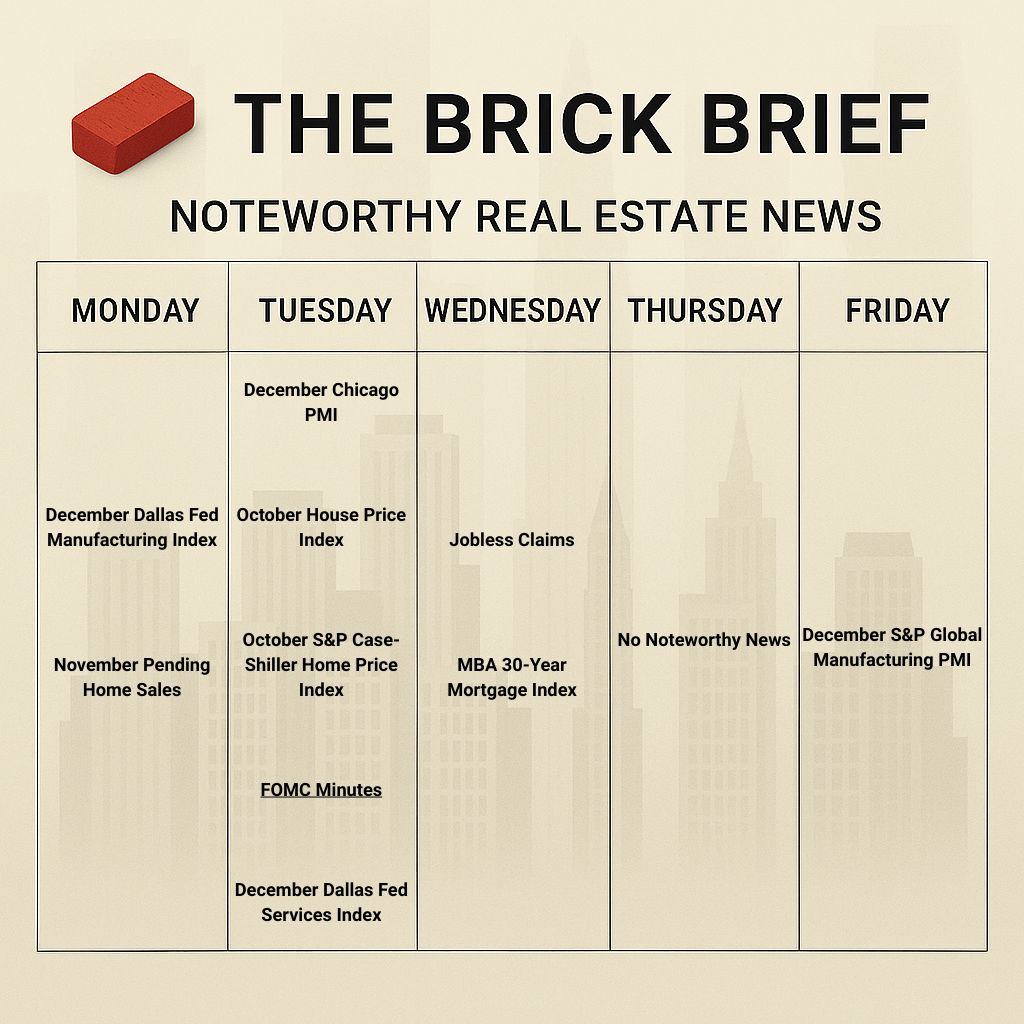

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.20% (+1 bps)

10Y Treasury Yield: 4.13%

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 760.31 (+0.24%)

30-day SOFR Average: 3.80%

Market Pulse & Rate Watch

Fed minutes show path to lower rates but no urgency – Most officials back further cuts if inflation cools, though deep divisions and strong growth keep January off the table (Bloomberg)

Chicago business activity rebounded in December but stayed in contraction – The Chicago Business Barometer jumped 7.2 points to 43.5 but remained below 50 for a 25th straight month (WSJ)

Market Mix

Commercial real estate stabilizes in 2026 – Slower growth, higher unemployment, and reduced construction in 2025 set the backdrop for normalization rather than a sharp recovery (CNBC)

Capital markets reengage in 2026 as pricing resets – Easing debt costs, tighter bond spreads, and returning institutional capital are expected to lift deal volume and compress cap rates (CNBC)

REIT take-privates and M&A accelerate in 2026 – Public REIT valuations lag private markets, positioning the sector for consolidation as valuation gaps narrow (CNBC)

Copper headed for biggest annual gain since 2009 as supply bets intensify – Prices rallied over 40% in 2025 on electrification demand, tariff-driven dislocations, and expectations that Fed easing and tech investment would keep markets tight into 2026 (Bloomberg)

Policy & Industry Shifts

Los Angeles cuts allowable rent hikes to 1%–4% – The city will tighten rent controls for the first time in four decades starting in February, down from the prior 3%–8% cap on most multifamily apartments (WSJ)

Residential

U.S. home price growth slows to 1.4% YoY – The Case-Shiller national index posted its weakest pace since mid-2023 in October as elevated mortgage rates continued to curb demand (WSJ)

FHFA House Price Index rises just 1.7% in October – This marked the slowest YoY home price growth in more than 13 years, reaching back to the post-financial-crisis recovery in 2012 (Reuters)

The 1.7% YoY change is the slowest gain since 2012 and is being driven by affordability pressure from high mortgage rates and modest resale inventory gains through October.

Private lending shifted toward long-term DSCR loans in 2025 as investor strategies evolved – DSCR loans surpassed bridge lending for first time with volumes up 94% YoY versus 27% growth for bridge loans (HousingWire)

Retail

Holiday 2025 retail traffic rose despite pressure – Retail and dining visits increased across most states, showing consumers stayed engaged even as spending remained selective (Placerai)

Holiday spending stayed bifurcated between value and premium – Thrift, off-price, and wholesale clubs outperformed while luxury held up and mid-tier apparel continued to lose traffic (Placerai)

Self-gifting drove holiday category winners – Pet care and home improvement outpaced traditional gift categories as consumers prioritized everyday utility over discretionary gifting (Placerai)

Data Centers

Big Tech channels hundreds of billions into AI infrastructure as compute demand surges – OpenAI, Meta, Nvidia, Google, Oracle, and SoftBank committed capital across chips, cloud, and data centers in deals ranging from $10B to $500B, accelerating pressure on power, land, and digital infrastructure supply chains (Reuters)

Goldman co-leads financing for 5-gigawatt Texas AI power campuses – The South Dallas One project is seeking hundreds of millions of dollars in initial equity and credit to build private gas-fired generation for data centers (Bloomberg)

Power and grid access have increasingly become the primary obstacle for data center development. Developer GridFree plans to bypass this constraint by pairing behind-the-meter (BTM) gas-fired generation with direct pipeline supply from Energy Transfer to allow modular 100-megawatt power blocks to come online in under 24 months without reliance on grid interconnection or diesel backup generators.

xAI expands Memphis, TN data center capacity to nearly 2 GW – Elon Musk’s AI company bought a third building near its Colossus sites to scale training compute (Bloomberg)

Financings

Refinancings

Dwight Capital provides a $67M HUD 223(f) refinance loan for 311-unit Emerald Bay multifamily property in Hialeah, FL - Financing backs J.V.C. Management’s newly completed seven-building apartment complex at 4030 West 88th Street in Miami-Dade County (CommercialObserver)

M&A

Building & Portfolio M&A

Retail

Trader Joe’s buys former Rite Aid retail property at 1331 Wilshire Blvd in Santa Monica, CA for $22M – Purchase ranks as most expensive retail sale in city over past two years; the grocer is expanding owned-store footprint amid severe retail supply constraints (CoStar)

Trader Joe’s core customer tends to be urban or suburban, higher income, and highly convenience driven, so the brand targets dense infill neighborhoods with strong foot traffic, easy parking, and daily needs retail adjacency.

Owning real estate rather than leasing secures long term control of scarce grocery sites, a strategy we have recently discussed Publix pursuing across Florida, while former drugstores offer rare, immediately usable footprints in markets where new grocery development is heavily constrained (LA).

Mixed-Use

J.P. Morgan buys out Todd Interests stake in East Quarter mixed-use district in Dallas, TX – Valuations range from $200M-$300M for the 20-acre downtown redevelopment, which spans 30 properties across eight blocks (TheRealDeal)

Office

Avdoo buys office building at 68 King Street in Manhattan, NY from 185 Varick Realty Corporation for $63M - Purchase sets up luxury residential conversion of six-story 68,476-SF asset in Hudson Square (CommercialObserver)

Multifamily

Penzance buys 396-unit Compass at City Center at 502 Waters Edge Drive in Newport News, VA from DF Ventures for $75.5M – Sale prices asset at $191K per unit and exits seven-year value-add hold following $6M capital improvement program (MultiHousingNews)

Distress Watch

Columbia Property Trust hit with default notice on $1.9B CMBS loan tied to office portfolio anchored by 650 California Street and 201 California Street in San Francisco, CA – Appraised value fell to $1.3B from $2.3B in 2021 across seven-building portfolio spanning SF, Manhattan, Boston, and New Jersey (TheRealDeal)

Proptech & Innovation

AXCS Capital acquires proptech startup Propvetter for under $1M – Deal brings AI-powered CRE underwriting and deal analysis platform in-house for George Smith Partners debt brokerage unit (CommercialObserver)