The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing lower rates unlock homeowner demand, multifamily demand hold up under affordability pressure, and life science markets stabilize as new supply fades.

🏠 Mortgage Rates Start Pulling Buyers Back In

December existing U.S. home sales jumped 5.1%, their biggest gain in two years, as easing mortgage rates and slower price growth pushed activity to the highest level since February 2023. Last week, mortgage refinancing demand jumped 40% WoW after 30-year rates briefly dipped below 6%; Zillow sees mortgage rates falling to ~5.8% in 2026 if Trump’s $200B MBS plan proceeds, which could unlock pent-up demand from homeowners who have spent years waiting on lower rates.

🏢 Multifamily Demand Holds Despite Slower Near-Term Momentum

CBRE expects barriers to homeownership to support multifamily demand in 2026, as high mortgage rates, a 105% buy-vs-rent premium, housing undersupply, and rate lock-in keep renters in place. Rent growth is expected to remain muted as CBRE sees operators prioritizing occupancy with concessions while Sun Belt and Mountain markets work through heavy supply and delayed pricing recovery.

🧪 Life Sciences Markets Shift From Oversupply Toward Stabilization

The life sciences lab construction pipeline is set to fall to ~6M SF in 2026, the lowest level since 2019, as developers sharply pull back new supply after two years of elevated vacancy. Leasing demand is expected to improve as pharma investment, stronger biotech valuations, and accelerating drug onshoring support absorption, helping stabilize lab and R&D vacancy near ~23.3%.

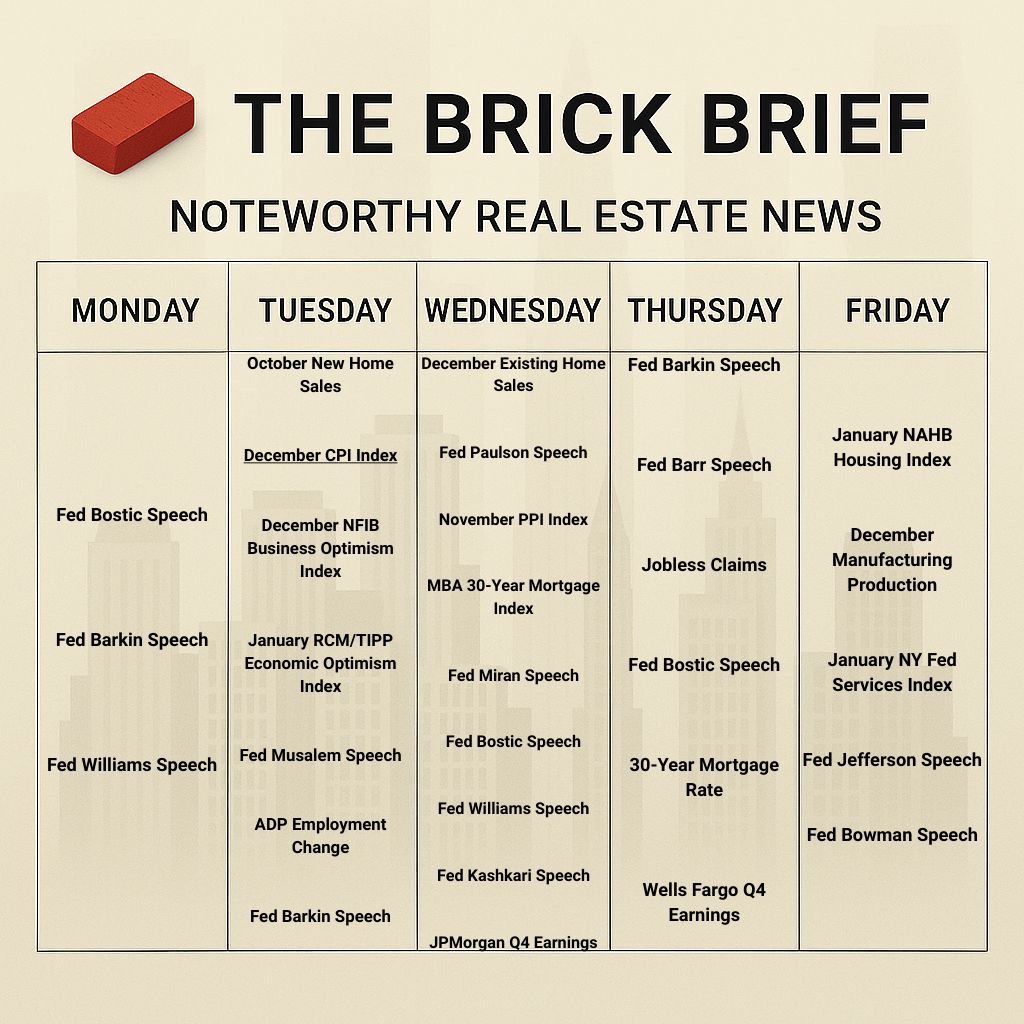

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.07%

10Y Treasury Yield: 4.14% (-4 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 773.50 (+0.95%)

30-day SOFR Average: 3.71%

Market Pulse & Rate Watch

Donald Trump says he has no plan to fire Jerome Powell despite DOJ probe – Trump said it is too early to decide, leaving uncertainty around Fed leadership as Powell’s term end nears (Reuters)

U.S. producer prices rose 0.2% in November as energy costs climbed – Trade margins compressed as businesses absorbed part of tariff-related pressures, keeping broader inflation moderate (Reuters)

Businesses absorbing tariff-related pressures remains something to watch

Fed’s Kashkari says the U.S. economy is set for solid growth in 2026 with inflation expected to moderate – The pace of disinflation and rate-cut timing remain unclear (Reuters)

Fed’s Miran says Trump-era deregulation could lower inflation and support rate cuts – He argues rolling back rules may lift productivity and shave ~0.5% off annual inflation, warranting a more accommodative policy stance (Reuters)

Fed’s Paulson says more rate cuts could follow if inflation cools and jobs stabilize – She expects inflation to move toward 2% by year-end and the labor market bending but not breaking (Reuters)

Fed’s Kashkari says it is “way too soon” to cut rates as inflation stays above target – He points to labor market resilience and lingering inflation pressures, with any cuts more likely later in 2026 (Reuters)

Market Mix

CBRE forecasts 16% jump in U.S. CRE investment to $562B in 2026 – Returns are expected to skew toward income and asset selection; cap rates are projected to compress modestly as capital shifts toward higher-quality office and industrial assets (ConnectCRE)

California rent control bill AB 1157 stalls in Assembly Judiciary Committee – The proposal to cap rent increases at 2% plus inflation, expand rent control to single-family homes and condos, and remove the 2030 sunset fails to advance this session (ConnectCRE)

Policy & Industry Shifts

NY Gov. Kathy Hochul unveils “Let Them Build” housing agenda – The plan pares back SEQRA reviews and revamps J-51 tax incentives to accelerate construction and support rent-stabilized buildings (Bisnow)

Residential

U.S. home sales jump 5.1% in December, biggest gain in nearly two years – Easing mortgage rates and slower home price growth lifted sales to the highest level since February 2023, though 2025 still ranked among the weakest years on record (WSJ)

Zillow sees modest existing home sales recovery in 2026 – Improving affordability and lower mortgage payments should lift sales to ~4.2M, with the strongest gains concentrated in the South and West as prices and transaction volumes gradually firm (Zillow)

Zillow sees mortgage rates falling to ~5.8% in 2026 if $200B MBS plan proceeds – Lower rates would lift existing home sales ~6.4% YoY, modestly boost prices, and ease rate lock even as stronger demand keeps inventory tight on net (Zillow)

JPMorgan Chase sees busier home-lending day after $200B mortgage bond purchases – Rates fell after Fannie Mae and Freddie Mac stepped in, though high home prices still cap demand (Bloomberg)

Mortgage refinance demand jumps 40% WoW after 30-year rates briefly dipped below 6% on Trump’s proposed $200B MBS purchase plan – Total applications rose 28.5% as borrowers rushed to lock in lower rates (CNBC)

December’s 5.1% jump in U.S. home sales reflects transactions that closed in October and November when mortgage rates were closer to ~6.3%, and the sharp 40% WoW spike in refinance demand after rates briefly dipped below 6% points to large pent-up demand from homeowners constrained by affordability and rate lock over the past few years; this suggests that sustained moves below 6% and into the mid-5% range – even temporary ones driven by mortgage buying from Fannie Mae and Freddie Mac – could unlock a far larger wave of refinancing and purchase demand.

Zillow and Redfin seek dismissal of FTC antitrust lawsuit over rental syndication deal – The companies argue the partnership expands rental listings, boosts competition, and benefits renters and landlords rather than suppressing rivals (HousingWire)

Multifamily

Barriers to homeownership are expected to support multifamily demand in 2026 – High mortgage rates, a 105% buy-vs-rent premium, housing undersupply, and rate lock-in are expected to drive lease renewals (CBRE)

Multifamily demand is expected to remain soft in early 2026 – Tepid job growth and low labor turnover are likely to limit household formation and migration in the near term (CBRE)

Multifamily rent growth is expected to stay muted in 2026 – Operators are likely to prioritize occupancy with concessions as Sun Belt and Mountain markets work through heavy supply and delayed pricing recovery (CBRE)

Office

Atlanta office sales hit $1.4B in 2025, up 56% YoY and the highest since 2022 – Class A and trophy buildings captured ~74% of all leasing; net absorption remained negative at -475K SF (GlobeSt)

Leasing

Arizona College of Nursing signs 40K SF lease at Jenel Real Estate’s 532 Fulton Street in Brooklyn, NY – The 10-year deal marks the nursing school’s first New York campus (CommercialObserver)

Industrial

Capital flows to industrial investment funds fell to lowest level since 2018 – Fundraising slowed as investors favored data centers, digital infrastructure, and niche industrial strategies over traditional warehouse vehicles heading into 2026 (CoStar)

LTL pricing index hits new high in Q4 as carriers hold pricing discipline – TD Cowen and AFS data point to modest cooling in Q1 and only tentative truckload recovery in late 2026 (FreightWaves)

Leasing

Amazon signs 615K SF lease with Prologis at 6100 Garfield Avenue in Commerce, CA – The 10-year deal for the former 99 Cents Only distribution center was the largest LA industrial lease of Q4 (Bisnow)

Retail

U.S. retail sales rose 0.6% in November, beating expectations – Spending strength remained concentrated among higher-income households as price pressures and tariffs continued to weigh on lower-income consumers (Reuters)

PacSun locations outperform host malls on YoY visits – Gen Z–skewed foot traffic drove brand-led demand and strengthens PacSun’s appeal as a mall tenant (Placerai)

Casual dining chain TGI Fridays targets 600+ new restaurant openings by 2030 – The now fully franchised brand aims to exceed 1,000 locations and ~$2B in annual revenue through flexible formats including airports, hotels, and international growth (Bisnow)

Data Centers

PJM Interconnection cuts 2027 peak power demand forecast, cooling AI boom expectations – PJM reduced the outlook by ~4 GW after finding some data center projects lack firm power or construction commitments (Bloomberg)

CBRE expects U.S. data center leasing to set a new record in 2026 – AI-driven demand is expected to keep vacancy near historic lows and pricing at record highs (CBRE)

CBRE sees large-scale AI deployments reshaping data center economics in 2026 – 10-MW-plus capacity now commands premiums rather than scale discounts (CBRE)

CBRE expects power availability to dominate data center site selection in 2026 – Ability to secure 300-MW-plus delivery timelines outweighs connectivity advantages (CBRE)

Life Sciences

CBRE expects life sciences lab construction pipeline to fall to 6M SF in 2026, lowest since 2019 – Sharply reduced new supply helps stabilize lab and R&D vacancy at cyclical highs (CBRE)

CBRE sees life sciences leasing demand improving in 2026 – Large pharma investments, onshoring activity, and stronger biotech valuations support space demand despite disciplined capital allocation (CBRE)

CBRE projects lab and R&D vacancy to stabilize at ~23.3% in 2026 – Dwindling speculative supply and emerging demand from robotics and advanced manufacturing support market balance (CBRE)

The pullback in life sciences construction, improving leasing demand from pharma and biotech, and accelerating drug onshoring are all expected to be tailwinds for lab and R&D markets, which have struggled with elevated vacancy and oversupply over the past two years. Perhaps this is what Breakthrough was seeing when the Tishman Speyer and Bellco Capital JV raised a $430M life sciences fund to capitalize on what it called the ‘most compelling life sciences investment window in years.’

Financings

Apollo Global Management buys $218M of existing debt backed by the St. Regis New York retail condominium in Manhattan, NY – The purchase gives Apollo Fifth Avenue retail exposure through a loan position rather than an equity acquisition (CommercialObserver)

Loans

Barings provides $326M construction loan for Yellowstone’s hotel-to-residential conversion at 440 West 57th Street in Manhattan, NY – The financing backs redevelopment of the former Watson Hotel into 316 apartments across two towers (TheRealDeal)

Knighthead Funding provides $52M acquisition loan for HB Nitkin’s Stamford office purchase at Metro Center in Stamford, CT – The financing backs the ~$70M acquisition of the 282K SF Class A property from Empire State Realty Trust (CommercialObserver)

Refinancings

Deutsche Bank and Société Générale provide $310M refinance for The Moinian Group’s office and retail asset at 535–545 Fifth Avenue in Manhattan, NY – The financing replaces a prior CMBS loan on the 522K SF Midtown office property (CommercialObserver)

Apple Bank provides an ~$87M refinance loan for GFP Real Estate’s 515 Madison Avenue Class A office tower in Midtown Manhattan, NY – The 10-year loan accompanies GFP’s buyout of ATCO’s remaining 40% stake, giving it full ownership (CommercialObserver)

Structured Finance

DataBank plans to raise $665M by securitizing 36 U.S. data centers – The ABS deal is backed by a $4.2B multitenant colocation portfolio spanning 14 markets (Bisnow)

Last September, DataBank raised ~$1.1B by securitizing three fully leased U.S. data centers in NoVa, Atlanta, and New York to monetize stabilized hyperscale assets and recycle capital for growth. There has since been a significant uptick in similar data center securitization deals as operators increasingly use ABS structures as an exit-style financing tool to unlock capital.

M&A

Company M&A

Hotel operator Kasa acquires apartment-hotel platform Mint House, adding ~1,000 rooms – Mint House operates short-term apartment hotels in NYC, Washington, D.C., Dallas, Nashville, Greenville, SC, and Menlo Park, CA (Bisnow)

Building & Portfolio M&A

Multifamily

Acacia Capital buys 287-unit Sofia multifamily from SummerHill Apartment Communities in Santa Clara, CA for $183M – The deal prices the 2024-built South Bay property at ~$640K per unit (TheRealDeal)

PGIM and Interstate Equities buy 184-unit Maddox multifamily from Mapletree in Sunnyvale, CA for ~$76.9M – The acquisition marks the second South Bay multifamily deal between the groups this month (TheRealDeal)

Just last week, Mapletree sold a 149-unit apartment property in Mountain View, CA also to PGIM and Interstate Equities for $87M. The deal priced the asset at ~$584K per unit and came in ~21% below Mapletree’s 2015 purchase price. The firm has been systematically selling U.S. apartment assets

Industrial

Fortress Investment Group buys majority stake in Spark LS life sciences and manufacturing campus in Morrisville, NC for $226.5M – The 106-acre Raleigh-area campus includes manufacturing space leased long term to Pokémon card producer Millennium Print Group; Bank of America provided $111.1M of acquisition financing (REBusinessOnline)

Westcore buys 332K SF industrial park at 23869–23975 N. 19th Ave and 1775 W. Alameda Rd in Phoenix, AZ for $90.7M – Fully leased Deer Valley acquisition from Mack Real Estate Group expands Westcore’s Phoenix footprint to 3.1M SF (ConnectCRE)

Office

Ken Griffin partners with Goldman Properties to buy 545Wyn office building at 545 Northwest 26th Street from Sterling Bay in Miami, FL for $180M – The deal adds ~500K SF Wynwood office space to Griffin’s growing Miami portfolio (TheRealDeal)

Real Capital Solutions buys 748K SF office tower at 401 North Michigan Avenue from Walton Street Capital in Chicago, IL for $132.5M – The distressed sale prices the Magnificent Mile asset about 53% below Walton Street’s 2017 purchase (TheRealDeal)

Institutional Fundraising

Crescent Real Estate closes $241.5M office-focused GP Invitation Fund IV – The Fort Worth-based firm has already deployed 15–20% of capital into Uptown Dallas office deals despite a slower fundraising environment (TheRealDeal)

Distress Watch

Luxury retailer Saks Global Enterprises files for Chapter 11 after adding ~$3.4B of debt to buy Neiman Marcus – Mounting losses and merger-related leverage strained liquidity and forced the filing (Bloomberg)

Goldman Sachs takes over Radford Studio Center in Los Angeles, CA after Hackman Capital Partners’ $1.1B CMBS default – Studio fundamentals have weakened as production activity slowed and higher floating-rate debt costs eroded cash flow (Bloomberg)

Nuveen takes control of 897K SF office tower at 321 North Clark Street in Chicago, IL after ~$74M mezzanine debt converts to ownership – The takeover follows default on a ~$296M loan stack and wipes out equity held by Diversified Real Estate Capital, Hines, and American Realty Advisors (TheRealDeal)

Proptech & Innovation

Rent and mortgage rewards fintech Bilt Technologies unveils credit cards capped at 10% interest after Trump pressure – The capped-rate cards function as a one-year promotional offer and position Bilt apart from large banks resisting interest-rate caps (Bloomberg)

Titl raises $2.5M seed to expand automated title verification nationwide – The multi-state rollout targets slow, fragmented title searches by reducing fraud risk and speeding property ownership verification through a centralized digital ledger (HousingWire)