The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Yesterday was a bit of a slow news day, but we saw inflation expectations ease, housing sentiment improve, and leasing momentum shift toward service-focused retail.

📉 Inflation expectations ease as trade talks resume

NY Fed’s May survey shows year-ahead inflation falling to 3.2%, the lowest in several months, as consumers grow more optimistic on jobs and finances. Meanwhile, U.S.–China trade officials met in London to ease tensions after rare earth exports to the U.S. plunged 34.5% in May.

🏠 Housing sentiment rises as supply builds

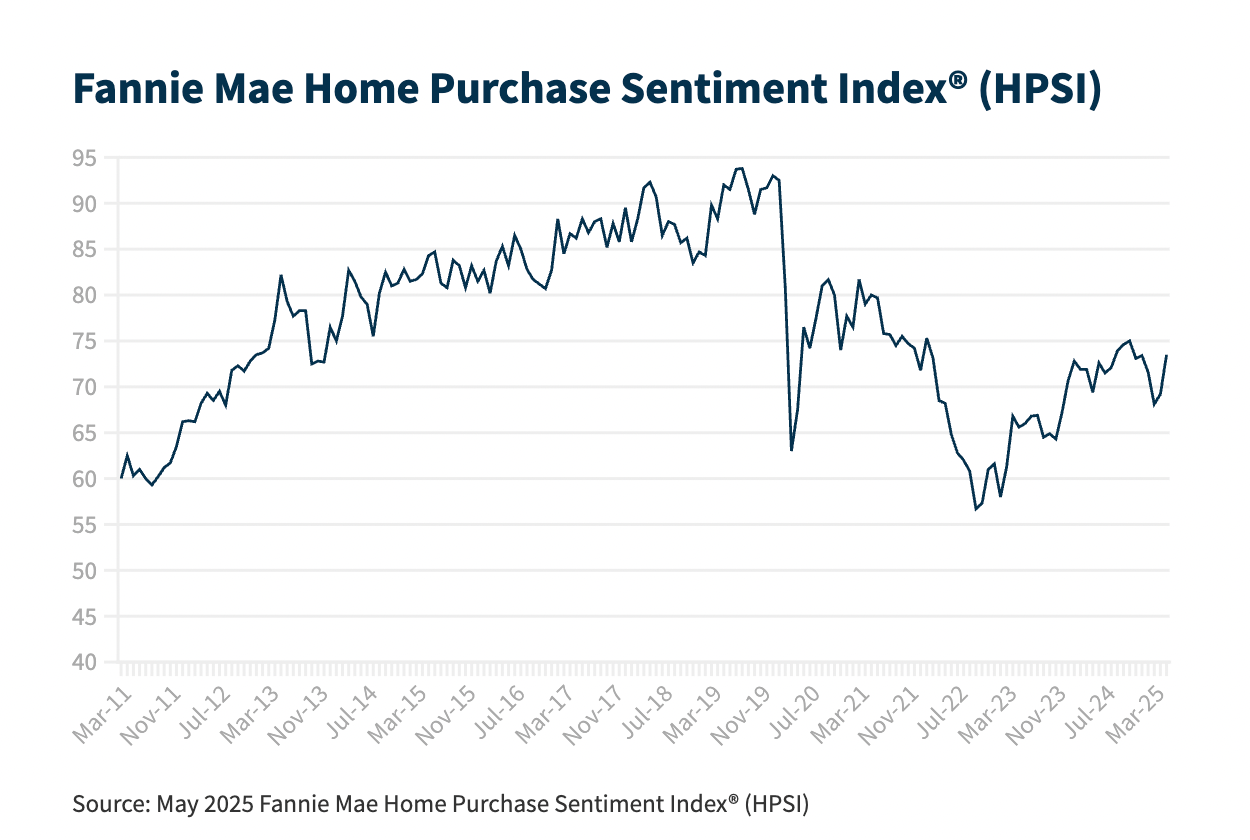

Fannie Mae’s sentiment index reached a 2025 high as home prices rose 4.2% year-over-year and optimism about selling improved. Active listings surpassed 1 million for the first time since 2019, signaling growing supply that could ease price pressures amid still-muted demand.

🛍️ Service retail drives leasing momentum

Dining, health, and wellness tenants led U.S. retail leasing activity, surpassing goods-based retailers for the first time. Darden Restaurants reported steady 2025 growth, with Olive Garden and LongHorn Steakhouse benefiting from strong foot traffic and expansion.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.95% (+6 bps)

10Y Treasury Yield: 4.49% (-1 bps)

WSJ Prime Rate: 7.50%

FTSE NAREIT Index: 772.68

30-day SOFR Average: 4.30%

Market Pulse

Easing inflation expectations could support long-term rate stability, while renewed US-China talks may reduce supply chain risk for industrial developers and EV manufacturers.

Inflation expectations ease in May – NY Fed survey shows year-ahead inflation outlook fell to 3.2%, with improved views on personal finances and job prospects (Reuters)

US-China trade talks resume in London – Officials aim to ease tensions over rare earth exports as Chinese shipments to the US plunge 34.5% in May (Reuters)

Brick Breakdown: Inflation Expectations Ease as Households React to Macro Shifts

Consumer inflation expectations fell in May across all time horizons, according to the New York Fed’s latest Survey of Consumer Expectations, signaling renewed confidence in the Fed’s tightening cycle and growing sensitivity to trade and economic developments.

• One-year inflation expectations dropped to 3.2% from 3.6%, while three-year and five-year outlooks edged down to 3.0% and 2.6%, respectively

• Consumers revised down expectations for gas, medical care, college tuition, and rent. Rent expectations are still elevated at 8.4%, but food price expectations rose to 5.5%, the highest since October 2023

• Home price growth expectations slipped to 3.0%, continuing a narrow trend and reflecting cooler housing sentiment in the South and West

• Labor market confidence improved modestly. Fewer respondents expect to lose their job, and more believe they could find a new one if needed, though perceived job-finding odds remain below the 12-month average

• Household income expectations ticked up slightly to 2.7%, but remain historically weak. Meanwhile, expectations for higher credit access and fewer delinquencies signal tentative optimism in personal finance

Takeaway: The sharp drop in short-term inflation expectations suggests that consumers are responding quite rapidly to macro news and trade war updates. This kind of expectation volatility adds pressure on the Fed to maintain credibility while balancing risks. For housing investors, softer rent and home price expectations may point to a more price-sensitive consumer, while easing inflation fears could support rate cuts in late 2025.

Residential

Rising inventory and stable prices suggest growing supply may relieve housing inflation, but persistent affordability concerns continue to limit buyer activity and constrain overall market momentum

Home prices rise 4.2% YoY in May – Northeast leads Clear Capital index as South lags, while oversupply and flat rents signal shelter-driven disinflation ahead (ClearCapital)

Fannie Mae housing sentiment index hits 2025 high – Rising optimism around rates and selling boosts HPSI to 73.5, though most still say it’s a bad time to buy amid affordability concerns (HousingWire)

U.S. homes for sale surpassed 1 million for the first time since 2019 – Inventory is rising fastest in the West and South, but remains 14% below pre-pandemic levels overall (GlobeSt)

Office

Manhattan office leasing jumps 46% above 5-year average – May volume hits 2.53M SF, up 37% YTD vs. 2024, while availability drops 260 bps YoY to 17.6% and rents dip 1% (CBRE)

Leasing

Walmart signs 338K SF lease at Tech Corners in Sunnyvale, CA – Largest Silicon Valley office lease since 2023 expands e-commerce division’s presence at Jay Paul’s 26-acre campus (ConnectCRE)

Market Mix

Construction

ICE worksite raids surge under Trump – Arrests disrupt projects and spark labor fears as undocumented workers, estimated at up to 20% of the construction workforce, face growing risk (Bisnow)

Retail

Service retailers outpace goods retailers in leasing for first time – Surge in dining, health, and wellness drives shift in U.S. retail demand as experiential tenants lead occupancy gains (CoStar)

Darden Restaurants sees steady growth in 2025 – Olive Garden and LongHorn Steakhouse drive gains with strong holiday traffic and expanding footprints despite early-year weather drag (Placer.ai)

Data Centers

Amazon to invest $20B in Pennsylvania – New AWS campuses in Salem and Falls Townships will create 1,250 jobs as part of broader AI-driven cloud expansion (Reuters)

Life Sciences

Massachusetts risks losing biomanufacturing edge – Despite $158B in U.S. Big Pharma investment, high costs and limited land shift major projects to states like Texas and Ohio (Bisnow)

Financings

Loans

Machine Investment Group secures $215M loan from Benefit Street – Debt package supports foreclosure acquisition and recapitalization of troubled twin-tower project in downtown San Jose (TheRealDeal)

Harvest Capital, TPG Angelo Gordon provide $88M loan for acquisition and construction – Financing backs Hines and JR Real Estate’s 320-home Bristow Station project in Northern Virginia (CommercialObserver)

Refinancings

GFH Partners secures $250M refi for U.S. industrial portfolio – Bahrain-based firm refinances 2.3M SF across seven states, backed by FedEx and General Mills tenancy (CoStar)

Tritec secures $140M refi for NY Bay Shore property – Truist refinances 418-unit Shoregate complex on Long Island’s South Shore, where vacancy sits at just 4.6% (TheRealDeal)

KRE secures $90M refi for Marlboro, NJ multifamily – New York Life backs fully leased 285-unit Beacon Hill complex, signaling lender appetite for stabilized suburban assets (CommercialObserver)

M&A

Building & Portfolio M&A

Blackstone buys 46% stake in $1.4B Manhattan office tower – Joint deal with Fisher Brothers includes $850M CMBS refi for 1345 Avenue of the Americas (ConnectCRE)

Related Companies and Oxford Properties list $600M mixed-use tower in New York, NY – Offering includes office, retail, Equinox gym, and hotel portions of 35 Hudson Yards, excluding residential condos (Bloomberg)

Carr Properties sells $84.3M office tower in Washington, DC – Shorenstein acquires 219K SF building at 901 K St. NW as Carr continues offloading downtown assets (Bisnow)

Anaheim, CA office tower sells to NL Ducks owners for $72M – Henry and Susan Samueli acquire Stadium Tower from CBRE and CalSTRS as part of their broader OCVibe megadevelopment strategy (CommercialObserver)

Hines, JR Real Estate acquire NoVA land for $55M – Duo buys 80-acre Thomas Farm at Bristow Station to develop master-planned community near Manassas (CommercialObserver)

Distress Watch

CMBS distress rate rises to 11% in May – CRED iQ reports first increase in four months as delinquencies and special servicing rates climb, signaling renewed volatility in CRE debt markets (CommercialObserver)

DivcoWest pauses new projects at $291M Cambridge Crossing in Boston, MA – High rates and tariffs stall multifamily plans despite strong pharma leasing (CoStar)

Machine Investment Group buys San Jose, CA resi towers for $182M in foreclosure – Firm acquires 643-unit 188 West St. James complex from Z&L Properties after default on $330M loan (TheRealDeal)

Invesco to auction Oakland’s largest hotel after $100M loan default – 500-room Marriott City Center heads to foreclosure as Gaw Capital exits amid mounting Bay Area lodging distress (TheRealDeal)