The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing the AI buildout accelerate despite bubble warnings from major banks, industrial demand strengthen as business uncertainty eases, and the retail barbell widen as both luxury and value segments outperform.

💾 AI Buildout Surges Despite Bubble Warnings

Even as Goldman, Citi, and JPMorgan warn of a potential AI bubble and elevated AI valuations, the AI infrastructure buildout is continuing to accelerate. Yesterday, BlackRock and MGX announced a $40B acquisition of Aligned Data Centers, the largest data center deal in history.

🏗️ Prologis Turns the Corner on Industrial Demand

Prologis reported a 15% QoQ jump in Q3 leasing and 4.3% YoY FFO growth as industrial uncertainty eased and demand made a clear move higher. Looking ahead, public REITs need to keep demonstrating growth to sustain premium valuations, and Prologis is doing so with a $15B expansion into powered land and hyperscale-ready data centers positioned for AI and logistics demand.

🛍️ Retail’s Barbell Splits Wider

Retail sales rose 0.5% in September as higher-income consumers sustained luxury spending while middle-income shoppers traded down to discount chains. Walmart said overall spending remains strong but lower-income households face growing pressure, widening the divide that continues to favor both high-end luxury and value retailers.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.27% (-4%)

10Y Treasury Yield: 4.02%

WSJ Prime Rate: 7.25%

FTSE NAREIT Index: 773.53 (+1.42%)

30-day SOFR Average: 4.19%

Market Pulse & Rate Watch

Trump declares US-China trade war – Announces 100% tariff on Chinese goods as Treasury Secretary Bessent proposes longer truce if Beijing halts rare-earth export controls, signaling renewed global trade tensions (Bloomberg)

U.S. nears trade deal with South Korea – Treasury Secretary Bessent expects an agreement within 10 days as both nations work to finalize a $350B investment and tariff-reduction package (Reuters)

Fed Beige Book shows stable growth and jobs – Economic activity held steady in recent weeks, but tariffs and AI-driven restructuring fueled layoffs and higher input costs as middle- and lower-income spending weakened (Reuters)

AI boom lifts growth as tariffs weigh on jobs – Economists in WSJ’s Q4 survey cite strong AI and data center investment driving GDP gains while tariff pressures and uncertainty curb hiring (WSJ)

Banks flag resilient economy despite risks – JPMorgan, BofA, and Goldman point to strong spending and deal activity supporting growth even as frothy markets and softer hiring raise caution (WSJ)

Grocery inflation squeezes consumers – Record beef and higher coffee prices push shoppers to cut back, stockpile staples, and adjust buying habits as food costs keep climbing (WSJ)

Insight: It’s important to note that grocery inflation isn’t just attributable to tariffs, although they do play a part. Beef and coffee prices are rising due to unusual weather conditions, with droughts shrinking the U.S. cattle population and extreme weather damaging Latin American coffee crops.

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Spending is holding up at the high and low ends, but mid-tier retail, hospitality, and service businesses are falling behind in the current environment (barbell effect).

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Market Mix

Private capital drives Q3 CRE rebound – CMBS issuance hits record pace as sidelined capital reenters and single-asset deals gain traction amid early signs of pricing recovery (Colliers)

Multifamily leads Q3 deal activity – Sales volumes sit just 10% below 2016–2019 averages with investors betting on operational gains over future cap rate compression (Colliers)

Residential

Big banks push for mortgage rule overhaul – JPMorgan, BofA, and Wells Fargo urge the Trump administration to ease post-crisis regulations to cut borrowing costs and revive homebuying amid a weak market (Homes.com)

Gen Z remains determined to buy homes – 82% say affordability is tougher than for prior generations, yet most are saving early and prioritizing career growth to reach ownership (Realtor.com)

Office

Leasing

BXP secures 275K-SF anchor lease with C.V. Starr at 343 Madison Avenue in New York, NY – The $2B, 46-story Midtown tower designed by KPF will deliver in 2029 with direct access to Grand Central (CommercialObserver)

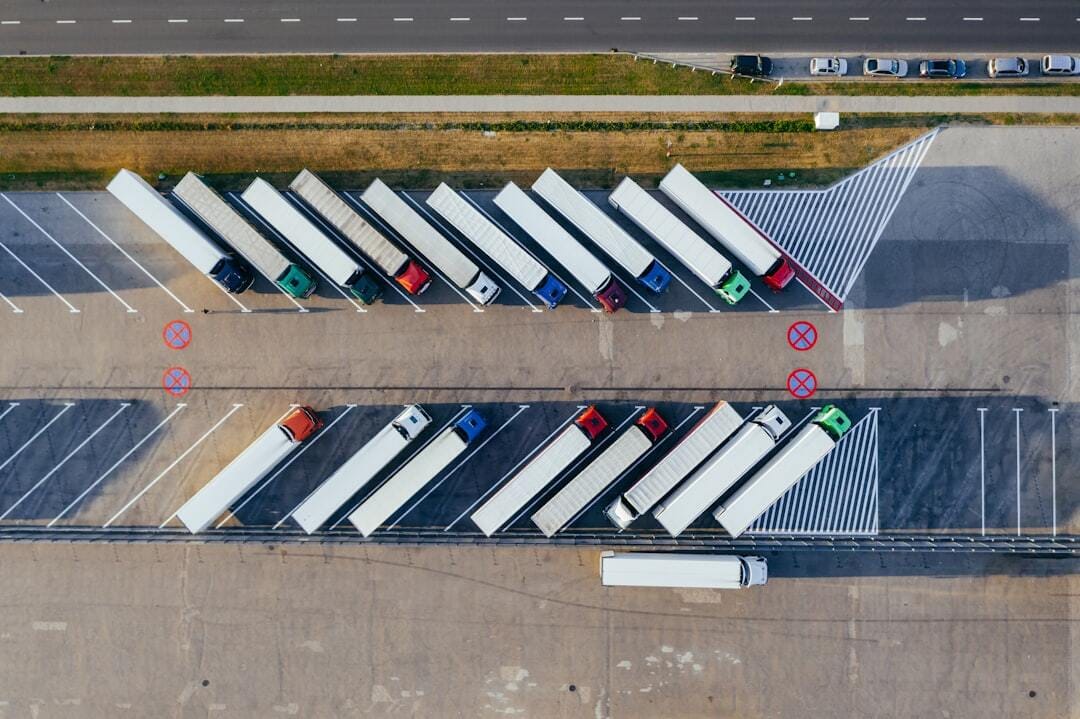

Industrial

Industrial stays resilient in Q3 – The only asset class with volumes above pre-pandemic levels as rent adjustments and slowing development support long-term fundamentals (Colliers)

Retail

Retail sales rise 0.5% in September – Growth driven by higher-income consumers as tariffs lift prices and middle- and lower-income households cut discretionary spending amid labor market softness (Reuters)

Walmart says shoppers remain resilient – U.S. CEO John Furner reports healthy spending despite tariff-driven inflation and uncertainty, with lower-income households feeling the most pressure (Reuters)

Mall traffic dips 1.9% YoY at indoor malls and 6.8% at outlet malls – The summer slowdown extended into September as value shoppers shifted toward discounters and online deals (Placer.ai)

Outlet malls lag peers – Value-focused consumers are favoring discount retailers like T.J. Maxx and Marshalls over longer mall trips amid higher living costs (Placer.ai)

Foot traffic stays near 2024 levels – Q3 visits slipped just 0.1% at indoor malls and 2.8% at outlets, showing steady demand despite inflation and tariff pressures (Placer.ai)

Insight: Retail performance continues to follow the barbell effect I highlighted a few months ago, with higher-income consumers sustaining luxury and discretionary spending while middle-income households trade down to discount and value retailers amid broader affordability constraints.

Data Centers

Big banks warn of AI bubble risk – Goldman, Citi, and JPMorgan executives cautioned that parts of the AI sector look “frothy” and may be overvalued, though it’s still too early to tell as record investment in AI infrastructure continues to accelerate (Bloomberg)

Meta invests $1.5B in El Paso, TX AI data center – The 1-GW facility, Meta’s third in Texas, will run on 100% renewable energy and supports hyperscalers’ plan to spend over $360B on AI infrastructure in 2025 (Reuters)

Hospitality

College football boosts hotel demand in the Southeast – Games in Georgia and South Carolina drove occupancy gains in smaller markets like Columbia as fans filled hotels near major stadiums (CoStar)

Earnings & Real Estate Impact

Prologis shares rose 6% after reporting 4.3% YoY growth in Q3 FFO and a 15% QoQ jump in leasing as executives said industrial uncertainty is fading and demand has reached “a clear turning point,” with activity strengthening across markets. The company is also channeling $15B into powered land and hyperscale-ready data centers, securing 5.2 GW of utility-fed capacity to build one of the largest global platforms for AI and cloud infrastructure.

Insight: Prologis’ 15% QoQ leasing surge demonstrates that industrial tenants are beginning to accept the new tariff environment and invest for the long term through renewed leasing commitments after months of hesitation. As for public REITs, sustaining growth is key to preserving premium valuations, and Prologis’ 4.3% YoY FFO growth and $15B data center expansion show that its growth story remains firmly intact.

Financings

Loans

Bungalow Projects and Bain Capital Real Estate secure $304M construction financing in Brooklyn, NY – The funding will support development of Echelon Studios, two high-end film and TV production facilities, including $156M in C-PACE financing from CounterpointeSRE (IREI)

Refinancings

Walker & Dunlop provides $238M refinancing for multifamily tower in Miami, FL – Crescent Heights secured the fixed-rate Freddie Mac loan for the 40-story, 588-unit Forma building in Edgewater that features a 53K-SF Whole Foods store and 85K SF of amenities (CommercialObserver)

Terra and New Valley secure $130M refinancing for multifamily complex in Miami, FL – New York Life and Blackstone provided the loan for the 460-unit Natura Gardens community (TheRealDeal)

Structured Finance

Wells Fargo, Morgan Stanley, and Goldman Sachs provide $1.2B CMBS refinancing for retail property in Dallas, TX – NorthPark Management refinanced the 1.9M-SF NorthPark Center, which has 98.6% occupancy and $1.4B in annual sales (CommercialObserver)

M&A

Company M&A

BlackRock and MGX acquire Aligned Data Centers for $40B – The largest-ever data center deal includes Microsoft and Nvidia as partners as investors accelerate bets on AI infrastructure demand (Bloomberg)

Building & Portfolio M&A

Office

SL Green acquires Park Avenue Tower office property in Midtown Manhattan, NY for $730M – Blackstone sold the 36-story, 622K-SF tower at 65 East 55th Street following a $25M renovation and 95% fund realization through its subsidiary Perform Properties (CommercialObserver)

Retail

Federal Realty acquires Annapolis Town Center retail property in Annapolis, MD for $187M – PGIM Real Estate sold the 480K-SF open-air plaza anchored by Whole Foods and Anthropologie (CommercialObserver)

Insight: Lenders, retail tenants, shoppers, apartment residents, and investors alike continue to appreciate grocery-anchored assets, particularly those anchored by Whole Foods. Everybody needs to buy groceries.

Multifamily

Bender Companies sells multifamily property in Carol Stream, IL for $54M – Highland Vista Properties bought the 293-unit complex at 201 Flame Drive for $184K per unit (TheRealDeal)

Goodman Real Estate acquires 119-unit multifamily property in Scottsdale, AZ for $66M – Baron Properties sold Scottsdale on Main for $555K per unit (TheRealDeal)

Hotel

University of California buys 331-key Residence Inn Berkeley for $176M – UC Investments acquired the hotel from Pyramid Global Hospitality at a 19% discount to its 2023 appraisal (TheRealDeal)

Cain acquires The Dominick Hotel in Manhattan, NY for $175M – CIM Group sold the 390-key SoHo property, which will be rebranded under Cain’s Delano luxury brand (CommercialObserver)

Distress Watch

Vornado’s 650 Madison Avenue office tower in New York, NY sent to special servicing – The 595K-SF property saw its value fall 21% since 2019 to $950M after the borrower group defaulted on payment obligations (TheRealDeal)

Proptech & Innovation

Blockchain-based lender Figure, which recently IPO’d, launches AI-powered DSCR loan platform - Enabling property cash flow qualification, ~5-day closings, and up to 80% lower origination costs (HousingWire)

Swiftbuild.ai launches AI-powered permitting platform to speed homebuilding – Its SwiftGov system cut zoning review times from 30 days to 2 in Florida, expediting 6,000 housing approvals (HousingWire)