The Brick Breakdown

Hello Brick Brief readers,

Hope you had a Merry Christmas. Recent news points to a continued weak labor market in 2026 that could strengthen the case for rate cuts, buyers gaining leverage even as home prices tick higher, and office assets at risk of getting ahead of fundamentals.

💼 Labor Freeze Pressures Rates

CEO caution is lengthening today’s no hire, no fire labor market into 2026, as 66% of leaders plan to hold headcount flat or cut jobs to lean more on technology. That weak hiring backdrop strengthens the case for Fed rate cuts next year, as job losses push unemployment to the center of the Fed’s focus.

🏡 Buyers Gain Leverage As Prices Hold

Home prices rose 0.2% in November and 2.6% YoY even as sellers outnumbered buyers by 37%. That imbalance is giving buyers leverage to push for cuts and concessions, but tight listings and thin volume continue to mute liquidity and true price discovery.

🏢 Office Rebound Meets Reality

According to Yardi Matrix, office assets sold for $190 per SF in 2025, up 7.1% YoY for the first increase since 2022. LaSalle, however, warned that investor interest could run ahead of fundamentals in 2026 as vacancy has remained high and cash flow remains under pressure.

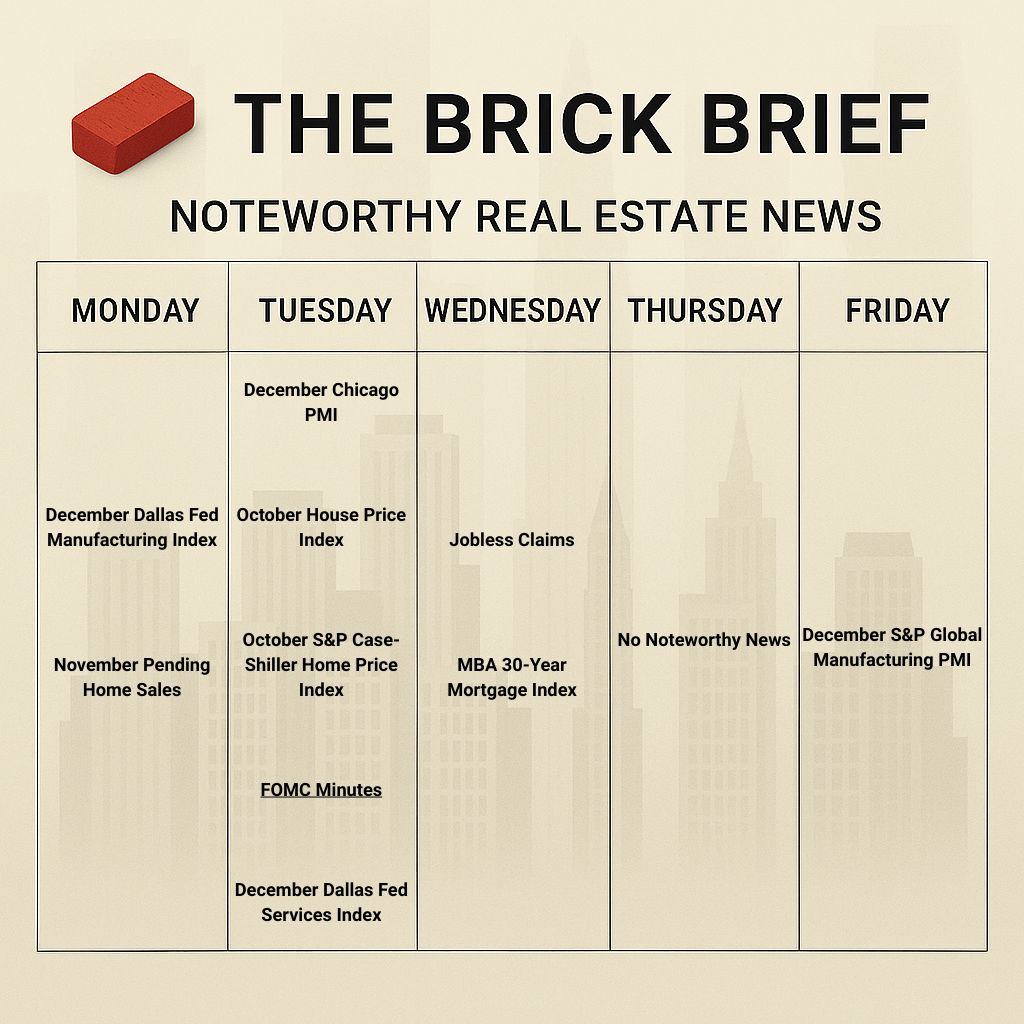

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.20%

10Y Treasury Yield: 4.14%

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 757.09

30-day SOFR Average: 3.84%

Market Pulse & Rate Watch

Based on current CEO sentiment, the “no hire, no fire” labor market looks set to persist into 2026. If that sluggish hiring backdrop continues, the ongoing labor market weakness could add pressure for more Fed rate cuts next year.

US companies plan hiring freeze for 2026 – 66% of CEOs say they will hold headcount flat or cut jobs as firms lean on technology; Indeed forecasts minimal hiring growth (WSJ)

US economy turns K-shaped again – The top 20% now drive nearly two-thirds of consumer spending while inflation and slower job growth force lower-income households to cut back, raising risks of a broader slowdown (Bloomberg)

US jobless claims fall to 214K – Initial claims dropped for a second week, but continued claims near 1.92M point to a “no hire no fire” labor market with sluggish hiring into year-end (Reuters)

US consumer confidence slides to 89.1 in December – The Conference Board index fell 3.8 points as anxiety over jobs, income, inflation, tariffs, and politics points to slower consumer spending after a strong Q3 (Reuters)

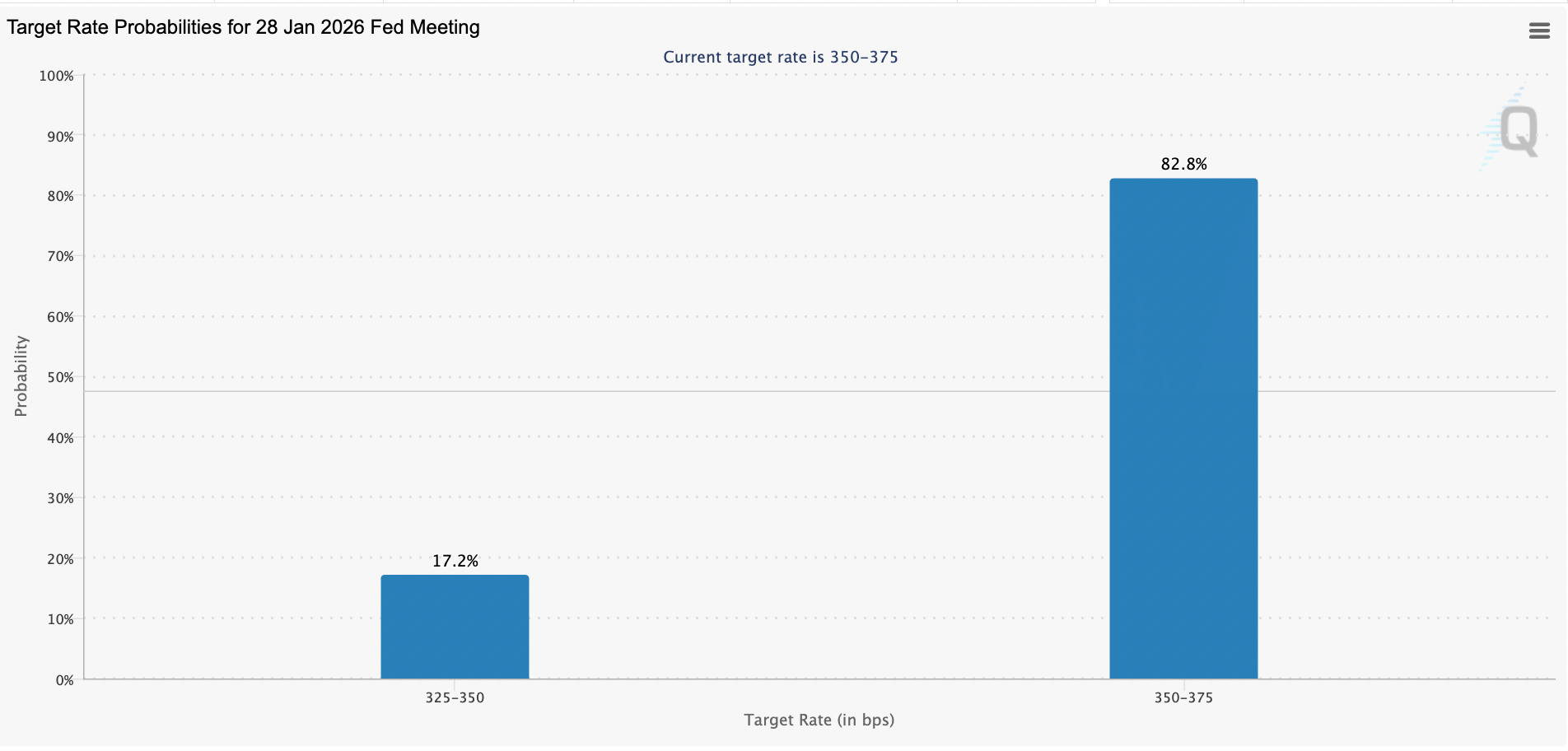

The Fed is likely to hold rates flat at its January meeting.

Residential

US 30-year mortgage falls to 6.18% – Rates dipped for a second week, but buyer demand remains near record lows as sellers outnumber shoppers and cut prices to move homes (Bloomberg)

US home prices rise 0.2% in November as YoY growth slows to 2.6% – Redfin data show the weakest annual gain since 2012; prices fell in 11 metros as buyers pulled back but limited listings kept values elevated (Redfin)

US housing market had 37% more sellers than buyers in November – Buyer demand hit 1.43M near record lows while sellers stayed elevated, giving buyers leverage to negotiate price cuts and concessions (Redfin)

The housing market is tilting toward buyers as sellers now outnumber demand, giving buyers leverage to negotiate price cuts and concessions. Tight listings and thin transaction volume, however, are still limiting liquidity and keeping true price discovery muted.

Median selling prices from national homebuilders may offer a clearer signal as builders need to keep inventory moving and are more willing to adjust pricing. For example, Lennar reported a Q4 2025 median selling price of $386,000 versus $430,000 in Q4 2024, a roughly 10% drop, though part of that decline is a shift toward building and selling smaller homes (due to buyer affordability constraints) rather than pure price cuts. Additionally, years of Sunbelt overbuilding are adding further downward pressure in the submarkets where national homebuilders are most active.

Build-to-rent pipeline hits 64K units under construction – More than 200 developers are building BTR homes led by Empire Group and Taylor Morrison as total operational supply tops 120K even as new starts begin to taper (RealPage)

Senators probe Florida insurer Demotech over mortgage risk – Lawmakers warn its ratings may mask climate-driven failures and expose Fannie Mae and Freddie Mac to systemic losses (Bloomberg)

Multifamily

Luxury apartment boom cools big-city rents – U.S. average rent fell 0.18% in November, the biggest drop in 15 years, as heavy supply in Austin, Denver, and Phoenix forces landlords to cut rents on older units (Bloomberg)

Multifamily rent concessions surge as vacancy hits 7.2% – A record 592K units delivered in 2024 is pressuring effective rents and cash flow, leaving lenders underpricing risk and over 5,300 CMBS loans with DSCRs below 1.0x heading into 2026 (Trepp)

Office

Office prices tick up for first time since 2022 - U.S. average reached $190/SF in 2025, up 7.1% YoY but still 33% below the 2021 peak (IREI)

LaSalle sees budding overpricing in US offices for 2026 – The firm warns renewed investor interest is running ahead of fundamentals as high vacancy and weak cash flow still weigh on the sector (PERE)

US offices turn to Class A sublets in 2026 – Tenants may lean on high-quality sublease space as new trophy supply dries up (CoStar)

High demand and limited supply in trophy office space continue to drive outperformance at the asset level. A thin office development pipeline should only make that imbalance even more pronounced in the years ahead.

San Francisco office availability drops nearly 2M SF in Q4 - Strong leasing cuts total to 47M SF, down 5M SF from the late-2024 peak (CoStar)

Downtown Dallas office faces crisis – The CBD has one of the nation’s highest vacancy rates as companies chase newer suburban offices despite booming metro growth (WSJ)

NYC office CMBS hits $14B across 11 assets in 2025 - Wall Street piles back into prime towers as issuance surges to $115B, the highest since 2007 (Bisnow)

Industrial

EQT sees large logistics portfolio deals returning in 2026 – The firm expects more buying opportunities at the top end of the industrial market as pricing resets and bid-ask spreads narrow (PERE)

Retail

Super Saturday traffic softens as shoppers trade down – Placer.ai data show YoY declines in apparel and electronics while visits rose at dollar, off-price, and thrift stores (Placerai)

Target faces hedge fund pressure on sales slump – Toms Capital’s stake adds pressure on incoming CEO Michael Fiddelke to revive growth after multiple quarters of falling comparable sales (Reuters)

Amazon tests 4,800-8,000 SF Whole Foods “Daily Shops” format -- Small grab-and-go stores aim to grow the brand in dense markets after Amazon Go’s cashierless convenience store concept failed (Bisnow)

Red Lobster cuts 10% of corporate staff due to high legacy rents – Pricey sale-leaseback leases from its 2014 deal continue to drag on profitability, pushing the chain to renegotiate terms after bankruptcy (Bisnow)

Bookstores stage comeback, with 422 independent openings in 2025 up 24% YoY – Community-driven demand and high retail vacancy are fueling new stores and a rapid Barnes & Noble expansion (Bisnow)

Data Centers

AI data centers revive dirty ‘peaker’ plants – Surging power demand is forcing utilities to keep oil, gas, and coal peakers online in PJM, driving up prices and pollution in nearby low-income communities (Reuters)

HGP proposes Navy reactors for data centers – The Texas-based power developer wants to repurpose retired US Navy nuclear reactors to deliver 450–520 MW of baseload power for AI data centers; it is seeking DOE backing and $1.8B–$2.1B in private capital (Bloomberg)

Financings

Loans

GoldenTree Asset Management provides nearly $116M construction loan for the Sage Intracoastal Residences condo tower in Fort Lauderdale, FL – The loan backs PMG’s 28-story waterfront project at 900 Intracoastal Drive (CommercialObserver)

Bank OZK provides an $82.3M construction loan for the Edgewater 27 multifamily tower in Miami, FL – The financing backs Trilogy Real Estate Group’s 247-unit project at 2728 NE 2nd Avenue in Edgewater (TheRealDeal)

BridgeCity Capital provides a $72M construction loan for a 117-unit multifamily project at 236 Gold Street in Brooklyn, NY – The financing backs Joel Schwartz’s Southside Units development in Downtown Brooklyn (TheRealDeal)

Citibank provides a $54M construction loan for the Dulce Vida affordable multifamily project in Miami, FL – The financing backs Coral Rock Development Group’s 227-unit fully income-restricted development at 1785 NW 35th Street in Allapattah (CommercialObserver)

M&A

Building & Portfolio M&A

Multifamily

Griffis Residential buys the 330-unit apartment building at 15560 Westminster Way North from Stockbridge Capital Group in Shoreline, WA for $112.5M – The off-market deal adds a four-year-old market-rate asset to Griffis’ growing Puget Sound portfolio (TheRealDeal)

S2 Capital buys the 344-unit Ovaltine Court multifamily complex at 1 Ovaltine Court from Osso Capital in Villa Park, IL near Chicago for $93.7M – The Dallas-based buyer is making its first Chicagoland investment at ~$273K per unit (TheRealDeal)

Retail

Albanese Cormier Holdings buys the 243K SF Shops at Legacy North mixed-use retail center from CTO Realty Growth in Plano, TX for $78M – The East Texas buyer is adding a high-traffic dining and entertainment hub at 7300 Dallas Parkway (TheRealDeal)

Office

MGR Real Estate buys the Orange City Square office complex from Granite Properties in Orange, CA for $89M – The Ontario-based firm is expanding its Orange County office portfolio with a four-building business center (TheRealDeal)

Land

Oak Row Equities and OKO Group buy the 4.25-acre Brickell Bay Drive waterfront assemblage from Aimco in Miami, FL for $520M – The partners landed a $464.5M acquisition and predevelopment loan from Tyko Capital; Oak Row is planning an ultra-luxury mixed-use project with branded condos and a hotel (Bisnow)

~$900M-listed REIT Aimco announced plans in mid-November to pursue a full liquidation of its portfolio of mostly stabilized multifamily asset. This sale follows news from two weeks ago that LaTerra Capital and Respark Residential agreed to acquire its seven-property, 1,495-unit Chicago-area portfolio for $455M.

Distress Watch

$17B+ CMBS theater exposure at risk in Netflix–Warner deal – The proposed acquisition could shorten theatrical windows and pressure cinema-backed loans; studio and office demand around Burbank and Hollywood could also shift (Trepp)

Cirrus Real Estate wins the distressed Holiday Inn Port of Miami-Downtown redevelopment site from entities managed by Gilberto Bomeny in Miami, FL with a $77M credit bid – The bankruptcy deal gives Cirrus control of the 340 Biscayne Boulevard site entitled for an 82-story mixed-use tower (TheRealDeal)

Proptech & Innovation

Air taxi startup Joby and parking tech firm Metropolis plan 25 vertiports – The partnership aims to repurpose US parking lots into electric vertical takeoff and landing air taxi hubs in cities like New York, Los Angeles, Miami, and San Francisco (CoStar)