The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing AI create new headwinds for an overbuilt life science sector, Prologis expand into data centers to sustain growth, and investors moving into grocery-anchored retail.

🧬 Life Science Faces an AI Reality Check

AI is shifting drug research from physical labs to digital models, cutting demand for traditional lab space. AstraZeneca’s $555M partnership with Algen shows pharma firms leaning on gene-editing simulations instead of wet-lab trials, adding even more headwinds to a life science market that is already overbuilt.

⚙️ REITs Chase the AI Infrastructure Boom

OpenAI signed another multibillion-dollar data center deal with AMD, committing to 6 GW of processors as it expands compute power. Prologis wants in on the data center buildout and plans to invest $8B in digital infrastructure and on-site energy projects to extend its growth story and sustain premium valuations.

🛒 Grocery-Anchored Retail Holds Its Ground

Demand for prime retail space remains strong as steady grocery traffic anchors resilient mixed-use developments. SJC Ventures’ $1B joint venture and Hines’ $428M Runway Playa Vista purchase highlight how grocery-anchored retail continues to attract capital even as broader retail faces consolidation.

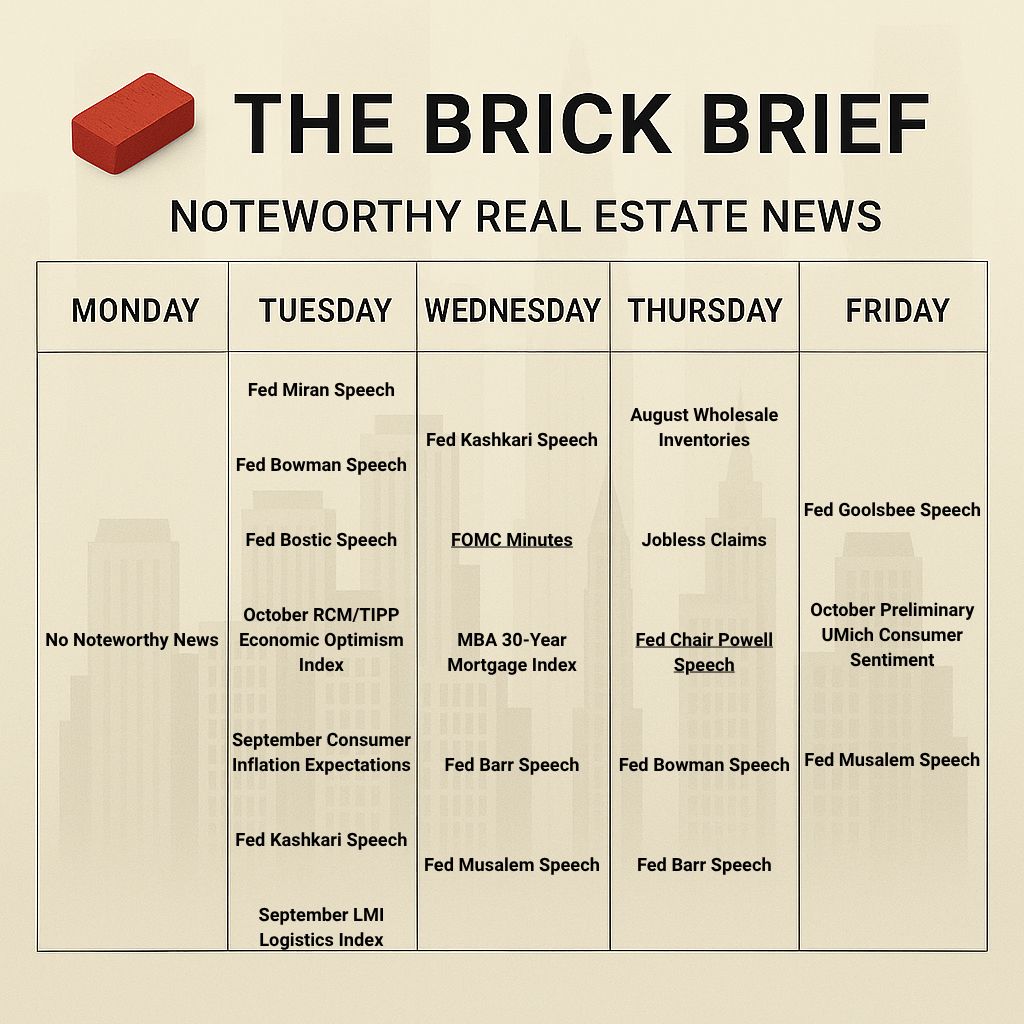

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.38% (+4 bps)

10Y Treasury Yield: 4.16% (+4 bps)

WSJ Prime Rate: 7.50%

FTSE NAREIT Index: 769.56 (-0.84%)

30-day SOFR Average: 4.27%

Market Pulse & Rate Watch

Jobless claims rise slightly to 224K despite shutdown – States continue reporting filings even as federal data collection halts, with hiring frozen and economists expecting the Fed to advance its next rate cut (Reuters)

Fed’s Schmid says policy is “appropriately calibrated” – The Kansas City Fed president warned against further rate cuts, citing persistent 3.5% services inflation and strong AI-driven business investment as signs the economy remains resilient (Reuters)

🧱 The Brick Lens🔎

Key Themes Today

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Life science offices remain under pressure as pandemic-era overbuilding flooded the market with new supply, and AI’s shift toward virtual drug discovery will add another headwind that could further shrink future lab demand.

Brick by Brick: AI Promises to Shrink Lab Space

AstraZeneca signed a $555M partnership with Algen Biotechnologies to license its AI-driven gene-editing platform for immune disorder therapies. Algen’s technology, developed from CRISPR research at UC Berkeley, uses machine learning to map genes to disease outcomes and identify drug targets with higher precision. The deal signals how large pharmaceutical firms are starting to embed AI directly into the earliest stages of drug discovery.

🧱 AI-driven research platforms can run digital simulations that predict how molecules interact with proteins and how patients might respond before a single lab experiment begins. These systems cut early-stage development timelines and costs by as much as 70%, allowing companies to prioritize only the most promising compounds for physical testing. As these tools mature, they will reduce the need for large-scale lab infrastructure and shift investment toward computational R&D environments.

🧱 The life science property market is already struggling with oversupply. U.S. lab vacancy climbed to 22.7% in Q2 as new projects outpaced leasing, leaving developers with excess capacity in key markets like Boston, San Diego, and the Bay Area. Even with stronger tenant demand, absorption remains negative and rents face growing pressure.

🧱Shares of $14B life science REIT Alexandria Real Estate Equities fell 4.55% today. Are investors repricing Alexandria’s prospects based on AstraZeneca’s new AI deal and the potential decline in future lab demand?

Takeaway: Just as signs suggest the worst of the COVID-era life science overbuilding may be easing, a new headwind is emerging. As virtual drug discovery gains traction, future lab demand will shrink, creating another serious headwind for an already overbuilt life science market struggling with high vacancy.

Policy & Industry Shifts

Trump urges Fannie Mae and Freddie Mac to spur homebuilding – President calls on mortgage giants to “get Big Homebuilders going,” claiming builders hold 2M vacant lots as his administration pursues privatization plans (Reuters)

Residential

Condo sellers outnumber buyers by 72% – High HOA fees, insurance costs, and new regulations are driving the steepest condo buyer’s market since 2020, with Florida and Texas leading the imbalance (Redfin)

72% of Gen Z renters move within two years – Younger renters are the most mobile cohort, with Austin, Charleston, and Raleigh leading relocation hotspots as economic uncertainty and flexible work drive short-term leases (GlobeSt)

Debt collectors profit from “zombie” mortgages – Firms are foreclosing on old second loans from the 2000s housing boom that borrowers thought were canceled, with over 600K homeowners potentially at risk as federal oversight weakens (Bloomberg)

Florida leads U.S. in vacant homes due to vacation and short-term rentals – Four Florida metros rank among the top five for unoccupied properties, led by Cape Coral at 38.7%, as seasonal use drives high vacancy rates statewide (Homes.com)

Office

Leasing

New York State Office of General Services signs 66K-SF office lease expansion at 919 Third Avenue in New York, NY – The agency grew its footprint to 117K SF at SL Green’s fully leased Midtown tower, with CBRE representing both parties (CommercialObserver)

Sagard Capital signs 40K-SF office lease at 280 Park Avenue in New York, NY – The Montreal-based asset manager expanded within Vornado and SL Green’s 1.3M-SF Midtown tower, taking the 33rd and 34th floors at $130 PSF (TheRealDeal).

Howden signs 24K-SF office lease at 600 Brickell in Miami, FL – The London-based insurance brokerage will open its first Miami office at Foram Group’s Brickell World Plaza in early 2026, with Colliers representing the tenant (CommercialObserver)

Industrial

Trump to impose 25% tariffs on imported heavy trucks starting Nov. 1 – The duties target medium- and heavy-duty vehicles over 10,000 pounds under a Section 232 national security probe, threatening higher costs across shipping and construction while boosting domestic truckmakers (Bloomberg)

Retail

QSR value deals lose steam – McDonald’s, Pizza Hut, and Dairy Queen saw weaker traffic from standard discounts, with only deep cuts or creative tie-ins like McDonald’s 50-cent cheeseburger and Pizza Hut’s $2-Buck Tuesdays driving strong gains (Placer.ai)

Data Centers

OpenAI signs $40B data center chip deal with AMD – Partnership gives OpenAI 10% stake if deployment goals met and commits to buying 6 GW of MI450 processors, challenging Nvidia’s dominance (WSJ)

Prologis to invest $8B in data centers and energy – The logistics REIT plans 20 digital infrastructure projects over four years as it expands into power generation to support AI-driven supply chains emphasizing energy reliability and resilience (ConnectCRE)

Insight: Fundamentally, publicly traded REITs need to prove they’re growing to justify premium valuations, and Prologis wants a piece of the data center boom as it pushes to extend its expansion story.

Midwest data center boom repurposes old factories and offices – Developers are converting defunct industrial sites and vacant office towers into AI inference centers as tech firms like Microsoft, SoftBank, and Meta expand smaller-scale data facilities across the region (Bisnow)

Hospitality

Hotel RevPAR growth slows across top 25 markets – Only 13 major U.S. markets saw revenue gains through August 2025 compared with all 25 in 2022, as the post-pandemic travel boom gives way to uneven performance across metros (CoStar)

Market Mix

Life Sciences

AstraZeneca signs $555M AI drug deal with Algen – Partnership grants AstraZeneca rights to develop immune disorder therapies using Algen’s AI-driven gene-editing platform, expanding its cell and gene therapy push (Reuters)

Insight: AI is reshaping drug development by moving early-stage research from physical labs to digital simulations. As companies like AstraZeneca adopt these platforms, they need less traditional lab and office space, adding pressure to an already overbuilt life science market.

Financings

Loans

Affinius Capital supplies $170M construction loan for 431-unit Piazza Alta Phase II multifamily project in Philadelphia, PA – Post Brothers secured the financing for the second phase of its Northern Liberties development, featuring two buildings with completion slated for 2027 (CommercialObserver)

Bain Capital and Bungalow Projects secure $156M C-PACE loan for Echelon Studios in Brooklyn, NY – CounterpointeSRE financed the state’s largest-ever clean energy loan to fund two low-carbon film studio developments in Bushwick and Red Hook totaling 455K SF (Bisnow)

J.P. Morgan lends $103M for 870K-SF Long Beach Towne Center retail mall in Long Beach, CA – CenterCal Properties and DRA Advisors acquired the property from Vestar for $145M with plans for upgrades and redevelopment (CommercialObserver)

M&A

Building & Portfolio M&A

Multifamily

Bonjour Capital acquires 180-unit Avalon Brooklyn Bay apartments in Brooklyn, NY for $75M – AvalonBay sold the residential portion of the 28-story tower at 1501 Voorhies Avenue in Sheepshead Bay, which includes 250K SF of apartments and 34K SF of amenities (TheRealDeal)

Tenet Healthcare acquires 153K-SF Victor Farris Building in West Palm Beach, FL for $62M – The Dallas-based hospital chain purchased the medical office and ground lease at 1411 North Flagler Drive within its Good Samaritan Medical Center campus (TheRealDeal)

Institutional Fundraising

SJC Ventures forms $1B JV to develop grocery-anchored retail and multifamily centers along the East Coast – The Atlanta-based developer partnered with a global life insurer and secured $143M in loans from Truist and Seacoast Bank for initial projects in Pennsylvania and Florida (CommercialObserver)

Insight: Despite bankruptcies from Claire’s, Big Lots, and Rite Aid, demand for prime retail space remains strong as retailers compete for limited, high-traffic locations. SJC Ventures is betting on that resilience with a $1B joint venture focused on grocery-anchored mixed-use projects, where steady grocery traffic supports retailers and residents benefit from everyday convenience right outside their doors. Whole Foods stands out as the anchor of choice because it draws a wealthy, health-conscious shopper base that keeps traffic strong and attracts premium retailers. Despite closing below the $475M Invesco paid in 2016, Hines recently paid $428M for the Whole Foods–anchored Runway Playa Vista, a rare bright spot that ranks among LA’s priciest deals in 2025 amid a troubled real estate market.

Distress Watch

CMBS distress rate falls to 11.28% in Q3 – Delinquency eased from 9.44% to 8.59% as retail and hotel sectors improved while office loans remained most pressured; issuance rose 26% YoY to $91.4B led by single-asset, single-borrower deals (CommercialObserver)

$575M in Texas CRE loans head to foreclosure in October – Multifamily assets dominate auctions across Houston, Dallas, San Antonio, and Fort Worth, with Harris County leading at $270M in distressed debt (TheRealDeal).

Bankrupt Rite Aid closes final 89 stores – The 62-year-old pharmacy chain ends operations after its second bankruptcy in two years, underscoring continued consolidation across the retail pharmacy sector (Bisnow)

Proptech & Innovation

Top 5 AI trends reshape brokerage marketing – Only 29% of firms provide AI content tools even as top agents using AI are twice as effective, highlighting a major opportunity to boost personalization, productivity, and tech adoption across brokerages (Inman)