The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support. Recent news has been a bit quiet due to the holidays. Today we’re seeing November pending home sales show early signs of renewed demand, while AI infrastructure investment continues to surge.

🏡 Housing Demand Is Finding Its Footing

November pending home sales rose 3.3% MoM and 2.6% YoY to a three-year high as lower mortgage rates and faster wage growth modestly improved affordability and pulled sidelined buyers back into the market. Looking ahead to 2026, CoStar’s Homes.com expects steady housing growth as rising incomes and resilient consumer spending support demand even as high prices, elevated mortgage rates, and constrained affordability continue to cap upside.

🏗️ AI Infrastructure Capital Keeps Scaling

SoftBank agreed to acquire data center investor DigitalBridge for $4 billion as it moves deeper into AI infrastructure despite rising AI bubble fears. On the other hand, the FT argues the AI boom reflects exuberance without irrationality as large incumbents keep spending aggressively to defend core businesses and hedge against competitive disruption.

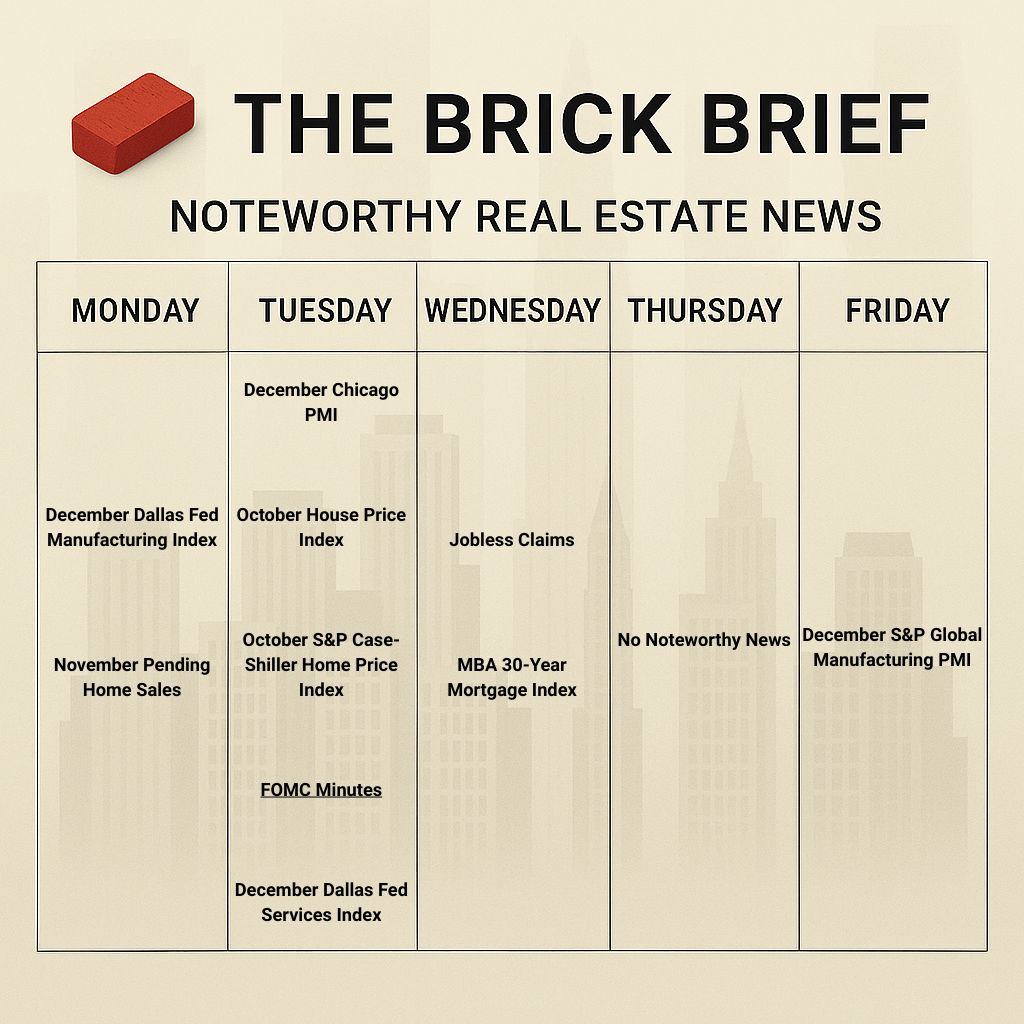

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.19% (-1 bps)

10Y Treasury Yield: 4.12% (-2 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 758.47 (-0.18%)

30-day SOFR Average: 3.81%

Market Pulse & Rate Watch

Trump signals potential move against Fed leadership ahead of chair pick -- President says Powell should resign, repeats he may try to fire him, and plans to name a preferred Fed chair candidate in January (Bloomberg)

Market Mix

Copper prices surged over 30% in 2025 to decade highs -- Tariffs, supply disruptions, and rising data center and electrification demand are locking in higher construction costs for U.S. builders with limited substitution options (Bisnow)

Copper is a critical component in construction for electrical wiring, plumbing, and HVAC systems. Higher material costs across inputs like lumber and copper add another headwind when land and labor costs already make new development economically challenging.

HUD says 50-year mortgage remains under consideration for 2026 -- Industry experts warn the ultra-long loan could deepen affordability risks by sharply increasing lifetime interest costs and complicating underwriting standards (NationalMortgageNews)

Residential

Residential

US pending home sales rose 3.3% MoM and 2.6% YoY in November to near three year high -- Improving affordability from lower mortgage rates and faster wage growth is pulling buyers back into the market (Reuters)

Homes.com sees steady housing growth in 2026 despite affordability pressures - Rising incomes and resilient consumer spending are expected to support demand even as high prices and mortgage rates constrain buying power in expensive markets (Homes.com)

Homes.com sees affordable Midwest and interior markets leading price gains in 2026 - Completed sales data suggests lower-cost metros like Cleveland, Cincinnati, and Pittsburgh will outperform as buyers prioritize value (Homes.com)

Homes.com sees slower job switching shaping housing demand in 2026 - Reduced labor mobility is expected to limit relocation while supporting homeownership stability in more affordable markets as Sun Belt growth cools (Homes.com)

CoStar’s Homes.com expects housing affordability to remain constrained in 2026 as high prices and mortgage rates limit buying power, even as rising incomes and a shift toward lower-cost markets offer modest relief at the margin.

Bloomberg argues the housing market is tilting toward Gen Z -- Rising resale inventory, slowing price growth, and a coming decline in boomer-owned households are expected to improve first-time buyer conditions over the next decade despite near-term affordability strain (Bloomberg)

Realtor.com urges lawmakers to address US housing supply gap -- Let America Build campaign pushes zoning reform and pro-building policies as national housing inventory remains more than 4 million units short heading into 2026 (HousingWire)

It takes the typical U.S. household 7 years to save for a down payment in 2025 - The timeline has improved from 2022 highs but remains well above pre-pandemic norms, with sharp gaps between high-cost coastal metros and more affordable Southern markets (Realtor.com)

Multifamily

US multifamily enters potential turning point in 2026 -- Slowing construction after years of oversupply is expected to gradually ease vacancies and support modest rent growth; expected recovery timing varies sharply by market and asset quality (CoStar)

Industrial

Leasing

DPR Construction leases 203K SF at Northlake II in Ashland, VA – Matan Companies pre-leased the full Building D at the four-building industrial development roughly 15 miles north of Richmond, pushing the 548K SF project closer to full occupancy (CommercialObserver)

Retail

DC-area restaurant closings rose over 25% in 2025 -- At least 92 eateries shut down as midpriced dining was hit hardest by weaker demand and margin pressure from rising operating costs (CoStar)

Data Centers

AI boom may reflect exuberance without irrationality – Valuations are high, but capital flows remain grounded in rational expectations about AI’s long-term economic potential rather than speculative mania (FT)

The AI bubble has remained a central debate in recent months, as critics point to stretched valuations, speculative data center development and financing, and the limited revenue or profit generation across much of the AI ecosystem so far (outside of a few specific segments). Billionaire developer Fernando de Leon recently raised concerns about hyperscaler tenants potentially breaking leases early and leaving data centers and invested capital stranded, and he further questioned why hyperscalers would avoid keeping data centers on their balance sheets if the assets were truly mission critical.

This article gives an interesting counter to prevailing AI bubble fears, arguing that today’s boom reflects exuberance rather than irrationality. While valuations are high and a bust remains possible, capital deployment is largely driven by rational expectations, particularly from large technology incumbents spending aggressively to defend core businesses and hedge against competitive disruption.

I lean toward this argument. These megacap technology companies are led by rational, highly informed executives with a far clearer view of the competitive landscape and technological roadmap than we do - Google acquired DeepMind back in 2014. There is a substantive reason these firms have pivoted so aggressively and are now shoveling enormous amounts of free cash flow toward AI and compute.

It is also worth noting that today’s LLMs are still trained primarily on text and images. A growing view is that true AGI may require training across three-dimensional environments with sight, sound, and touch (world models). If that proves true, today’s investment cycle may reflect early positioning for a much larger and even more capital-intensive phase still ahead rather than speculative excess.

For example, Meta is building toward an AI product and hardware ecosystem through its smart glasses, which will likely record continuous visual and audio data and require enormous amounts of compute to train, process, and deploy at scale.

Zuckerberg has long wanted to own the next hardware layer, which helps explain the aggressive pivot toward and then away from the metaverse and now toward AI glasses and augmented reality. This is where people will interact with AI models and the physical world through an Iron Man–style assistant embedded in glasses rather than a chatbot on a screen.

And importantly, Meta is not alone in this view. Google's Gemini-powered smart glasses are coming in 2026.

That is why Zuckerberg plans to spend $600B on data centers over the next three years. The goal of the AI infrastructure buildout is not to have the best chatbot.

Hospitality

Unpredictable demand and rising costs squeezed hotel operators in 2025 -- Flat RevPAR, tariff driven cost volatility, and pricing uncertainty pressured margins even as labor conditions improved and staffing stabilized (CoStar)

Life Sciences

Boston biotech hiring stalls despite deep talent pool -- Empty labs and shrinking venture funding are leaving Ph.D. graduates facing weak job prospects and forcing some to look outside the region for work (WSJ)

Financings

Loans

Goldman Sachs’ Urban Investment Group leads a $278M construction financing for the Arverne East Building D affordable multifamily project in Far Rockaway, Queens - The loan funds L+M Development Partners’ 320-unit first phase of the Arverne East master plan (CommercialObserver)

Refinancings

Deutsche Bank provides a $350M refinance for the Paradise Plaza retail complex at 151 NE 41st Street in Miami, FL - The loan refinances a portion of the Miami Design District luxury mall owned by Dacra, Brookfield Properties, and L Catterton (CommercialObserver)

M&A

Company M&A

SoftBank buys data center investor DigitalBridge for $4bn to deepen AI infrastructure push -- Masayoshi Son is accelerating large scale bets on data centers, compute, and connectivity despite rising bubble concerns (FT)

Building & Portfolio M&A

Multifamily

L&G Asset Management America buys Alder apartment community at 15091 Belford Avenue in Parker, CO for $97.2M - The acquisition marks the firm’s fourth Denver-area multifamily purchase in the past year (TheRealDeal)

Industrial

Walmart buys 2.4M SF industrial campus in Glendale, AZ from Lincoln Property Co. for $152M – The off-market deal marks the second-largest industrial sale in metro Phoenix history and highlights demand for big logistics sites with highway and rail access (FreightWaves)

Land

Avdoo pays $63M for a development site at 68 King Street in New York City, NY - The acquisition positions the developer to pursue a high-end residential project with more than 200,000 SF of potential buildable area through additional air rights (TheRealDeal)

Distress Watch

Summit Properties USA agrees to acquire a portfolio of roughly 5,100 mostly rent-stabilized apartment units across Brooklyn, Manhattan, Queens, and the Bronx in New York City from Pinnacle Group for $451M - The stalking-horse bid sets a floor price for the bankrupt portfolio ahead of a January Chapter 11 auction (Bloomberg)