The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Thank you for your continued support! Today we’re seeing October home affordability improve, office confidence build as supply tightens, and megaproject activity surge even as construction costs rise.

🏡 Sellers Trim Faster as October Affordability Improves

Sellers are creating clearer affordability in October as faster and repeated price cuts pull more buyers into a market where listings are lingering longer. This shift is accelerating price discovery as cumulative October reductions hit record levels and allow more buyers to act while inventory sits.

🏢 Office Confidence Builds on Leasing Gains and Limited Supply

Office sentiment has improved sharply as return to office momentum drives steady occupancy gains and new leasing activity even though hybrid work continues to cap a full rebound. Confidence is strengthening further as a historically thin construction pipeline points to limited future supply and sets the stage for firmer landlord leverage.

🏗️ Megaproject Tailwinds Carry Construction Despite Cost Pressures

Megaproject tailwinds are outweighing the rise in construction costs as demand for data centers, manufacturing plants and infrastructure continues to lead activity. October’s 21% jump in starts and the wave of billion-dollar projects broke ground even as tariffs and labor costs climb, which JLL expects to intensify in 2026.

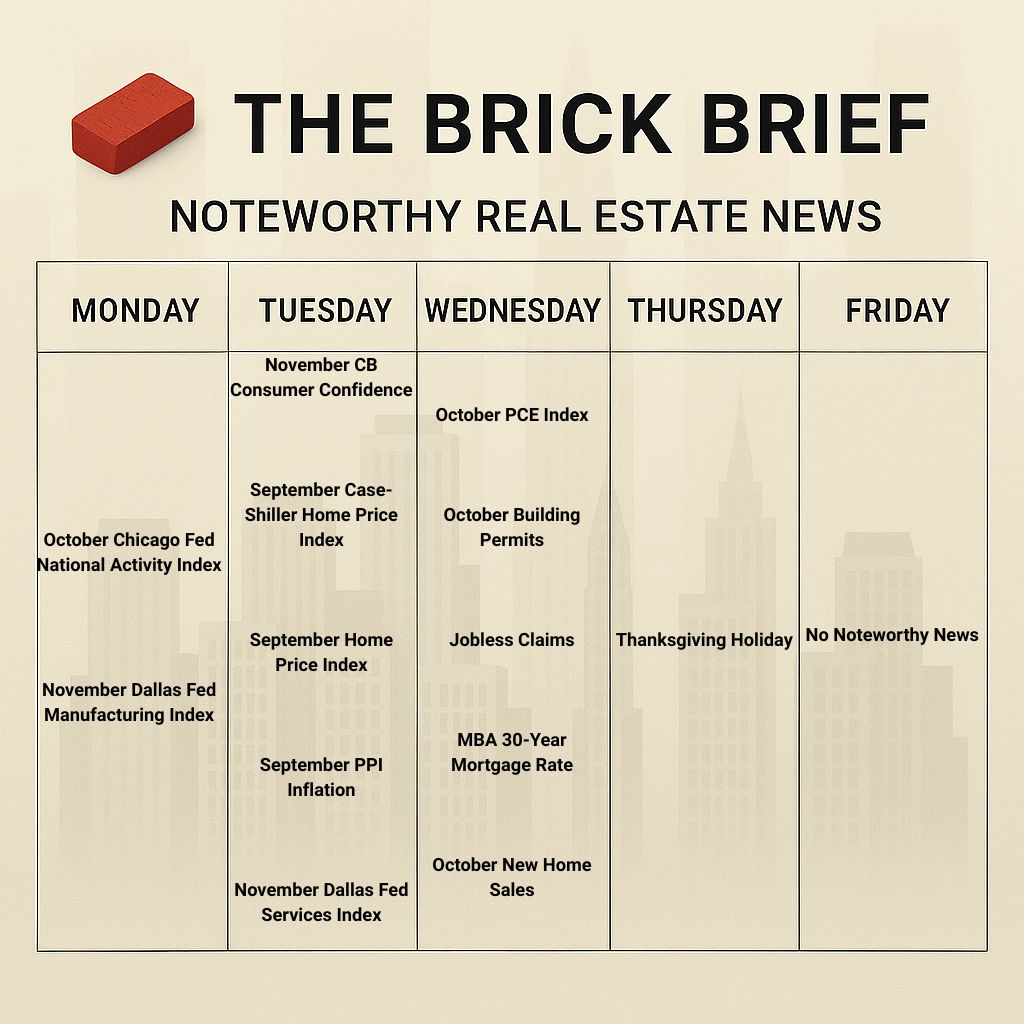

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.32% (-2 bps)

10Y Treasury Yield: 4.03% (-4 bps)

WSJ Prime Rate: 7.25%

FTSE NAREIT Index: 762.52 (+0.14%)

30-day SOFR Average: 4.04%

Market Pulse & Rate Watch

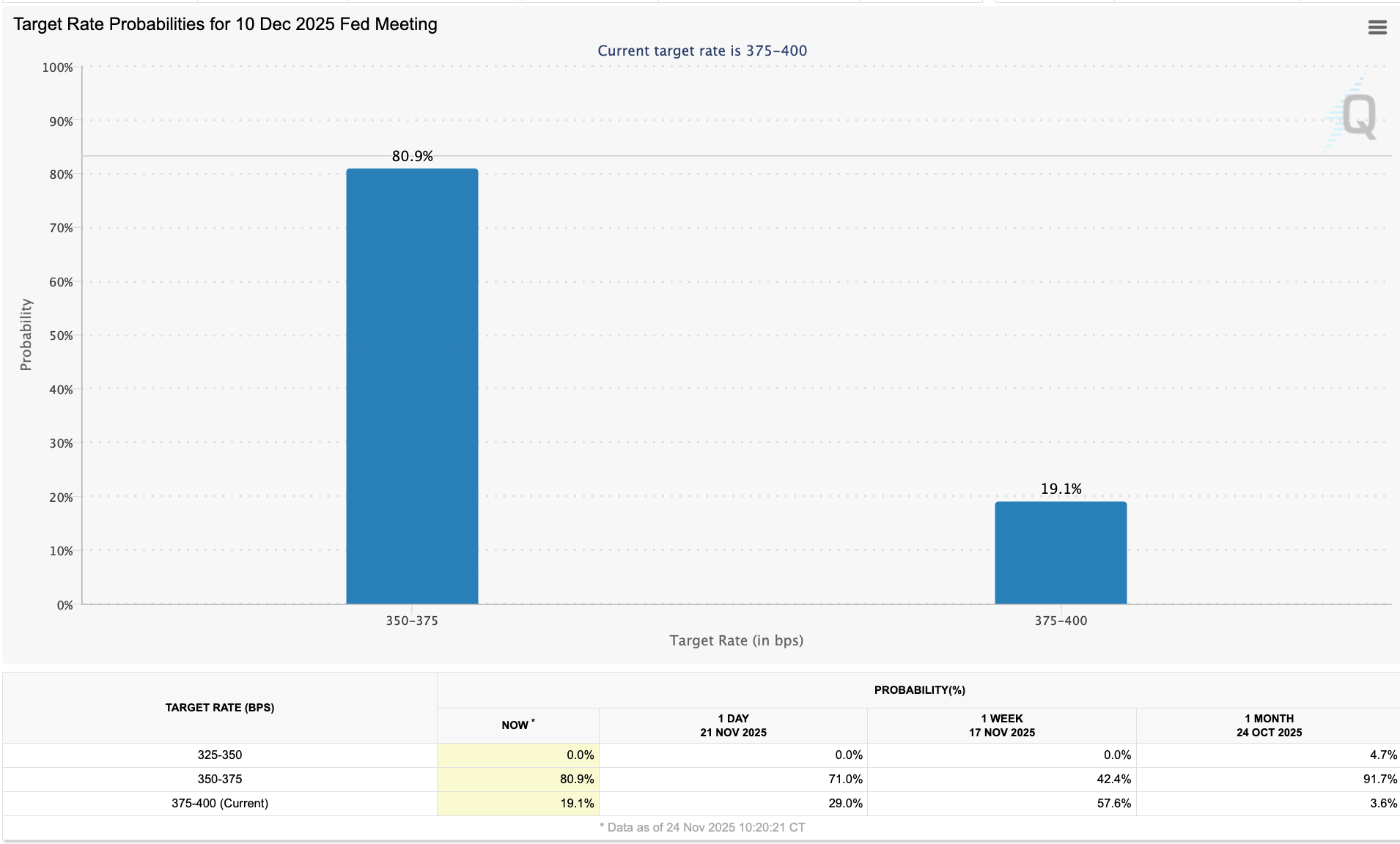

Additional Fed support for a December move pushed the 10-year toward 4% as markets lifted cut odds to about 80%.

Fed’s Daly backs a December rate cut – She says the labor market faces a higher risk of sudden weakening than an inflation rebound because tariff-driven cost pressures have been muted (WSJ)

Fed’s Waller backs a December cut – He says labor-market weakness supports easing now, while January is uncertain because shutdown-delayed data could reveal either firmer inflation or further job softening (Reuters)

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Flight to quality is most pronounced in office, where demand is concentrated in top-tier buildings, but the same shift is unfolding in retail and industrial.

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Market Mix

U.S. CRE transaction volume rose 18% YoY through Q3 – SOFR fell ~30 bps after October’s cut while 5- and 10-year treasury yields and lending spreads held near year-to-date lows (CushmanWakefield)

Construction starts jump 21% – Ten $1B+ megaprojects broke ground in October as data centers, manufacturing plants and major infrastructure builds offset a sharp 39% drop in multifamily activity (Bisnow)

Insight: The tailwinds behind data center, manufacturing and infrastructure megaprojects have outweighed the rise in construction costs, which continue to climb due to tariffs and labor-driven pressures that JLL expects to intensify in 2026.

U.S. real estate enters a new upswing – A sharp 2022–2024 correction reset pricing, tightened fundamentals and created the conditions for investors to capture early-cycle growth tailwinds (IREI)

Bonus depreciation lifts single-tenant net lease demand – Investors chase STNL assets as 100% bonus depreciation boosts activity in car wash, convenience store and QSR formats (IREI)

Policy & Industry Shifts

DOGE dissolved after rescinding hundreds of planned lease terminations – The Musk-led federal efficiency unit ultimately cut just 4.8M SF from GSA’s footprint, adding uncertainty to government-backed office assets (Bisnow)

Massachusetts rent control ballot qualifies for 2026 – Homes for All Massachusetts gathered enough signatures to place a local-option rent control measure on next year’s statewide ballot (HousingWire)

Residential

$25K cumulative October price cuts match a record high – Homes are taking longer to sell, leading sellers to trim prices multiple times as improved affordability fuels the most active fall since 2022 (Zillow)

Insight: October prices come from late-summer contracts, while Zillow’s October listing data offers a real-time read. Faster trimming is creating affordability gains that are lifting buyer activity and accelerating price discovery.

Refi demand surges as rates fall – A jump in refinancing activity is raising costs across the mortgage market as lenders reprice to handle the wave of borrowers rushing to swap out 7%–8% loans (WSJ)

Fannie Mae projects $2.5T in mortgage originations by 2027 – The GSE’s new outlook calls for a gradual rebound toward early-2020s volume levels after several years of tightened activity (NationalMortgageNews)

Homeowners insurance premiums set to jump 16% by 2027 – Cotality projects 8% increases in both 2026 and 2027 as rising construction costs, climate risks and insurer pullbacks drive the fastest premium growth on record (Realtor.com)

Office

U.S. office construction falls to lowest level since 2011 – The national pipeline has plunged as fewer groundbreakings leave tenants with shrinking options and only a handful of traditional towers still moving forward (CoStar)

Insight: Stronger office leasing and occupancy paired with a historically thin construction pipeline may be driving the recent upswing in confidence across the sector.

64 U.S. office sales over $50M closed in Q3 – Activity increased 50% YoY with buyers including Blackstone, Baupost, Shorenstein and Lincoln Property Co. (CushmanWakefield)

Leasing

EQT Partners expands to 115K SF at 245 Park Avenue in New York, NY – The private equity firm added a full floor at SL Green’s tower, bringing its Midtown footprint to 115K SF (CommercialObserver)

Overtime expands to 41K SF at 20 Jay Street in Brooklyn, NY – The sports media company renewed and enlarged its Dumbo footprint at Two Trees Management’s building with a new 7-year lease (CommercialObserver)

Retail

Dollar stores see steady traffic gains – Dollar Tree and Dollar General post mid-single-digit YoY visit growth as inflation fatigue pushes shoppers toward value (Placer.ai)

Data Centers

Amazon to spend up to $50B to expand AI and HPC services for US agencies – AWS will add 1.3 GW of secure federal data-center capacity and deploy Amazon, Anthropic and Nvidia AI tools across more than 11,000 government clients (Bloomberg)

Amazon to invest $15B to build new Indiana data-center campuses – The project adds 2.4 GW of capacity and 1,100 jobs as Amazon expands AI cloud infrastructure (Reuters)

Amazon’s data center footprint tops 900 facilities – New documents show AWS relies on more than 440 colocation sites and 220 edge locations as it expands global capacity for AI demand (Bloomberg)

Moca Systems warns data-center construction will peak in 2026 – Its new report shows the AI-driven building surge is front-loaded as hyperscalers shift future capex from new campuses to GPUs and computing hardware (Bisnow)

Life Sciences

IQHQ halts its $1B Fenway Center lab project in Boston, MA – The developer is pausing construction beyond the completed deck until it secures 50% leasing as life sciences vacancy tops one-third and financing conditions tighten (Bisnow)

Financings

Tech giants raise nearly $100B in bonds – Amazon, Microsoft, Google, Oracle and Meta tap debt markets to fund a $400B AI and cloud buildout as global AI investment heads toward a projected $4T by 2030 (Reuters)

DoubleLine warns AI debt could strain credit markets – Nearly $90B in hyperscaler bond sales has raised concern that a projected $1.5T wave of data-center debt could re-lever the investment-grade market by 2030 (Reuters)

Loans

Rudin secures a $350M office-to-resi conversion recapitalization for 845 Third Avenue in New York, NY – Quantum Pacific is investing $80M while BDT&MSD is providing a $250M construction loan (CommercialObserver)

Ambient Communities secures a $66M affordable housing construction loan in San Diego, CA – Genesis Capital provided the financing for the 198-unit Palm & Hollister Apartments (CommercialObserver)

Refinancings

Crow Holdings Capital and Constellation Real Estate Partners secure a $74M industrial refinance in El Paso, TX – Affinius Capital provided the loan for the 799K SF Constellation Trade Center (CommercialObserver)

M&A

Building & Portfolio M&A

Office

Capstone Equities buys a Chelsea office tower in New York, NY for $81M – GDSNY sold the newly built 12-story 322–326 Seventh Avenue property it completed in 2022 (CommercialObserver)

Related Ross buys the One Clearlake office tower in West Palm Beach, FL for $55M – Bradford Allen sold the 18-story, 222K SF property at 250 South Australian Avenue (TheRealDeal)

Institutional Fundraising

$23.3B in private real estate fund closings have posted since October – Debt funds led with raises from Bridge Debt Strategies V, TPG Real Estate Credit Opportunities and Greystar Credit Opportunities II (CushmanWakefield)

Distress Watch

Waterfall Asset Management moves to seize Rudy Gabsi’s 90% stake in 611 West 56th Street in New York, NY – The lender filed suit after Gabsi failed to pay a $92M judgment tied to the condo project’s defaulted 2016 loan (TheRealDeal)