The Brick Breakdown

Hello Brick Brief readers,

Happy Friday. Today we’re seeing rate cut odds bounce back after weak October jobs data, builders struggle to sell homes despite steep mortgage buydowns, and Airbnb outperform a slowing U.S. hotel market.

💼 Yields Drop as Labor Market Weakens

Bond yields fell as unemployment rose to 4.4% and job cuts surged to 153K, the highest October level since 2003. The 10-year Treasury yield slid back down to 4.09% and mortgage rates eased to 6.29% as investors priced in weaker growth and higher odds of a December Fed rate cut.

🏠 Builders Struggle as Buydowns Lose Effect

Homebuilders are running out of room to spur demand, and some are offering mortgage buydowns to rates as low as 1%. These incentives make payments look cheaper without cutting home prices, but rising job insecurity and oversupply are leaving new homes sitting unsold at 2009 highs.

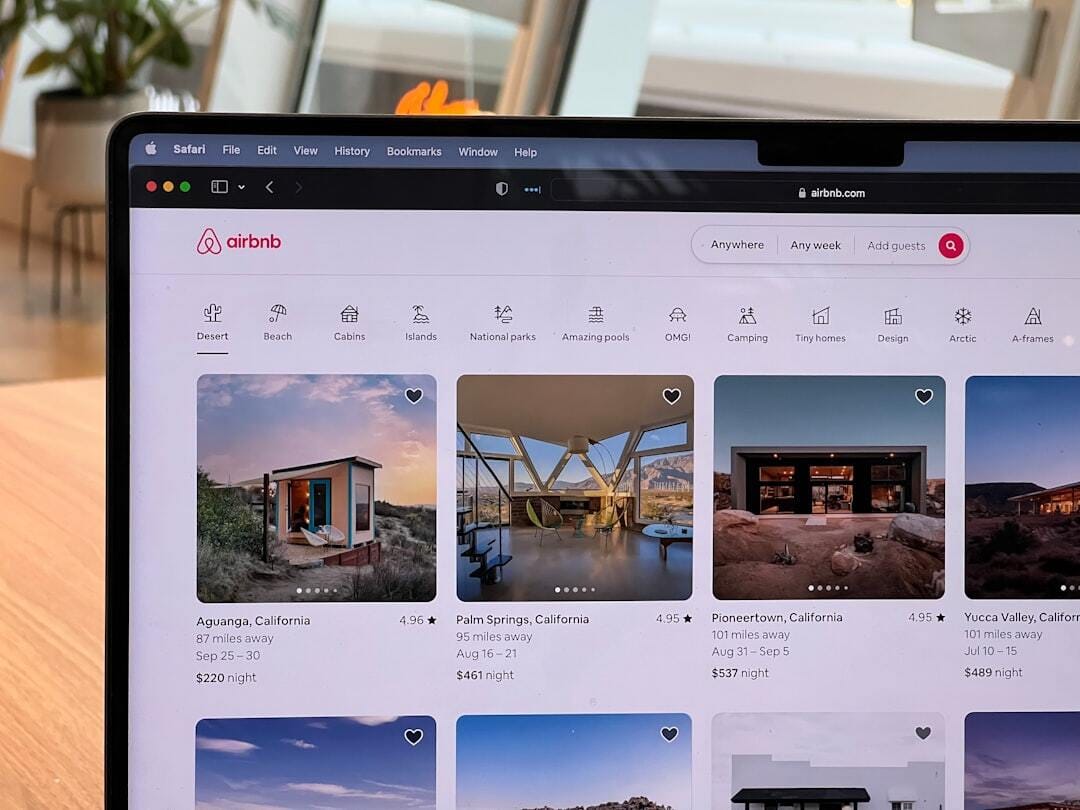

🌍 Airbnb Outperforms Hospitality Slowdown

Airbnb is defying consumer weakness in U.S. hospitality by leaning on international travelers and longer stays. The company’s 14% rise in gross bookings and strong Q4 outlook show that diversified demand and flexible offerings are helping it weather the US hospitality slowdown.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.29% (-8 bps)

10Y Treasury Yield: 4.09% (-6 bps)

WSJ Prime Rate: 7.25%

FTSE NAREIT Index: 757.54 (-0.35%)

30-day SOFR Average: 4.19%

Market Pulse & Rate Watch

U.S. unemployment rises to 4.4% in October – The jobless rate reached a four-year high as hiring slowed and layoffs increased, with the Chicago Fed estimating that furloughs from the government shutdown added upward pressure (Reuters)

Initial jobless claims rose to 229K last week – Layoffs remain limited and hiring steady despite private reports of job cuts tied to AI and cost reductions (Reuters)

Job cuts hit 153K in October – Layoffs surged 183% from September to the highest October level since 2003, led by 33K tech job cuts as firms adjust to AI-driven restructuring (CNBC)

Insight: Yesterday, ADP reported a 42K gain in private-sector jobs, so why did Challenger count 153K layoffs? ADP tracks workers still on payrolls, while Challenger measures announced cuts that haven’t yet taken effect, meaning many of those layoffs are coming but not yet reflected in payroll data. Therefore, in November we can likely expect ADP to report weaker hiring, as Challenger is a better real-time gauge of employment while ADP tends to lag.

Fed’s Musalem says recent rate cuts were appropriate to support jobs – Policy is now between modestly restrictive and neutral as tariff-driven inflation is expected to ease in 2026 (Reuters)

Fed’s Hammack warns policy may be too loose – The Cleveland Fed chief said rates are near neutral and that she’s “nervous” given inflation remains the bigger risk compared to a still-stable labor market (Reuters)

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Market Mix

CRE investment sales rise 19% YoY and loan originations jump 48% through Q3 – Newmark reported stronger lending and refinancing activity as lower rates spurred $587B in 2025 debt volume and a 15% quarterly gain in sales (CommercialObserver)

Policy & Industry Shifts

Virginia election turns data centers into political flashpoint – Governor-elect Abigail Spanberger’s win signals tighter scrutiny on energy costs and siting rules as data center power use nears 60% of state households (Bisnow)

Maryland sues Trump administration over FBI HQ reversal – The state alleges illegal actions in canceling the $3.5B Greenbelt project and redirecting $1B in funds to keep the agency in D.C. (Bisnow)

Residential

Homebuilders struggle to sell even with 4% mortgage offers – Completed but unsold new homes hit 2009 highs as demand stays weak despite aggressive rate buydowns (WSJ)

Builders offer rates as low as 1% to spark demand – Incentives on new homes surged to 7.5% of sale prices as job insecurity and cheap rents keep buyers sidelined despite record discounts (Bloomberg)

Insight: Mortgage buydowns are no longer sustaining enough sales for builders, and some are getting desperate enough to offer 1% rates. So why offer 1% mortgage rates rather than cut home prices directly? Builders use buydowns to make payments look cheaper without lowering headline prices, which protects comps and keeps reported sales velocity steadier even as real demand softens. Regardless, home prices across the Sunbelt continue to cool as excess inventory builds and affordability remains strained.

42 is the median age of U.S. homebuyers - Millennials lead at 35%, with Gen Z 18%, Gen X 23%, and Boomers 23% (Zillow)

40% of homebuyers live in the South – The region drives both demand and supply, while the Midwest holds 26%, the West 23%, and the Northeast 12%; over half of all homes for sale sit in the South (Zillow)

$97.6K is the median household income for homebuyers - This is above the $74.6K U.S. median, with 33% earning $100K to $199.9K and 17% at $200K+ (Zillow)

Flood-prone U.S. counties saw 29K outflows in 2024 – High-risk areas like Miami-Dade and Houston lost residents as rising insurance costs, climate risk, and politics pushed people to safer, cheaper regions (Redfin)

Office

Office tenant improvement costs plateau at record highs – TI allowances have surged 112% since 2016 to $212 per SF but grew only 8% last year as landlords curb spending amid rising costs and limited new supply (Bisnow)

REIT Peakstone sells $365M in Class B suburban offices to go all-industrial – The company is exiting Sunbelt and secondary market holdings to focus on industrial outdoor storage and cut debt below $1B (Bisnow)

Leasing

BakerHostetler renews 115K-SF office lease at 45 Rockefeller Plaza in New York, NY with Tishman Speyer – The law firm has occupied the 39-story Midtown tower since 2001, (CommercialObserver)

Sixth Street signs 103K-SF sublease at The Spiral in New York, NY with Tishman Speyer – The deal at 66 Hudson Blvd. ranks among Midtown South’s largest October transactions and runs through 2042 (CommercialObserver)

Industrial

Leasing

A1R Water leases 112K SF at Countyline Corporate Park Building 30 in Hialeah, FL with Terreno Realty – The 10-year deal at 4341 W. 108th St. establishes the air-to-water technology firm’s new facility (CommercialObserver)

Retail

Retail rents post slowest growth in over a decade – National rent growth cooled sharply last quarter, though the South stayed strongest with Tampa leading all U.S. markets for annual retail rent gains (CoStar)

U.S. holiday sales growth to slow sharply – Retail sales are expected to rise just 2.5%–3.6% this season, the weakest since 2018, as inflation and trade uncertainty curb consumer spending despite sales topping $1T for the first time (Reuters)

Eyewear retailer Warby Parker posts 9% YoY visit growth – Expansion to 45 new stores and longer in-store visits boosted retail revenue to 73% of total sales as shoppers shift offline (Placer.ai)

Earnings & Real Estate Impact

Airbnb shares rose ~5% despite missing Q3 earnings expectations as revenue increased 10% YoY, guidance for Q4 came in above forecasts, and gross bookings rose 14% YoY driven by stronger international travel and longer stays.

Insight: Airbnb is outperforming broader hospitality weakness thanks to a more diversified consumer base and flexible offerings that extend beyond traditional hotel stays. Its mix of international travelers, longer bookings, and unique accommodations continues to attract demand even as hotel spending softens (and now includes bookable services in addition to lodging).

Financings

Refinancings

Arden Living secures $161M refinancing for Forty Six Fifty apartments in New York, NY – Starwood Property Trust provided the loan for the 222-unit mixed-use property at 4650 Broadway in Manhattan’s Inwood neighborhood (CommercialObserver)

Brio Living Services secures $113.5M financing for senior living redevelopment at Porter Hills Village in Grand Rapids, MI – Ziegler provided tax-exempt bonds to fund a 250K-SF replacement building and 57 new independent living units set for 2027 completion (ConnectCRE)

Thor Equities secures $72M refinancing for Gordon Logistics Center in Adairsville, GA – Benefit Street Partners provided a two-year floating-rate loan for the 1M-SF Class A industrial facility completed in 2023 (CommercialObserver)

Noah Properties secures $50M refinancing for Novú Apartments in Niles, IL – Walker & Dunlop Investment Partners provided bridge financing for the 180-unit Class A multifamily complex completed earlier this year (CommercialObserver)

M&A

Company M&A

Blackstone sells $1.8B senior housing portfolio across U.S. after steep losses – The firm is offloading about 90 properties totaling 9,000 units, with some assets trading over 70% below purchase price (WSJ)

Insight: Blackstone is unloading its $1.8B senior housing portfolio at steep losses just as Welltower doubles down on the same sector. So why is Blackstone selling? The firm entered in 2016–2017 when valuations were high and operating margins looked stable, but post-pandemic labor shortages, rising wages, and weak rent growth crushed returns and made these assets less competitive than its industrial and data center holdings. Welltower, on the other hand, is buying in at the bottom of the cycle, as aging demographics lift long-term demand and distress among private owners creates discounted entry points for higher-quality assets.

Property management firm Akam acquires residential operator Orsid New York in Manhattan– The deal adds 260 residential buildings to Akam’s management portfolio following its March merger with Metro Management (CommercialObserver)

Building & Portfolio M&A

Multifamily

Sterling Investors and Simpson Housing acquire The Signature apartments in Reston, VA for about $240M from BXP – The 508-unit, two-building complex at 11850 Freedom Dr. is 95% leased (CommercialObserver)

Healthcare

Harrison Street acquires six-property senior housing portfolio in California for $200M – The firm partnered with Oakmont Senior Living and Blue Mountain Enterprises on the 669-unit venture spanning five operational assets and one development site (CommercialObserver)

Hospitality

Vici to buy Golden Entertainment’s Nevada casinos in $1.2B deal – The REIT will acquire seven properties including The Strat in a sale-leaseback, offering a 41% premium as Golden goes private (Bisnow)

Ketu Amin to acquire 752-key hotel The Westin Michigan Avenue Chicago for $72M from Pebblebrook Hotel Trust – The Mag Mile asset at 909 N. Michigan Ave. sold for about $96K per key, well below its 2018 valuation (TheRealDeal)

Industrial

Morgan Stanley Real Estate Investing acquires industrial outdoor storage facility in Southern California for $92M – The asset is triple-net leased to Oldcastle Infrastructure, a CRH subsidiary (IREI)

Distress Watch

Regional banks’ CRE portfolios remain stable – Office loans are still the main weak spot, with 11.8% delinquent and provisions projected to rise to 24% of revenue in 2026 (Reuters)