The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing continued resilience in new home sales, grocery lunch trips taking share from QSR, and AI capital flowing into both real estate tech and life science drug development.

🏡 New Home Sales Hold Up

Sales of new U.S. homes are holding near the fastest pace since 2023 as builders rely on price cuts and incentives to sustain demand. Builders must actively move elevated inventory to reduce inventory risk, promoting price discovery; median new home prices were down 8% YoY in October.

🛒 Grocery Lunch Trips Shift In-House

According to Placer.ai, fresh-format and value grocers led YoY visit growth as consumers shifted more meals in-home amid inflation and tariff uncertainty. Short sub-10-minute midday grocery visits rose from 15.9% to 16.6%, aligning with earnings from Chipotle and Cava that flagged softer traffic tied to a more value-conscious consumer; shoppers are trading QSR lunches for quick grocery and prepared-food trips rather than exiting lunchtime spending.

🤖 AI Capital Broadens Beyond Core Tech

Real estate tech firm Luxury Presence raised a $37M Series C led by Bessemer Venture Partners to scale Presence CRM, an AI-driven platform that surfaces client opportunities from existing agent data and prioritizes outreach actions. In life science and AI drug development, biotech startup Proxima raised an $80M seed round to map protein interactions with proprietary data and models.

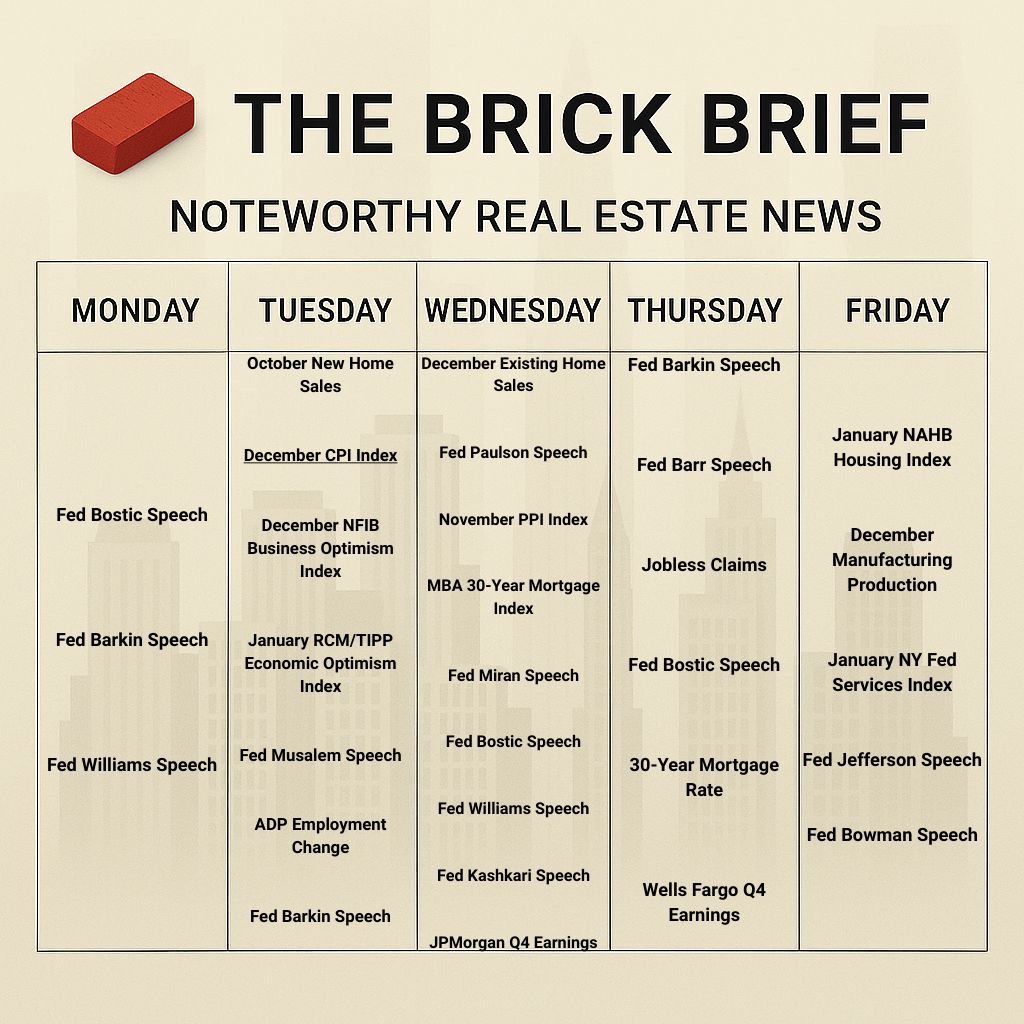

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.07% (+6 bps)

10Y Treasury Yield: 4.18% (+1 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 766.23 (+0.23%)

30-day SOFR Average: 3.71%

Market Pulse & Rate Watch

Inflation holds at 2.7% YoY in December – Consumer prices matched November’s pace, giving the Fed breathing room as it weighs price pressures against a cooling labor market (WSJ)

Jamie Dimon warns political interference with the Fed would push rates higher – The JPMorgan CEO says undermining Federal Reserve System independence would fuel inflation and raise borrowing costs after DOJ scrutiny of Jerome Powell (WSJ)

Fed’s Musalem says rates are well positioned for risks on both sides – Policy sits near neutral and leaves little need for further cuts while inflation remains elevated (Bloomberg)

Options traders price in no Fed cuts in 2026 – SOFR-linked positioning increasingly favors a hold-all-year scenario as labor markets steady and inflation stays above target (Bloomberg)

January Fed rate cut expectations are nearing 0%

Market Mix

REIT investor confidence in 2026 hinges on management and asset quality – After absorbing tariffs, inflation, rate uncertainty and dividend cuts in 2025, performance is set to diverge across sectors and platforms (CommercialObserver)

Policy & Industry Shifts

Trump administration targets homebuilder buybacks – FHFA chief Bill Pulte says builders should redirect capital toward lowering housing costs instead of repurchasing shares (WSJ)

Residential

Sales of new US homes hold near fastest pace since 2023 – Builders are using price cuts and incentives to sustain demand as inventories remain elevated; median new home prices fell 8% YoY (Bloomberg)

Mortgage lock-in begins to ease in US housing market – More homeowners now hold rates above 6% than below 3%, reducing the incentive to stay put and helping lift existing-home sales off multi-year lows (GlobeSt)

To reduce interest rate and carrying-cost risk, U.S. homebuilders need to move inventory off their balance sheets, forcing faster price discovery in new construction. That urgency contrasts with the existing-home market, where owners can stay on the sidelines unless prices match expectations set during the 2021 peak, a stance made easier by their ~3% mortgage rates.

The lock-in effect, however, is weakening, setting the stage for greater resale price discovery and higher transaction volume as home sellers return to reality after years of stalled existing-home activity.

Multifamily

Multifamily CLO lending triples to $19.7B in 2025 – Over two-thirds of issuance backed apartments as borrowers roll 2021-era bridge loans and lenders lean on flexible floating-rate debt, per Moody's (Bisnow)

Office

Manhattan office leasing hits 42.9M SF in 2025, best since 2014 – Class A drove ~70% of activity as availability fell and Downtown leasing rebounded, setting up faster recovery momentum into 2026 (GlobeSt)

Northern Virginia office posts first net occupancy gain since 2019 – The market logged ~480K SF of positive net absorption in 2025 as leasing outpaced move-outs for the first time in five years (Bisnow)

Leasing

AI firm Graphite signs 24K SF lease at 148 Lafayette Street in SoHo, NY -- Tishman Speyer leased sixth and seventh floors to the AI firm on a five-year term, more than tripling its New York office footprint (CommercialObserver)

Industrial

Savills finds gaps in US manufacturing comeback – Tracked megaprojects delivered just $42.2B of capital investment as delays and cancellations rose, underscoring a widening gap between reshoring headlines and on-the-ground progress (GlobeSt)

This remains something to monitor, as onshoring is expected to be a meaningful tailwind for industrial real estate.

Retail

GameStop to close 470 stores nationwide – GameStop accelerates its retail pullback with shutterings across 43 states as specialty retailers continue to struggle (Bisnow)

Grocery visits rose across formats in 2025 – Fresh-format and value grocers led YoY growth as consumers shifted more meals in-home amid inflation and tariff uncertainty (Placerai)

Short midday grocery visits increased from 15.9% to 16.6% – Traditional grocers captured a larger share of sub-10-minute trips between 11 a.m. and 3 p.m. as shoppers substituted prepared foods for QSR lunches (Placerai)

Recent earnings from Chipotle, Cava, and other fast-casual chains have flagged softer same-store traffic tied to a more value-conscious consumer. Placer.ai suggests some lunch demand is shifting toward quick grocery trips and prepared foods. The rise in sub-10-minute midday grocery visits points to consumers trading QSR lunches for lower-cost, faster alternatives rather than exiting lunchtime spending altogether. Another win for grocery-anchored retail. Grocery-anchored retail stands to benefit as midday grocery visits continue to take share as consumers stay focused on value.

Data Centers

Meta hires former Trump adviser and ex-Goldman executive Dina Powell McCormick to drive ~$600B AI infrastructure push – The new role focuses on securing government and sovereign capital for gigawatt-scale data center projects (Bloomberg)

Apollo seeks secondary market for $3.5B xAI chip financing – Apollo Global Management is opening trading on a private loan tied to xAI Corp GPU and data center spending as demand for tradable private credit grows (Bloomberg)

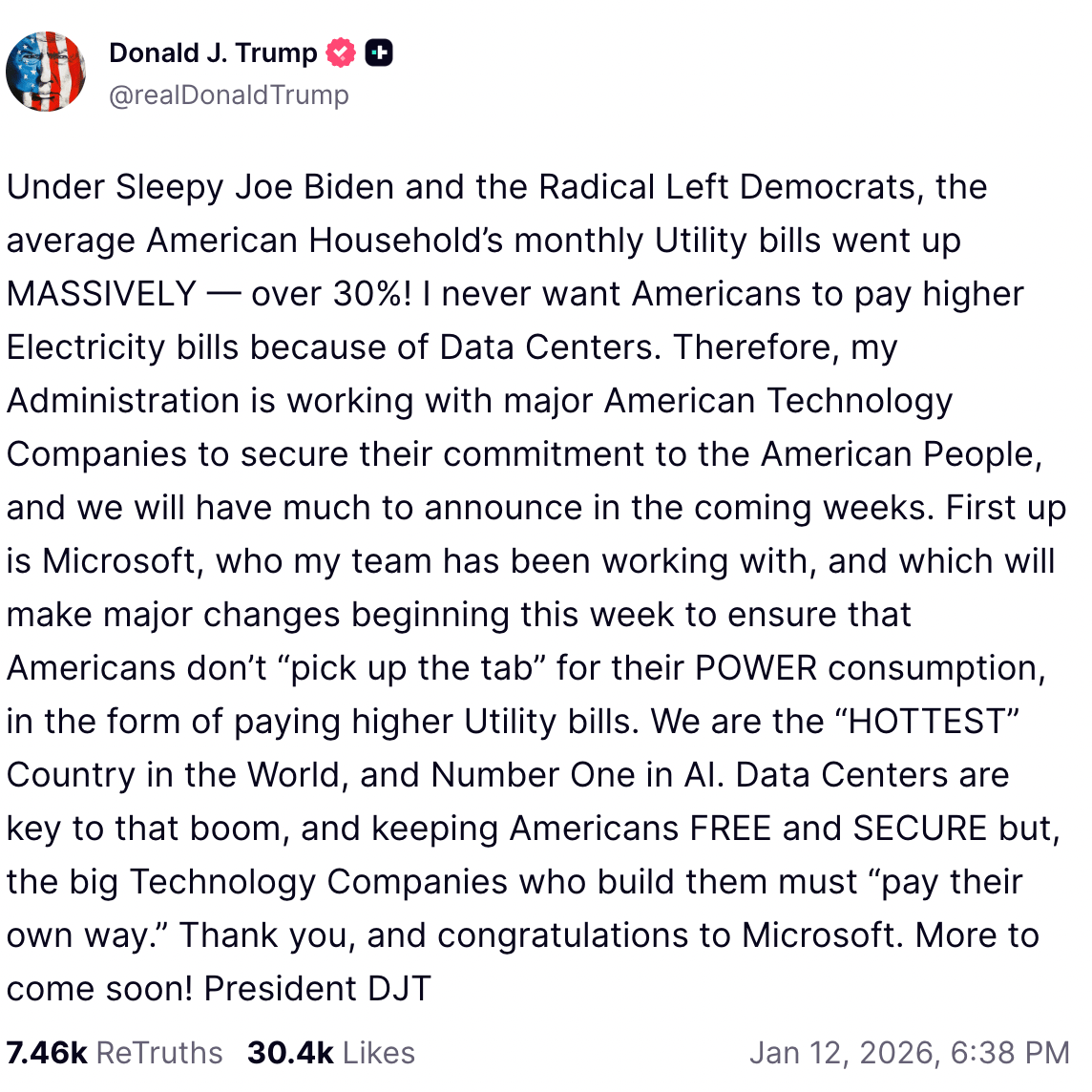

Microsoft pledges to cover data center grid costs – Microsoft Corp says it will pay for power infrastructure tied to its AI buildout to avoid passing higher electricity bills onto consumers (Bloomberg)

There is already a precedent in Virginia’s GS-5 framework, where data centers (NoVa’s data center alley) consuming ≥25 MW must cover ~85% of contracted transmission & distribution costs and ~60% of generation costs tied to their load to protect other ratepayers. Amid state and broader affordability pressure, we will likely see more state regulations that require hyperscalers to directly fund the grid & power capacity their growth demands.

New York shifts grid power costs to data centers – Large AI facilities must self-generate or pay higher rates to prevent rising electricity bills for households (Bloomberg)

Life Sciences

Johnson & Johnson invests $2B in North Carolina life science manufacturing – The company is expanding biopharma facilities in Wilson County and Holly Springs focused on oncology and neurological medicines (ConnectCRE)

Proxima raises $80M seed for AI drug discovery – The biotech startup, which is backed by DCVC and NVIDIA, aims to build proximity-based medicines by mapping protein interactions with proprietary data and models (Bloomberg)

Financings

Loans

Bank OZK and Affinius Capital provide $140.7M construction financing for 270-unit mixed-use multifamily project in Ardmore, PA -- The financing supports Piazza Auto Group and Radnor Property Group’s project with $112.6M senior and $28.1M mezzanine debt (CommercialObserver)

Refinancings

GFP Real Estate closes $86.5M refinance for 515 Madison Avenue office tower in Midtown Manhattan, NY and acquires remaining 40% stake from ATCO -- The transaction gives GFP full ownership of the 42-story Class A DuMont Building (CommercialObserver)

M&A

Building & Portfolio M&A

Multifamily

Waterton buys 395-unit Motif multifamily community in Woodland Hills, CA from TruAmerica Multifamily for $156.3M -- The deal prices at ~$396K per unit and marks a discount to the seller’s 2015 basis (CommercialObserver)

APW Avenue Group buys 152-unit apartment tower in Downtown Los Angeles, CA from MetLife for ~$69M -- The 22-story asset traded at ~$453K per unit, one of the priciest multifamily deals on a per-unit basis in Los Angeles last year (TheRealDeal)

Land

Homebuilder Lennar buys 152-acre residential development site in Sunrise, FL for ~$165M -- The entitled Solterra site allows ~900 homes including townhouses and single-family units in Broward County (CommercialObserver)

Office

Cross Ocean Partners and CP Group acquire a 722K SF eight-building office portfolio in Orlando, FL from City Office REIT for $96M -- The Central Florida portfolio is 93% leased and spans downtown and suburban office assets across the Orlando metro (ConnectCRE)

TPG Angelo Gordon and Aurora Capital Associates buy 80K SF office and retail building in Manhattan Meatpacking District, NY from Epic for $71M -- The five-story asset traded at ~$888 per SF, marking TPG’s first known Meatpacking District investment (TheRealDeal)

Distress Watch

Office owner Vornado retains 650 Madison Avenue after curing $800M loan – The Plaza District asset exited special servicing with ownership intact as the REIT brought the mortgage current and funded reserves (TheRealDeal)

Proptech & Innovation

Real estate tech firm Luxury Presence raised $37M to build an AI-powered CRM for real estate agents – The raise includes Series C equity led by Bessemer Venture Partners plus $15M in J.P. Morgan debt to fund the Presence CRM rollout (HousingWire)