The Brick Breakdown

Hello Brick Brief readers,

Happy Monday. In recent news, we saw a surge in December Fed rate cut odds, steady office traffic recovery, and continued momentum in U.S. reshoring.

🧱 Fed Signals Push Cut Odds Higher While Officials Remain Split

Markets raised the probability of a December rate cut to roughly 67% after New York Fed President Williams said softer inflation and labor risks give the Fed room to ease. Fed officials remain sharply divided moving into December as they balance unemployment and inflation concerns; early-career joblessness has intensified and college grads now make up 25% of the unemployed.

🏢 Office Traffic Continues to Recover

Office visits continue to rise as hybrid routines stabilize, with national traffic down 30.8% from 2019 but up 4.7% YoY as RTO drives gradual steady gains. San Francisco office visits sit further behind at 42.1% below 2019 levels but up 11.8% YoY, which should continue to rise as office occupants move into the spaces they recently agreed to lease.

🏭 Tariffs Accelerate U.S. Manufacturing Investment

Manufacturers continue to redirect production toward the U.S. over tariff and supply-chain concerns, which Hines expects to drive a $1T reshoring wave by 2030 that could lift warehouse demand 35% and add 1.3B SF of new space. Recently, Nokia committed $4B to U.S. R&D and network development while AstraZeneca plans to invest $2B to expand Maryland biologics and manufacturing capacity.

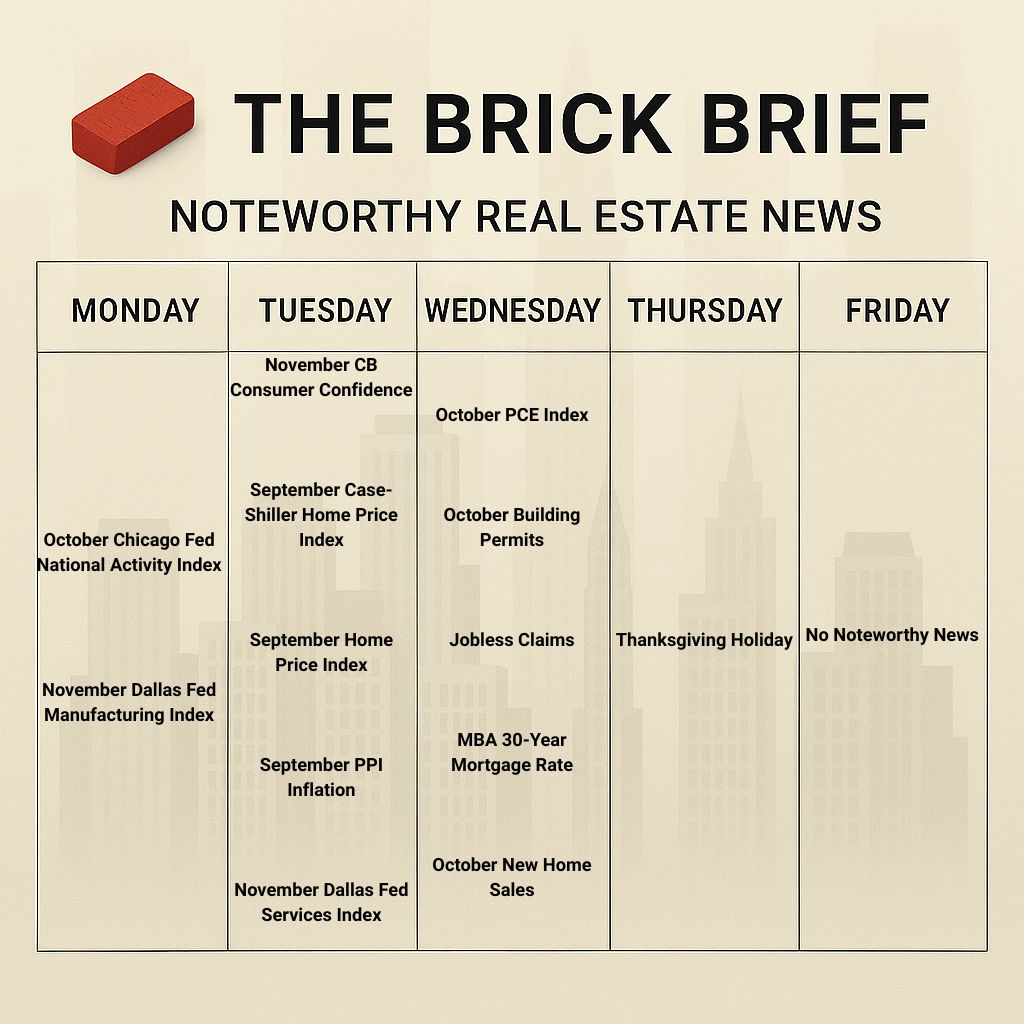

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.34% (-2 bps)

10Y Treasury Yield: 4.07% (-2 bps)

WSJ Prime Rate: 7.25%

FTSE NAREIT Index: 761.42 (+1.36%)

30-day SOFR Average: 4.07%

Market Pulse & Rate Watch

Fed's Williams signaled room for a near-term cut – Softer labor-market risks and easing inflation pressures pushed market odds of a December cut to about 70% (Bloomberg)

Fed's Collins is hesitant to support a December rate cut – She said policy is already mildly restrictive and the Fed must balance inflation risks with a softening job market (Reuters)

Fed's Logan urged holding rates steady – She said a December cut requires clearer inflation progress or labor-market cooling given strong financial conditions (Reuters)

Fed officials are sharply divided ahead of December – Williams signaled support for a cut while several policymakers pushed to hold, setting up the most contentious vote in years (Bloomberg)

Consumer sentiment falls to near historic lows in November – The University of Michigan index slipped to 51 as high prices continue to frustrate households (WSJ)

College grads now make up a record 25% of the unemployed – White-collar hiring has slowed sharply, with layoffs rising and AI-driven cuts fueling higher joblessness among degree-holders and young workers (Bloomberg)

Insight: The Fed remains split on December cuts as officials debate labor weakness versus inflation risks. New York Fed President Williams, part of the core troika with Powell and Jefferson, signaled room for a near-term cut that pushed market odds of a 25 bps December move to ~67%. Last Monday, Vice Chair Jefferson implied that December will likely be a live decision, while Powell has yet to express his view.

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Spending is holding up at the high and low ends, but mid-tier retail, hospitality, and service businesses are falling behind in the current environment (barbell effect).

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Brick by Brick: Two Upper-UpScale San Francisco Hotels Sell for 75% Below Prior Valuation

Newbond Holdings and Conversant Capital agreed to acquire the Hilton San Francisco Union Square and Parc 55, two upper-upscale convention hotels with nearly 3,000 rooms that represent more than 8% of the city’s total hotel inventory. This $408M sale price is a dramatic repricing of San Francisco’s big-box hotels that delivers one of the largest distressed hospitality resets in the country and reflects a 75% decline from the properties’ 2016 appraisal.

🧱 Why Did Values Fall So Far?

San Francisco’s hotel values fell as core demand weakened between 2020 and 2023 when office vacancies climbed, corporate travel thinned, street conditions deteriorated and convention bookings stalled. Park Hotels & Resorts surrendered a $725M loan after cash flow failed to recover, and room revenue remained more than 10% below 2019 levels in October

🧱 Signs of Recovery Are Pulling Capital Back

Capital is returning as group and leisure demand recover across the city. Convention activity is building momentum as last year’s 25 events rose to 34 in 2025. San Francisco’s AI and tech boom is beginning to lift activity across the city as companies move in, expand headcount and pull more people back into the urban core, strengthening both office traffic and residential demand. Placer.ai reported that October San Francisco office visits rose 11.8% YoY, which is set to continue to rise office occupants move into the spaces they have agreed to lease.

🧱 Blackstone Is Also Moving In

Blackstone is nearing a $130M acquisition of the 277-room Four Seasons San Francisco as it steps back into the city’s hotel market. Luxury hotels have continued to outperform with steady YoY revenue gains, and the Four Seasons is positioned to capture rising corporate travel, high-end tourism and event demand tied to the city’s AI boom.

🧱 Capital Plans Aim to Reposition Union Square’s Big-Box Hotels

Newbond and Conversant are pursuing a convention-led rebound as the assets regain competitiveness through targeted upgrades. They plan to modernize rooms and meeting space and use improving visitation trends, stronger convention calendars and the city’s broader AI-driven recovery to pull group and corporate business back into Union Square.

Takeaway: The new investors are stepping into San Francisco’s hotel market to take advantage of the tailwinds created by the city’s AI-driven recovery as rising office traffic, growing visitation and stronger corporate activity begin to rebuild demand. Their bet reflects the view that large upper-upscale and luxury hotels will benefit most from this shift as the urban core stabilizes and business travel and events regain momentum.

Market Mix

CRE yields expected to edge lower in 2026 – CoStar forecasts broader deal activity, firmer prices and improving liquidity to push cap rates down, with industrial and multifamily already seeing compression (ConnectCRE)

Policy & Industry Shifts

Trump says he agrees with NYC mayor-elect Mamdani on building more housing to lower rents – The two found unexpected common ground on affordability after meeting in Washington, D.C. (TheRealDeal)

Compass challenges Zillow’s listings policy in federal court – The brokerage seeks to block rules that bar homes marketed off-MLS within 24 hours, arguing Zillow is using its platform power to control inventory visibility (Bloomberg)

States move to curb apartment junk fees – New caps, bans and disclosure rules on application, screening and late fees are creating a fragmented compliance map for multifamily owners that raises legal risk and limits ancillary revenue (GlobeSt)

Residential

Fannie Mae sees mortgage rates falling below 6% next year – MBA expects rates to stay flat through 2026 (Inman)

Luxury home prices rose 5.5% YoY in October to a $1.28M median – Growth tripled the 1.8% pace in non-luxury homes as affluent buyers stayed active despite higher rates (Redfin)

Office

Office visits were 30.8% below 2019 and up 4.7% YoY – October data shows steady RTO momentum despite hybrid norms (Placer.ai)

San Francisco visits were down 42.1% vs 2019 but up 11.8% YoY – Miami was down 10.2% vs 2019 and up 11.3% YoY, and New York was down 16.2% vs 2019 and up 4.8% YoY (Placer.ai)

Insight: San Francisco office visits should continue to rise as the city’s recent wave of AI-driven tech leasing begins to translate into occupancy. Foot traffic and occupancy are lagging indicators because most tenants move in 9–18 months after signing a lease, so many of the companies behind this year’s leasing surge have not yet begun operations.

Friday office visits accounted for just 12.4% of weekday traffic – Workers remain heavily concentrated midweek despite five-day mandates (Placer.ai)

Low-leverage office loan spreads tighten to 203.75 bps – Lenders priced 50–59% LTV office loans over the 10-year Treasury at 2025’s lowest level, signaling improving optimism for safer parts of the sector (Trepp)

Leasing

Nvidia leases 45K SF at 1090 Dr. Maya Angelou Lane in San Francisco, CA – The chipmaker took a full floor at Mission Rock’s Tishman Speyer–Giants development (CoStar)

Industrial

US manufacturing slowed to a four-month low in November – Tariff-driven price increases curbed demand, new orders softened, and inventories hit a record high even as services activity and hiring held up (Reuters)

Nokia will invest $4B in U.S. AI-driven network development – $3.5B will go to R&D and $500M to manufacturing as the company expands its U.S. footprint to mitigate tariff and trade risks (Reuters)

AstraZeneca will invest $2B to expand Maryland manufacturing – The move supports 2,600 jobs, adds new biologics and clinical facilities, and advances the company’s broader $50B U.S. expansion plan (Reuters)

Insight: Recent manufacturing and pharmaceutical plant investments show how tariff policy is pushing companies to rebuild U.S. production capacity. Hines sees a $1T reshoring boom by 2030 that could lift warehouse demand 35% and add 1.3B SF of industrial supply.

Retail

US retail sales likely rose 0.4% MoM in September – Spending stayed resilient but risks are rising as high prices strain lower-income shoppers and job-security fears grow (Bloomberg)

Consumers seeking value are spending big at retailers like Walmart, Gap and TJ Maxx – Strong year-end spending shows shoppers prioritizing deals even as tariffs and a softer economy raise pressure (WSJ)

Department-store visits fell for most chains in Q3 – Only a few brands saw YoY growth, but October showed broad improvement that points to stronger holiday momentum (Placer.ai)

Data Centers

Google says it must double AI serving capacity every 6 months to meet demand – AI infrastructure chief Amin Vahdat told employees the company needs 1000x more compute in 4–5 years as surging usage outpaces supply (CNBC)

Hospitality

U.S. hotel RevPAR fell 4.6% YoY for the week of 9–15 November – Veterans Day falling on Tuesday drove sharp midweek declines, with group demand down 14.4% and the Top 25 Markets posting the largest pullbacks (STR)

Financings

JPMorgan originated $5B in affordable-housing financing in Q3 – Funding will create or preserve 39,000 affordable units as the bank expands construction lending and tax-credit investments (CommercialObserver)

M&A

Building & Portfolio M&A

Mixed-Use

Mori Trust buys 38 stories of 35 Hudson Yards in New York, NY for $540M – Related Companies and Oxford Properties sold the hotel-and-office portion of the tower (Bloomberg)

United Construction buys a 104K SF office and retail building in Flushing, Queens for $64.25M – Madison Realty Capital sold the fully occupied 41-60 Main Street property (CommercialObserver)

Multifamily

Friedkin Property Group buys 304-unit multifamily tower One East Delaware in Chicago for $130M – Golub & Co. and Alcion Ventures sold the 26-story Gold Coast property at a loss from their 2016 basis (TheRealDeal)

Hospitality

Newbond Holdings and Conversant Capital buy the Hilton San Francisco Union Square and Parc 55 for $408M – Park Hotels & Resorts sold the two-hotel, 3,000-room portfolio at a 75% discount to its 2016 appraisal as investors bet on a San Francisco recovery (Bloomberg)

Distress Watch

Real estate finance tech vendor SitusAMC was hacked – JPMorgan and Citi are assessing exposure after client data was stolen and the FBI launched an investigation (Bloomberg)

JPMorgan shops a $270M defaulted loan on the 967K SF 500 West Monroe office tower in Chicago – Spear Street Capital failed to pay off the mortgage at maturity (TheRealDeal)

Proptech & Innovation

Seed rounds become the new Series A in proptech – Real estate and construction AI startups are raising $5M–$10M seeds from institutional investors as data moats, workflow integration and NOI impact reshape early-stage capital (CommercialObserver)

AI slop floods real estate marketing – Synthetic video is crowding social feeds and forcing agents to lean on real expertise, clearer messaging and authentic content to maintain client trust (Inman)