The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! Today we’re seeing gradual YoY office gains, strong retail demand, and mixed life sciences news.

🏢 Office Leasing Slowly Recovers

Placerai reports that office occupancy rose 4.9% YoY in December, while U.S. office leasing increased 5% YoY in 2025; visits, however, remain 36.2% below 2019 levels, with warmer markets like Miami (-10.9%), Dallas (-18.8%), and NYC (-19.6%) posting much smaller gaps. Seasonality and climate-based attendance gaps tell us that hybrid work has normalized, but offices are still in a slow and gradual recovery.

🛍️ Retail Demand Expands

Retail leasing expanded in late 2025 as tenants absorbed more than 12M SF, driven by fewer move-outs and steady backfill leasing from discount chains that tightened availability and strengthened store-level fundamentals. German grocer Aldi plans to open 180 more U.S. locations in 2026 as part of its $9B five-year expansion toward ~2,800 stores, while Amazon is proposing its first big-box retail store that will blend grocery and limited warehouse functions.

💊 AI Is Reshaping Life Sciences

Nvidia and Eli Lilly will invest $1B in a joint five-year Bay Area AI research lab to accelerate drug discovery using AI, a long-term net-negative for wet lab space. That being said, we’re seeing positive news across life sciences leasing, M&A, and refinancing: TransMedics signed a ~498K SF lease with Blackstone’s BioMed Realty in Somerville, MA; Tishman Speyer and Bellco Capital secured a $465M CMBS for their Torrey Heights campus in San Diego, CA; and Healthpeak Properties agreed to acquire a 1.4M SF campus in South San Francisco, CA for $600M.

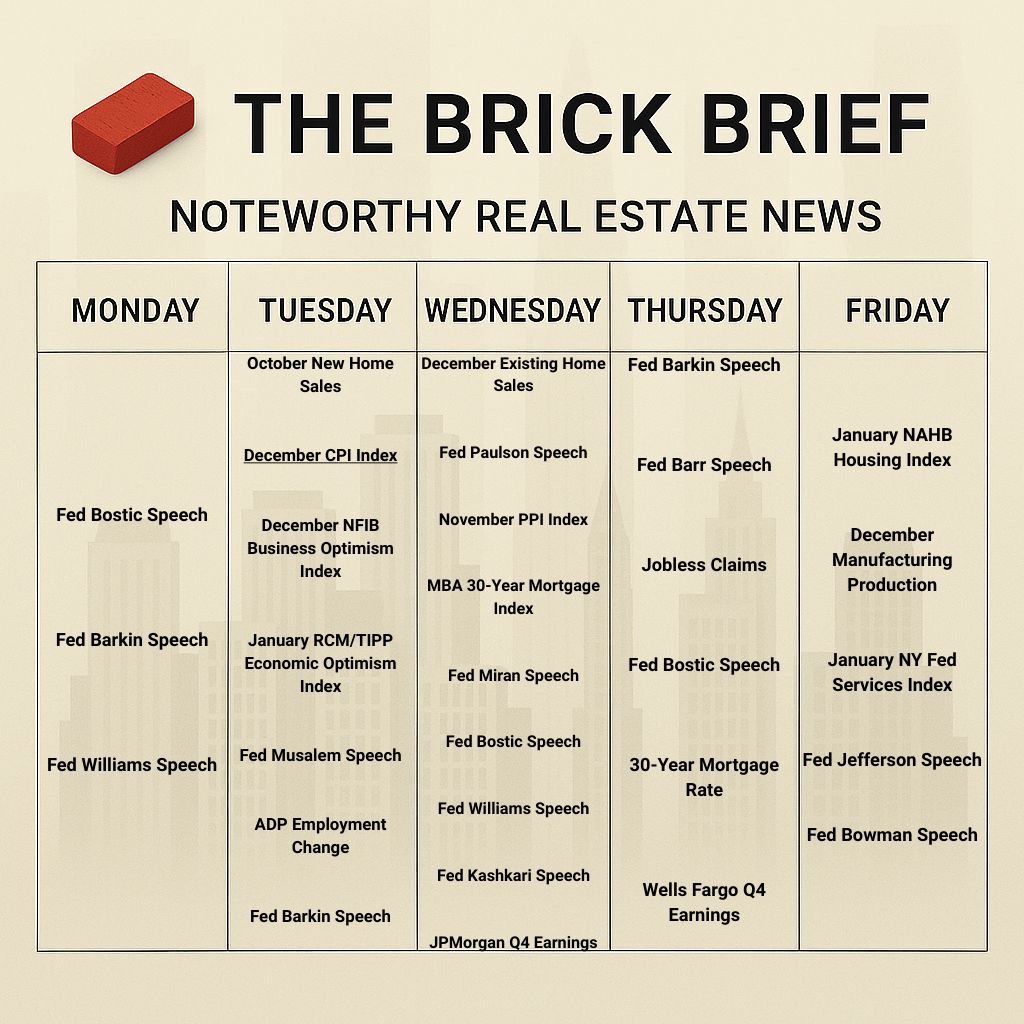

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.01% (-5 bps)

10Y Treasury Yield: 4.18% (+1 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 761. (+0.13%)

30-day SOFR Average: 3.71%

Market Pulse & Rate Watch

Fed’s Williams says policy is well positioned – John Williams sees no near-term rate cuts as inflation cools toward 2% by 2027 and the labor market stabilizes (Reuters)

Goldman’s chief economist warns Fed probe threat raises independence concerns – Jan Hatzius says pressure on Jerome Powell reinforces risks to central bank independence but expects policy decisions to remain data-driven despite political attacks (Reuters)

JPMorgan Chase forecasts next Fed move as a 2027 rate hike – Goldman Sachs and Barclays have pushed expected rate cuts to mid-2026 as labor data signals slower cooling and markets price a January hold (Reuters)

Policy & Industry Shifts

New York Governor Kathy Hochul plans to loosen environmental rules to speed homebuilding – The state would exempt most housing projects from SEQRA to cut approval times by up to two years and lower construction costs amid worsening affordability (WSJ)

Colorado legislature targets housing, energy, and data centers in 2026 – Jared Polis has prioritized housing affordability and faster energy permitting as lawmakers weigh zoning reforms and potential data center regulations amid a ~$850M budget deficit (Bisnow)

L.A.’s Measure ULA mansion tax tops $1B in under three years – The transfer tax on $5.3M+ property sales has generated ~$307M over the past six months (CommercialObserver)

Washington considers requiring all home listings to be marketed publicly - A draft bill in the state legislature targets private and pocket listings as portal and brokerage battles over listing control intensify (Inman)

Residential

Zillow Research forecasts ~2.9% rent inflation and ~3.2% Owners’ Equivalent Rent inflation – The December CPI shelter outlook points to continued cooling in housing inflation as market rents slow heading into 2026 (Zillow)

U.S. household real estate value falls $361B to ~$48T – Aggregate home values declined in Q3 2025 as prices edged lower and mortgage debt increased (Realtor.com)

Political threats to Fed independence risk higher mortgage rates – Realtor.com warns that pressure on the Federal Reserve could undermine inflation credibility, push up long-term Treasury yields, and keep 30-year mortgage rates elevated despite political efforts to lower them (Realtor.com)

Wall Street landlords pitch compromise after Trump homebuying threat – Firms like Pretium Partners and Invitation Homes are backing purchase limits and rent-to-own plans as Donald Trump targets institutional buyers (Bloomberg)

Hedge fund manager Bill Ackman proposes prepayment penalties to lower mortgage rates – He says limiting early payoffs could cut 30-year rates by ~0.65%, though Wells Fargo disputes any meaningful borrower benefit (Bloomberg)

U.S. property insurance premiums fall after hurricane-free 2025 – A quiet storm season has reduced losses and increased insurer competition, pushing rates lower into early 2026 (Bisnow)

Multifamily

Rent concessions surge across Sun Belt apartments – Overbuilding has pushed landlords in cities like Phoenix to offer free rent and perks; 54% of units advertise at least one month free as excess supply pressures rents (WSJ)

$30B Fannie-Freddie IPO uncertainty stalls multifamily deal flow – Unclear timing and guarantee details around a potential preferred-share sale are keeping apartment investors cautious despite multifamily representing only ~10% of the GSEs’ $7.5T loan book (CommercialObserver)

Office

U.S. office leasing activity rose 5% YoY in 2025 – Leasing volumes rebounded from 2024 lows as tenant demand improved; Boston led major markets in growth (IREI)

December office attendance hits a 36.2% post-pandemic gap – Visits per working day ran 36.2% below 2019 levels, though December 2025 still marked the busiest in-office December since COVID, pointing to seasonal WFH rather than fading RTO momentum (Placerai)

Office recovery posts 4.9% YoY growth despite December dip – Nationwide office visits rose 4.9% YoY with gains across every tracked market, led by San Francisco (Placerai)

Chicago trails with a 47.6% attendance gap while warm markets hold up – Chicago office visits lagged 2019 by 47.6%, while Miami (-10.9%), Dallas (-18.8%), and NYC (-19.6%) posted far smaller December gaps (Placerai)

The seasonality and climate-based office attendance gaps are a great snapshot of today’s office dynamics. Hybrid work has normalized, and employees have more flexibility in when they come in. Office visits and leasing, however, are still up 4.9% YoY and 5% YoY respectively, so we’re still seeing a slow and gradual recovery.

Leasing

Deloitte inks ~600K SF office lease at Morgan Stanley Real Estate Investing’s Waterview tower in Rosslyn, VA – The deal takes over nearly the entire 24-story building and ranks as Northern Virginia’s largest office lease of 2025 (CommercialObserver)

National Philanthropic Trust signs 40K SF at 2 Ash Street in Conshohocken, PA – Gladstone Commercial secured the largest suburban Philadelphia office lease last quarter at Three Tower Bridge (Bisnow)

PayPal leases 261K SF at Hines’ 345 Hudson Street in Hudson Square, Manhattan, NY - The 10-year deal consolidates three floors ahead of PayPal’s planned move next year (TheRealDeal)

TransMedics signs ~498K SF at 188 Assembly Park Drive in Somerville, MA – Blackstone’s BioMed Realty secured a full-building lease for the Assembly Innovation Park tower that will serve as the company’s global HQ and manufacturing hub (Bisnow)

Industrial

Power constraints emerge as a key bottleneck in U.S. industrial real estate – AI-driven data center growth and rising warehouse power needs are tightening competition for well-located, power-ready Class A logistics assets (Prologis)

Prologis believes that power-ready industrial facilities are now also a strategic differentiator because rising AI-driven data center and warehouse energy demands are tightening competition for well-located Class A logistics assets.

Interestingly, Bisnow recently reported that Prologis was planning to develop a 13-building data center campus in Shelbyville, Indiana, at a site where power infrastructure is already in place. Since the REIT has empty land with built-in power capacity, they have the option to develop either industrial or data center projects based on demand.

U.S. container imports fell 3.9% YoY in November – Trump’s trade war redirected Asia-origin volumes toward faster-growing global markets, extending an eight-month decline in North American traffic (FreightWaves)

Retail

Retail leasing demand surged late 2025 as retailers absorbed more than 12M SF – Fewer move-outs and steady backfill leasing led by discount chains tightened availability and supported stronger store-level fundamentals (CoStar)

German grocer Aldi to open 180 U.S. stores in 2026 as part of the retailer’s $9B five-year push toward ~2,800 U.S. locations – The expansion spans 31 states as cost-conscious shoppers favor private-label groceries (Reuters)

Amazon proposes first big-box retail store near Chicago – The 229K SF Orland Park location would exceed a typical Walmart Supercenter and blend grocery retail with limited warehouse functions (Bisnow)

Data Centers

Donald Trump says tech giants must cover data center power costs – He says firms like Microsoft should pay their own way so rising electricity bills from AI infrastructure do not fall on U.S. consumers (Bloomberg)

Meta Platforms data centers need ~$14B in new nuclear reactors – Deals with Oklo and TerraPower would add ~1.9 GW of fission capacity over the next decade (Bloomberg)

New York Governor Kathy Hochul plans 5 GW nuclear expansion – The move responds to rising electricity demand driven by data centers industrial users and broader electrification (Bloomberg)

Microsoft plans $400M data center near San Antonio, TX – The ~200K SF Castroville project adds to one of the fastest-growing U.S. data center markets (Bisnow)

$7B AI liquid cooling market surges due to GPU heat constraints – Global data center liquid cooling revenue is set to jump from ~$3B in 2025 to ~$7B by 2029 as hyperscalers adopt liquid systems to handle soaring AI chip power densities (ConnectCRE)

Life Sciences

Nvidia and Eli Lilly to invest $1B in joint AI research lab – The five-year Bay Area project will use Nvidia’s Vera Rubin chips to accelerate drug discovery as pharma leans deeper into AI-driven development (Reuters)

AI-based drug discovery is accelerating and will be a long-term net negative for lab space demand, That being said, we’re seeing some recent positive news in life sciences across leasing, M&A, and refinancing: TransMedics signed a ~498K SF lease with Blackstone’s BioMed Realty in their Somerville, MA Assembly Innovation Park campus; Tishman Speyer and Bellco Capital secured a $465M CMBS for their Torrey Heights life science campus in San Diego, CA; and Healthpeak Properties agreed to acquire a 1.4M SF campus in South San Francisco, CA for $600M.

Financings

Loans

Mizuho provides $289M acquisition loan for The Shops at Skyview, a 555K SF grocery-anchored retail center in Flushing, NY – The financing backs Acadia Realty Trust and TPG Real Estate’s $425M purchase of the Queens shopping center from Blackstone and Perform Properties (CommercialObserver)

PACE Loan Group provides $100M C-PACE construction loan for Patmos Hosting’s 421K SF Patmos AI Campus data center in Kansas City, MO – The financing funds energy-efficient upgrades and electrical infrastructure at the 35-MW facility (CommercialObserver)

Peachtree Group provides $70M C-PACE loan for Hall of Fame Resort & Entertainment Company’s 183-key Tapestry Collection by Hilton hotel and indoor water park in Canton, OH – The financing supports construction at the Hall of Fame Village campus (CommercialObserver)

Refinancings

Nomura provides $185M refinance loan for Stiles and Shorenstein Investment Advisers’ 25-story office tower, the Main, in Fort Lauderdale, FL – The loan replaces existing debt on the 2020-built Downtown asset (CommercialObserver)

Walker & Dunlop provides $116M Fannie Mae refinance loan for Rose Associates and Battery Global Advisors’ 440-unit Alexander Crossing multifamily complex in Yonkers, NY – The five-year fixed-rate financing refinances the Class A waterfront property (CommercialObserver)

Ashkenazy Acquisition buys the Neiman Marcus flagship property at 9700 Wilshire Boulevard from Saks Global in Beverly Hills, CA for $50M – The deal adds ~350K SF of Golden Triangle retail as Saks sells the land and leases back the store amid financial strain (TheRealDeal)

Structured Finance

JPMorgan Chase, Deutsche Bank and Goldman Sachs provide $465M CMBS loan for Tishman Speyer and Bellco Capital’s Torrey Heights life science campus in San Diego, CA – The five-year refinancing backs the 520K SF fully built-out campus owned via Breakthrough Properties (CommercialObserver)

M&A

Building & Portfolio M&A

Multifamily

RXR Realty buys ~45% stake in Upper East Side luxury apartment building and 20 townhomes from GO Partners in Manhattan, NY at ~$435M valuation – The minority investment keeps GO as majority owner while expanding RXR’s exposure to high-end residential assets (Bloomberg)

Industrial

Orden Company buys 257K SF industrial warehouse and office asset from IHC State in Ontario, CA for $57M - Fully occupied Inland Empire property was marketed to allow assumption of existing debt (TheRealDeal)

Office

Closer Properties lists a 49% stake in Park Avenue Plaza at 55 East 52nd Street in Manhattan, NY at a ~$1.3B valuation - The asset spans 1.2M SF and is nearly fully leased; Fisher Brothers retains the majority ownership stake (TheRealDeal)

Store Capital buys single-tenant private school building from Spring Education Group in San Jose, CA for $62.6M - The sale-leaseback keeps Basis Independent operating at the property as Store expands its net-lease education portfolio (TheRealDeal)

Retail

Ashkenazy Acquisition buys the Neiman Marcus flagship at 9700 Wilshire Boulevard from Saks Global in Beverly Hills, CA for $50M – Neiman Marcus will stay as a long-term tenant through a sale-leaseback (TheRealDeal)

Life Sciences

Healthpeak Properties buys 1.4M SF Gateway Boulevard life sciences campus in South San Francisco, CA for $600M – The Denver-based healthcare REIT expands its Oyster Point footprint as part of a ~$925M acquisition spree focused on core biotech markets (Bisnow)

Institutional Fundraising

American Landmark Apartments completes ~$400M first close of Fund V – The value-add multifamily fund is raising toward a ~$1B target to deploy across Sun Belt apartment acquisitions and renovations (IREI)