The Brick Breakdown

Hello Brick Brief readers,

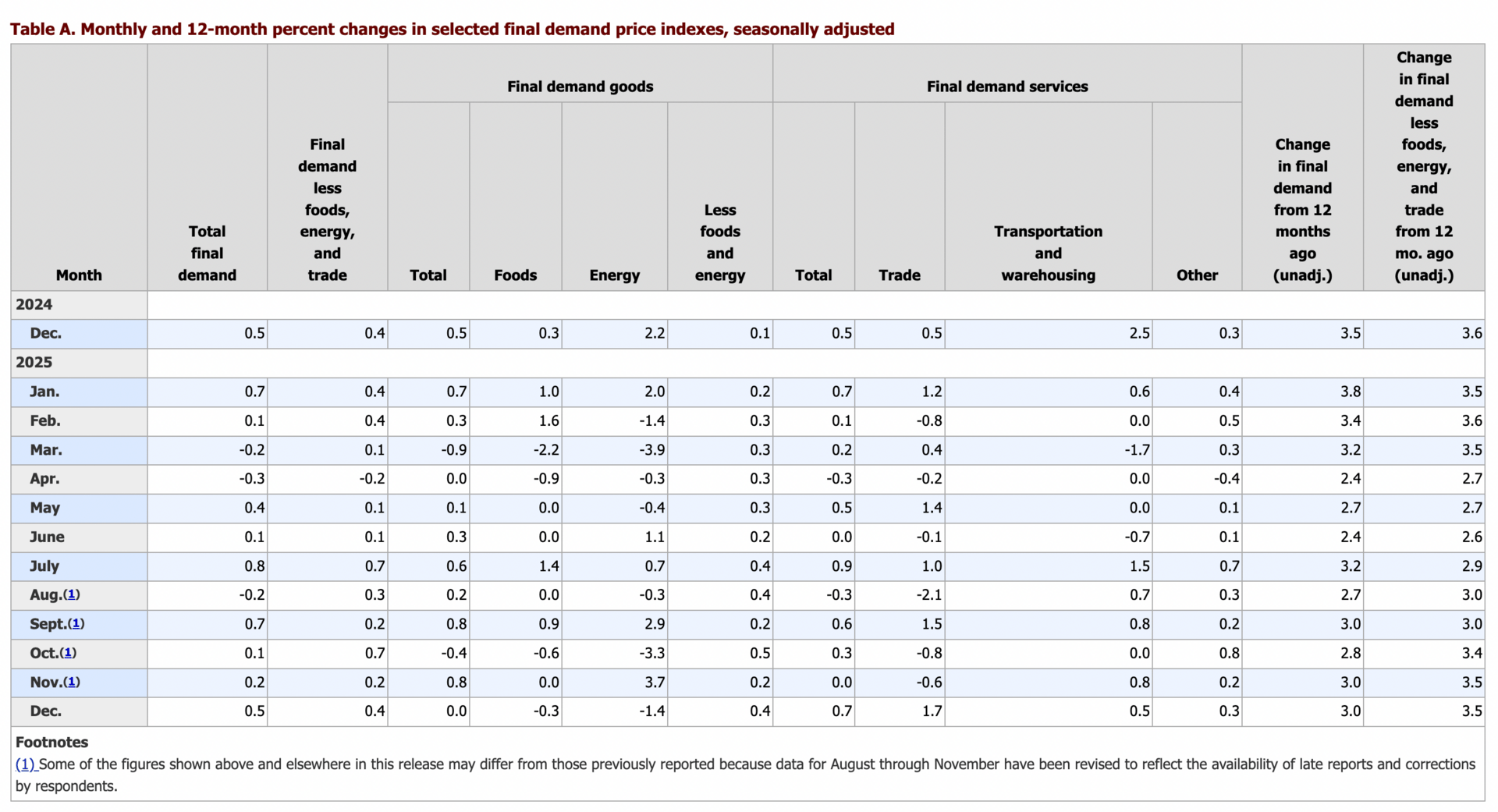

Happy Monday. In recent news, Trump selected Kevin Warsh as his Fed chair, December producer prices ticked up 0.5% as businesses passed higher costs through services, Blackstone is seeing CRE dealmaking begin to stir after a two-year lull, and Oracle plans to double down on cloud and AI infrastructure investment.

🏦 Fed Uncertainty Keeps Policy Tight

Markets are split following Kevin Warsh’s nomination as Fed chair as investors weigh support for rate cuts against a push to shrink the balance sheet that could limit policy flexibility. To complicate the Fed’s rate cut outlook, December producer prices rose 0.5% as businesses passed tariff-driven costs through services, keeping delayed inflation risks firmly in focus.

🏢 CRE Dealmaking Reawakens

In its Q4 earnings call, Blackstone reported that CRE dealmaking is beginning to stir after a two-year lull as financing conditions ease and valuations start to recover. Additionally, the asset manager plans to pursue more REIT take-privates, using ~$53B of real estate dry powder to acquire discounted public platforms constrained by limited scale and muted growth paths.

⚡ Oracle Bets Big on AI Infrastructure

Oracle plans to raise ~$45B–$50B in 2026 through a mix of equity and unsecured bonds to fund cloud and AI capacity tied to large-scale data center expansion. Oracle’s rising debt has become a hedge for potential stress in speculative data center financing, but Larry Ellison continues to stake the company’s future on AI compute as the core driver of long-term relevance.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.16%

10Y Treasury Yield: 4.23% (-3 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 772.53 (+0.22%)

30-day SOFR Average: 3.68%

Market Pulse & Rate Watch

Donald Trump nominates Kevin Warsh as Fed chair – Markets split between confidence in Fed independence and concern over tighter policy as Warsh backs rate cuts but pushes to shrink the balance sheet (FT & WSJ)

US producer prices jump 0.5% in December on tariff pass-through – Services drove the biggest PPI gain in five months as businesses pass higher costs through and keep the Federal Reserve on hold (Reuters)

December PPI; Source BLS.gov

BlackRock, Bridgewater, and Pimco brace for renewed US inflation risk – Breakevens and inflation swaps are rising as stronger growth, commodities, tariffs, and AI spending challenge the market’s rate-cut consensus (Bloomberg)

Fed’s Bowman still backs rate cuts despite pause – Michelle Bowman expects three cuts this year and says the hold was about timing and data gaps rather than a shift in policy stance (Reuters)

Fed’s Musalem says no more rate cuts needed – Alberto Musalem says policy is now neutral with inflation above target and growth supported unless the labor market weakens (Reuters)

Market Mix

U.S. commercial and multifamily mortgage debt rose $53.4B in Q3 2025 to $4.93T – Multifamily lending led the increase with debt up $40.3B QoQ to $2.24T, driven primarily by agency and GSE portfolios (MultiHousingNews)

Blackstone says CRE dealmaking is stirring after a two-year lull – Easing financing conditions and exposure to data centers and real estate credit are reviving transaction activity as valuations begin to recover (Bisnow)

Blackstone eyes more REIT take-privates amid lagging public markets – ~$53B of real estate dry powder positions firm to buy discounted public platforms (PERE)

This move is a continuation of a broader theme where private investors are exploiting deep public-market discounts to acquire high-quality real estate platforms at significant discounts to replacement cost. Public investors continue to shun smaller REITs with limited/no growth paths, pushing valuations well below NAV. Private capital, however, can apply a different lens that prioritizes asset-level cash flow, control, and long-term value creation over public market optics.

Policy & Industry Shifts

100,000-unit landlord Mid-America Apartment Communities agrees to pay $53M to settle RealPage rent-collusion lawsuit – Deal resolves claims tied to data-sharing practices while broader antitrust cases continue (Bisnow)

Residential

New listings rise ~1% YoY in late January as mortgage rates near 3-year lows – Buyer demand is improving but homes still take 63 days to sell as excess supply keeps the market tilted toward buyers (Redfin)

New-home construction costs rise 3.8% YoY as labor inflation accelerates – Construction service costs jump 5.6% far outpacing materials, worsening housing affordability despite more modest tariff-driven price pressure (Homes.com)

Home prices outpace rents in 69% of US counties in 2025 – Ownership remains cheaper than renting in most markets, but faster home-price growth is shrinking affordability and widening the homeowner–renter wealth gap (Homes.com)

Multifamily

Apartment rents fall 1.4% YoY in January to lowest level in four years – National median rent hits $1,353 as record vacancies and lingering new supply pressure landlords despite slowing demand (CNBC)

40% of apartment owners report leasing and occupancy pressure from immigration enforcement – Impact is most acute in immigrant-heavy markets like Florida, where tenant disappearances and payment delays are driving vacancies higher (Bisnow)

Office

Value-weighted office prices rose 3.8% YoY in 12 months ended December 2025 – Major-market deals drove gains as investors concentrated on higher-quality assets (CoStar)

SL Green says foreign capital is flooding back into NYC office – Global investors view Manhattan offices as “real estate Treasuries” due to downside safety and return potential (CoStar)

Leasing

Decagon plans ~70K SF office lease at 680 Folsom Street in Financial District, San Francisco, CA – AI startup expansion adds momentum to tech-led office demand tightening vacancy (TheRealDeal)

Intercom leases ~45K SF at 85 Second Street in Financial District, San Francisco, CA – AI firm expands office footprint as tech-driven leasing continues to tighten SF office availability (TheRealDeal)

Cigna renews 33K SF at 2 Grand Central Tower in Midtown, Manhattan, NY – Sovereign Partners keeps insurance tenant in 44-story office tower near Grand Central (CommercialObserver)

Industrial

Global logistics rents stabilized in 2H25 as demand reengaged and new supply pulled back - Rent declines slowed to -1.4% in the second half with ~40% of markets flat to positive, setting up moderate rent growth in 2026 (Prologis)

Tesla plans $20B annual capital spend to expand factories and repurpose production lines – Fremont becomes focal point as investment shifts toward robotics, AI chips, and R&D real estate (CoStar)

Retail

Yum! Brands posts YoY foot traffic growth every quarter in 2025, led by Taco Bell +2.8% in Q4 – Taco Bell remained the primary growth engine, while Pizza Hut (+1.3%), Habit Burger & Grill (+1.0%), and KFC (+0.8%) all delivered positive average visits per location despite QSR-wide pressure (Placerai)

Brand-level divergence emerges in Q4 despite portfolio strength – Taco Bell delivered the strongest and most consistent YoY visit gains, Pizza Hut and Habit showed mostly positive same-store growth, and KFC saw near-flat same-store visits amid footprint consolidation (Placerai)

Data Centers

Oracle plans to raise ~$45B–$50B in 2026 to fund cloud and AI capacity – Funding will split between equity and unsecured bonds; scrutiny is rising as debt climbs and exposure to OpenAI-linked infrastructure grows (Reuters)

Oracle has been at the heart of speculative data center financing, and its bonds are increasingly traded through CDS, bond forwards, and options as hedges against leverage risk and potential AI-driven contagion as debt climbs. However, Larry Ellison, like Mark Zuckerberg at Meta, is doubling down and staking Oracle’s future on this buildout; he clearly believes AI compute capacity is the only path to staying relevant.

Powered land is emerging as a critical bottleneck solution for data center growth as power and entitlements replace buildings as the key constraint - CRE firms are pre-entitling and electrifying land to capture AI-driven demand amid grid delays and rising community pushback (Bisnow)

Hospitality

Luxury hotels outperform other classes in 2025 as a K-shaped recovery splits the US hotel market – High-end properties capture stronger demand while midscale and economy hotels lag amid uneven consumer spending (CoStar)

Hotel construction pipeline shrinks as rooms under construction fall to 136,000 – Elevated construction loan rates and persistently higher build costs are keeping new U.S. hotel supply growth muted (CoStar)

Life Sciences

Eli Lilly to build $3.5B Pennsylvania drug plant – Facility will produce injectable weight-loss drugs, create 850 jobs, and expand US manufacturing as pharma firms move to avoid import tariffs (Reuters)

U.S. Food and Drug Administration launches PreCheck to speed domestic drug manufacturing – Program fast-tracks plant construction and reviews to reshore critical medicines and strengthen US supply chains (Reuters)

Financings

Loans

Bank OZK provides $323.8M construction loan for Four Seasons Private Residences Coconut Grove condo project in Miami, FL – Financing backs CMC Group and Fort Partners’ 70-unit Four Seasons–branded development in Coconut Grove (CommercialObserver)

BridgeInvest provides $57M construction loan for Freemont Frisco Apartments affordable multifamily project in Frisco, TX – Financing backs Stryker Properties and Griffon Capital Management’s 313-unit development (TheRealDeal)

Refinancings

Ares Management and JPMorgan Chase provide $525M refinance loan for One High Line luxury condo development in West Chelsea, Manhattan, NY – Financing supports Witkoff Group and Access Industries’ 236-unit project as unsold inventory carries forward (TheRealDeal)

Wells Fargo provides $190M refinance loan for Ink Block and 7INK multifamily projects in South End, Boston, MA – Financing backs National Development’s 495-unit adjacent properties (CommercialObserver)

Structured Finance

Blackstone Mortgage completes $1B CRE CLO offering – New issuance adds to surge in nonbank CRE CLO deals hitting market in early 2026 (CoStar)

Citi Real Estate Funding provides $630M CMBS refinance for West Shore’s 13-property Sun Belt multifamily portfolio across five states – Loan backs 4,077 units at ~93% occupancy and includes a $60.5M mezzanine tranche (MultiHousingNews)

Goldman Sachs and Morgan Stanley provide $160M CMBS refinance loan for multifamily and office portfolio – Financing backs Haven Capital assets spanning ~900 units and ~955K SF across NY, NJ, MO, and Washington, D.C (CommercialObserver)

M&A

Building & Portfolio M&A

Multifamily

Hines acquires the 235-unit Tempo at Riverpark apartments in Oxnard, CA, for $105M – Sale prices the Class A community at ~$447K per unit, marking a sharp gain from Bascom’s ~$75M purchase in 2018 (MultiHousingNews)

Rockefeller Group and Atlas Capital Group buy church property at 200 West 97th Street from Catholic Church in Upper West Side, Manhattan, NY for $96M – Buyers plan housing redevelopment while preserving church and rectory (CommercialObserver)

DWNTWN Realty Advisors–led partnership buys Design 41 mixed-use property in Miami Design District, FL for $72.5M – Deal targets high-quality asset in one of Miami’s most luxury-oriented submarkets (CoStar)

Richard Battaglia buys 127-unit Lumia luxury apartment building at 850 North Azusa Avenue from Serrano Development in Azusa, CA for $53M – Newly built transit-adjacent asset adds exposure to tight San Gabriel Valley multifamily market (TheRealDeal)

NexPoint buys the 240-unit Waterford Place multifamily community in Greensboro, NC, for $50M – The deal reflects ~49% value growth since 2020 and prices the asset at ~$206K per unit, well above metro averages (MultiHousingNews)

Industrial

Clarion Partners acquires $592M seven-building industrial portfolio across Los Angeles, Inland Empire, and Seattle – 2.2M SF, fully leased assets deepen expansion of firm’s U.S. logistics platform (IREI)

StorageMart buys 15 self-storage facilities from Carlyle Group across New York City for ~$1B – Portfolio adds ~1.3M SF and ~25,500 units to StorageMart’s NYC platform (CommercialObserver)

EQT Real Estate buys 390K SF Blankenbaker Station industrial portfolio from Washington Capital Management and Roebling Development in Louisville, KY for $55.8M – Two-building park is fully leased to Packsize International (REBusinessOnline)

Distress Watch

Bankrupt Saks Global is closing 62 discount stores to refocus on luxury retail - The retailer is betting full-price luxury sales can stabilize cash flow (Bisnow)

LA’s stalled $1.2B Oceanwide Plaza is nearing a deal to exit bankruptcy and clear the way for a sale - A creditor settlement would unlock a long-delayed disposition of the incomplete Downtown megaproject (Bisnow)

Tishman Speyer emerges as frontrunner to acquire Chrysler Building ground lease in Midtown, Manhattan, NY – Deal hinges on resetting Cooper Union ground rent after RFR exit and Signa bankruptcy (TheRealDeal)

Concord Wilshire Capital emerges as frontrunner with $60M bid for distressed mixed-use development site in Royal Palm Beach, FL – Offer targets 38-acre, entitled project tied to $47.4M foreclosure judgment pending bankruptcy court approval (TheRealDeal)