The Brick Breakdown

🌐 Tariffs escalate, adding pressure to Fed outlook

Trump’s threat of a 50% tariff on Chinese goods and China’s pledge to "fight to the end" have intensified market volatility and raised fears of prolonged inflation. Fed officials, including Governor Kugler, reaffirmed the central bank's 2% inflation target but signaled that trade-related price shocks could delay policy adjustments.

💸 Bond yields and mortgage rates surge on trade tension

The 10-year Treasury yield jumped 22 basis points to 3.15%, and the 30-year mortgage rate rose to 6.75%, marking the largest daily gain since March 2020. Investors are responding to escalating tariff threats and inflation risks, which have clouded the Fed’s outlook and pushed markets to reassess the timing and likelihood of future rate cuts.

🏠 Housing sentiment weakens as supply peaks

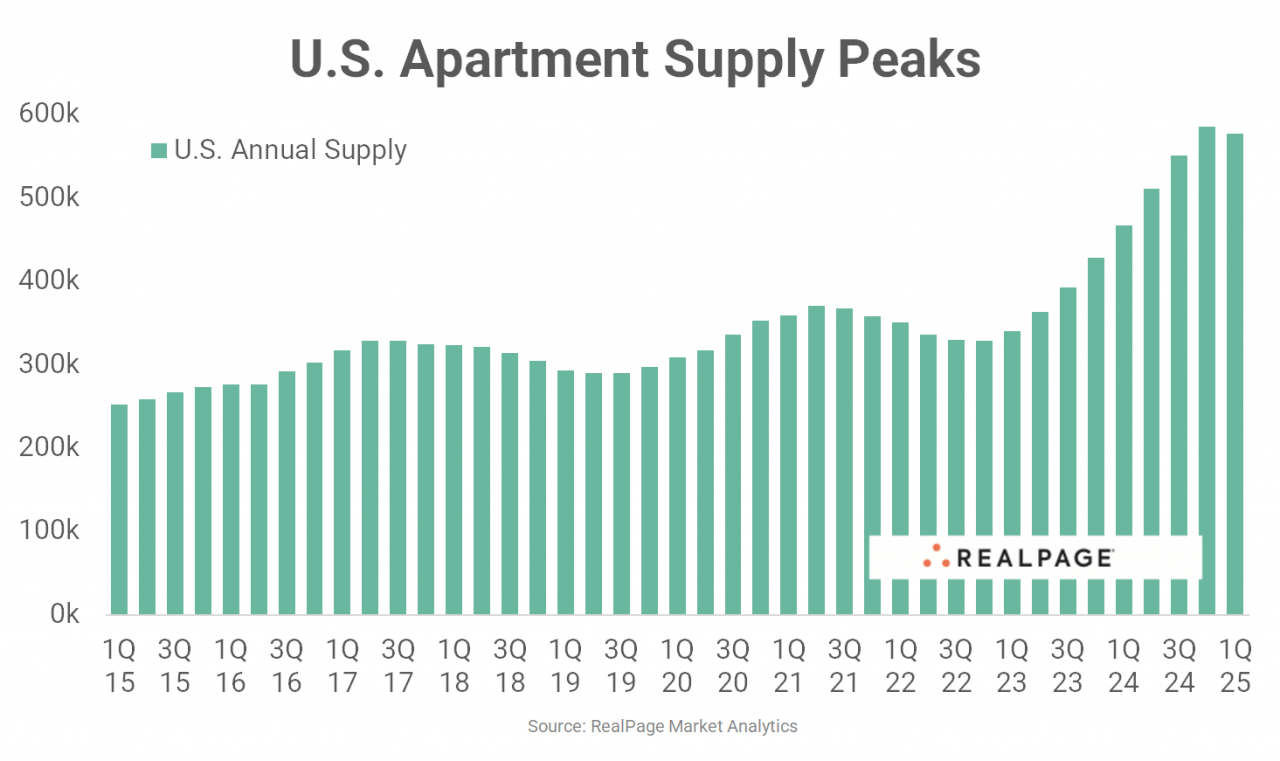

Fannie Mae's home purchase sentiment index dropped to 68.1, its lowest level in a year, as economic anxiety and job loss fears dampen buyer confidence. At the same time, the U.S. apartment market hit a peak with 577,000 units delivered in Q1 2025, though deliveries are projected to decline steadily in the coming years.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.75% (+20 bps)

10Y Treasury Yield: 3.15% (+22 bps)

FTSE NAREIT Index: 704.38 (-2.88%)

30-day SOFR Average: 4.33%

Market Pulse

Escalating tariff threats and inflation concerns rattled markets, pushing bond yields sharply higher as investors reassessed recession risks and the Fed’s ability to cut rates in a volatile economic environment

Trump threatens 50% tariff on Chinese goods – China vows to "fight to the end" and take countermeasures to protect its interests (AP)

Bond yields surge as tariffs spark market volatility – 30-year yield jumps most since March 2020 amid concerns over Trump's tariffs, while mortgage rates rise as investors price in recession risks (Bloomberg)

BlackRock CEO Larry Fink: CEOs believe recession is already here – Fink cites cautious consumer behavior and downturn in various sectors (WSJ)

Fed Governor Kugler emphasizes inflation control – Tariffs may drive short-term price hikes, but the Fed remains committed to a 2% target (Reuters)

U.S. consumer borrowing declines in February – Credit-card balances drop sharply while non-revolving loans decrease, reflecting growing caution amid high borrowing costs and inflation concerns (Bloomberg)

Residential

Housing sentiment continues to weaken amid economic uncertainty and slowing price growth, even as apartment rents are expected to rise and supply begins to decline from peak levels

Home purchase sentiment falls to its lowest level in a year – Fannie Mae index hits 68.1, driven by rising job loss fears amid economic uncertainty (Realtor.com)

Home price growth slows in February to 2.7% YoY – Condo prices drop for first time in over a decade, with Florida markets seeing largest declines (MortgageOrb)

U.S. apartment supply peaks as volumes hit 577K units in Q1 2025 -- Deliveries are expected to decline moving forward, with a drop to 431K units by 2025 and further reductions by 2027 (RealPage)

Apartment rents to accelerate in 2025 – Kansas City, Chicago, and Pittsburgh top cities for rent growth, as demand stays solid and completions moderate (CoStar)

Americans’ $35T in housing wealth drives rising costs – Increased home equity leads to higher property taxes, borrowing challenges, and reduced college aid eligibility (WSJ)

Texas, California, Florida lead in young adult homeownership – These states have the highest number of young homeowners, with fewer barriers to ownership (GlobeSt)

Office

Office construction slows in 2025 – 52.8% of space preleased as demand weakens, with FIRE (Finance, Insurance, and Real Estate) firms dominating leasing activity (Colliers)

D.C. office leasing stable to start 2025 – Federal real estate cuts under Trump have had minimal impact so far, with availability at 23.5%, down 20 bps from last quarter (CommercialObserver)

Industrial

Self-storage sales hit $3B in 2024 – Seattle leads with high-value transactions, while demand for coastal and suburban markets fuels investor interest in early 2025 (StorageCafe)

Tariffs drive up construction costs, canceling $300M factory plan – Plastics recycling plant in Erie scrapped as new tariffs push up material and machinery prices (Bisnow)

Market Mix

February commercial real estate sales surge 30% YoY to $24.4B – Retail leads with a 105% jump, but price changes were mixed, with office and multifamily seeing declines (GlobeSt)

Earnings & Real Estate Impact

Levi Strauss beat Q1 expectations and maintained its full-year forecast, suggesting confidence in consumer resilience, even as the company plans targeted price increases to offset rising tariff-related costs that could contribute to broader inflation

Levi Strauss beats Q1 profit expectations and maintains its annual forecast, excluding tariff impacts. The company plans "surgical" price hikes to manage supply chain disruptions and rising costs from tariffs (Reuters)

Financings

Ares Management secures $564M CMBS refi – Loan arranged by Morgan Stanley, Deutsche Bank, and Goldman Sachs for a 37-property industrial portfolio across nine states (CommercialObserver)

NewYork-Presbyterian secures $186M refi for NYC Helmsley Medical Tower -- DASNY provides financing for the 517-unit mixed-use tower (CommercialObserver)

Werner, Metro Loft secure $90M for NYC office-to-residential conversion – Financing supports 430 rental units in at 675 Third Ave. Midtown East project (CommercialObserver)

First Citizens Bank refinances Birmingham, Alabama medical office with $53.5M loan – Loan supports Grandview Physicians Plaza II owned by Rethink Healthcare Real Estate (REBusinessOnline)

Dwight Mortgage Trust provides $50M acquisition loan for N.J. apartments – Financing supports $59M acquisition of 331-unit Silverwoods property in Toms River, N.J (CommercialObserver)

M&A

Company M&A

Brookfield sells 8% stake in $20B+ property fund to its insurance unit – Brookfield Wealth Solutions acquires stake in BSREP IV, alongside other asset sales (Bisnow)

Building & Portfolio M&A

Essex Property Trust sells Santa Ana, California towers for $240M – Crescent Heights acquires two-tower complex at $685K/unit (CoStar)

Tishman Speyer in talks to buy 148 Lafayette Street in SoHo, Manhattan for $120M – Deal with Epic comes after company's focus on Hudson Yards (CommercialObserver)