The Brick Breakdown

Hello Brick Brief readers,

Happy Monday. In recent news, Nareit sees stronger REIT performance in 2026, existing home sales rose in November despite a sluggish housing market, and multifamily construction is stabilizing.

🏢 REIT cash flow holds up into year end

Nareit reported strong operating performance for REITs in 2025, with FFO up 6.2%, NOI up 4.7%, and dividends up 6.3%. REITs now trade at crisis like discounts versus the S&P 500 and private real estate, which Nareit believes sets up relative outperformance in 2026 as public and private valuations converge.

🏡 Affordability lifts existing home demand

Improving affordability is bringing buyers back as existing home sales rose 0.5% MoM in November to a 4.13M pace, the highest since February, driven by lower mortgage rates and payments falling to 32.6% of income. Tight supply is keeping the market constrained as new listings fell 30% MoM, although Zillow expects sales to rise 4.3% in 2026 if rates drift toward 6%.

🏘️ Multifamily shifts from pullback to stabilization

Multifamily construction is stabilizing as NMHC reports starts holding roughly flat while easing material and labor costs offset weak rent growth after a two year pullback. That leveling sets up a steadier 2026 as industry leaders expect flat rents and near equilibrium vacancies while Sun Belt oversupply clears.

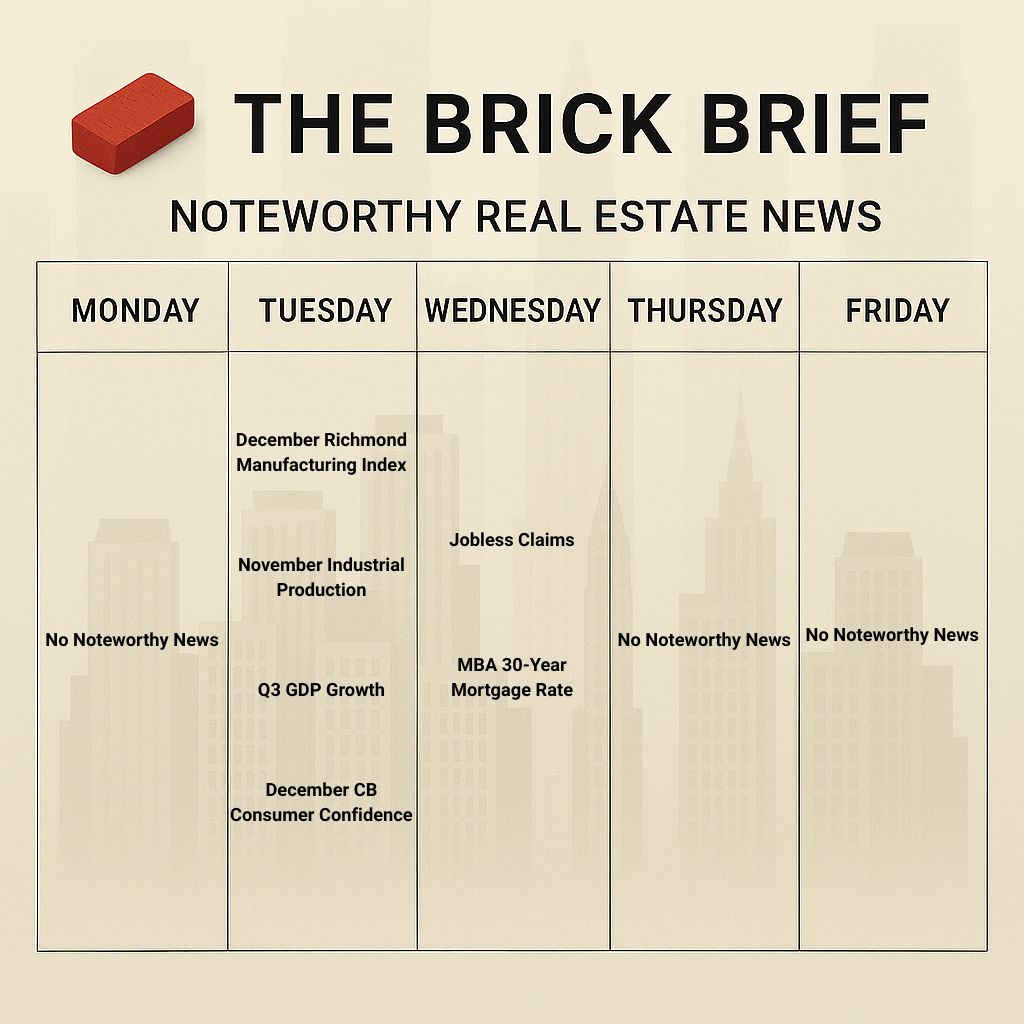

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.25% (+3 bps)

10Y Treasury Yield: 4.16% (+1 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 748.49

30-day SOFR Average: 3.91%

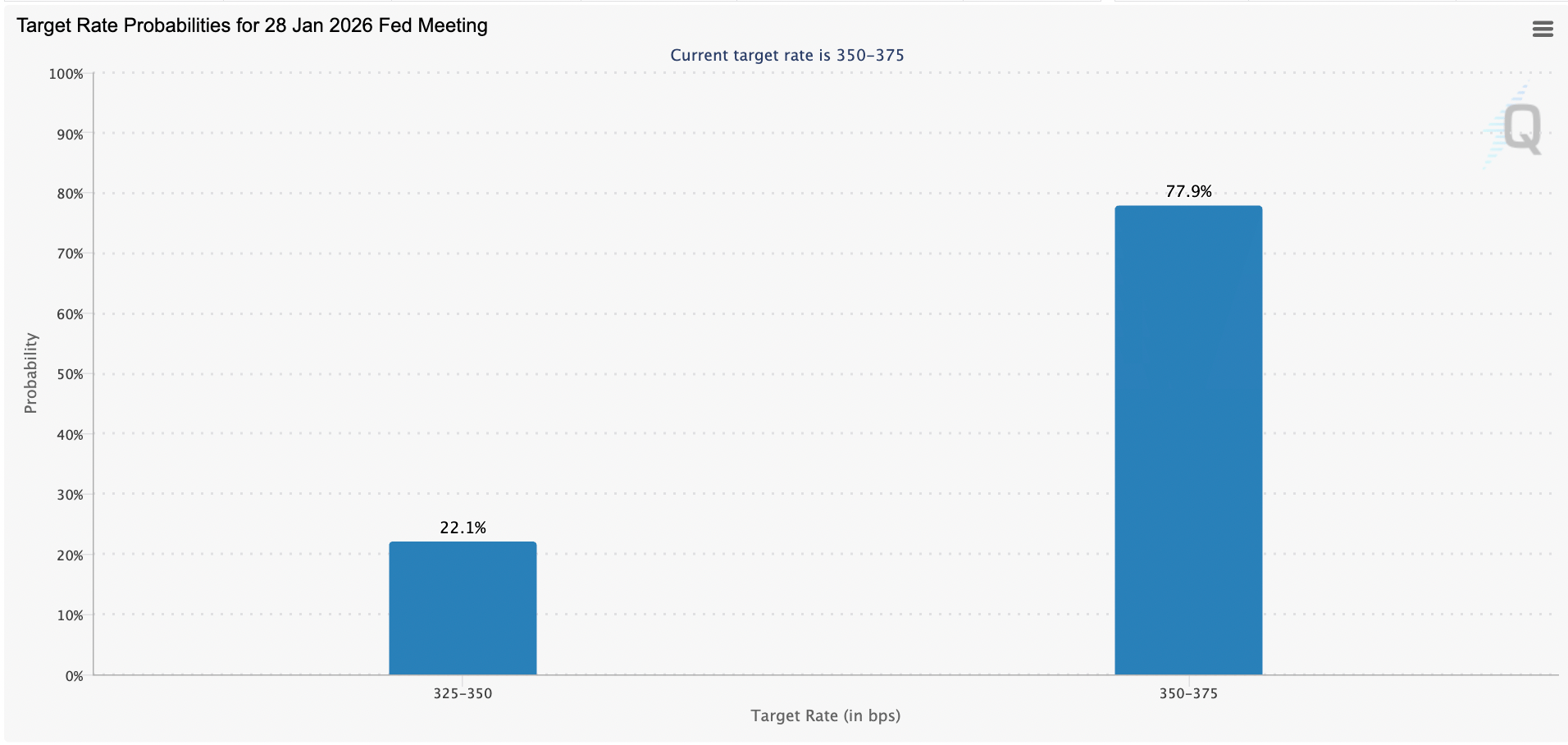

Market Pulse & Rate Watch

Jobs anxiety could soon replace inflation fears – With price pressures cooling, attention is shifting toward the labor market as the real driver of affordability and economic risk (WSJ)

NY Fed’s Williams says November CPI was distorted lower and sees no urgency to cut again – Data collection issues likely shaved about 0.1% off the 2.7% reading; he argues policy is already well positioned after recent easing (CNBC, Reuters)

Fed’s Hammack signals rates on hold into spring – Cleveland Fed President Beth Hammack says inflation remains too high and takes November’s cooler reading with a grain of salt after opposing the past 75 bps of cuts (WSJ)

Apollo cuts risk and stockpiles cash ahead of potential market turmoil – Marc Rowan says the firm is cutting leverage, trimming CLO exposure, boosting Treasury liquidity at Athene, and running private credit more conservatively to be ready when markets crack (FT)

Market Mix

REIT operating growth remains strong in 2025 with FFO up 6.2% – Nareit says NOI rose 4.7% and dividends climbed 6.3% even as higher rates and trade friction held valuations back (Nareit)

REIT valuations at crisis-like discounts set up 2026 upside – Gap versus the S&P 500 and private real estate is among the widest since the GFC and COVID, positioning listed REITs for relative outperformance as multiples converge (Nareit)

Nareit’s 2026 Outlook expects stronger relative performance for listed REITs next year after a prolonged stretch of public market underperformance. Operating performance remained strong in 2025: REIT FFO rose 6.2%, NOI increased 4.7%, and dividends climbed 6.3% even as higher rates and trade friction weighed on sentiment. Despite that operating strength, REITs are trading at crisis-like discounts versus both the S&P 500 and private real estate, with gaps rivaling the GFC and early COVID. Nareit argues that as multiples converge, listed REITs could see relative outperformance in 2026.

That said, Nareit has clear incentives to lean bullish, while REITs have lagged for real reasons: elevated leverage, looming refinancing risk at higher rates, and persistent negative sentiment from the CRE valuation reset.

Still, the size of the public-private valuation gap is hard to ignore, and private capital has been aggressively targeting smaller, discounted REITs.

Recent REIT Deal Activity Includes:

Ares and Makarora agreed to acquire Plymouth Industrial REIT in a $2.1B take-private. Plymouth owns a portfolio of small-bay industrial properties across secondary U.S. markets.

MW Group, Blackstone, and DivcoWest will take Alexander & Baldwin private in a $2.3B all-cash buyout. A&B owns 21 retail centers, 14 industrial assets, and four office properties across Hawaii.

Centerspace is exploring a potential sale as it fields takeover interest. The REIT owns ~13,000 apartment units across the Western U.S., concentrated in Denver, Salt Lake City, and smaller regional markets.

Morgan Properties agreed to acquire Dream Residential REIT for $354M. Dream owns 15 garden-style apartment communities with ~3,300 units across Dallas, Cincinnati, Oklahoma City, and Tulsa.

Aimco plans to liquidate its remaining portfolio and return capital to shareholders. The company owns 15 stabilized apartment properties across major U.S. markets, including a $520M Miami waterfront portfolio, and said liquidation offers more value than continuing as a small public REIT.

Policy & Industry Shifts

House panel advances housing bill to cut zoning red tape – The Housing for the 21st Century Act would streamline infill approvals, ease NEPA reviews and lower construction costs as lawmakers push supply-side reforms into 2026 (Bisnow)

Residential

Mortgage rates hit a one-year low but owners still won’t sell – Nearly 30M households or 54% of mortgage holders are locked into 4% or lower loans, keeping listings tight despite improved affordability (WSJ)

Existing-home sales rise 0.5% MoM in November – Sales hit a 4.13M annual pace, the highest since February, as lower mortgage rates drove a third straight monthly gain in a still-sluggish market (WSJ)

New listings fell 30% MoM in November as affordability hit a 3-year high – Price cuts normalized to 21% of listings while mortgage payments dropped to 32.6% of income (Zillow)

U.S. home values were flat at 0.2% YoY in November as the market rebalanced – Inventory improved, affordability edged lower with payments down $105 YoY; Zillow expects sales to rise 4.3% in 2026 if rates drift toward 6% (Zillow)

Housing inventory growth slows to 13.54% YoY into year end – Down from over 30% earlier in 2025 as new listings normalized and improved mortgage spreads and sales momentum absorbed supply (HousingWire)

50% of affordable housing developers see deal pipelines pressured in 2026 – TD Bank survey shows rising construction costs, tariffs, and policy uncertainty weighing on projects even as 62% still expect sector growth (HousingWire)

Multifamily

Multifamily construction may be stabilizing after two-year pullback – NMHC’s December survey shows starts holding roughly flat versus three months ago as lower material and labor costs offset still-weak rent growth (ConnectCRE)

Multifamily outlook points to stabilization in 2026 – Industry leaders expect rents to flatten, vacancies to hold near equilibrium, and construction to slow further as oversupplied Sun Belt markets work through inventory and investors pivot to value-add and workforce housing (ConnectCRE)

Office

70% of real estate leaders plan to add space in 2026 but favor flexibility – Visual Lease and CoStar survey shows firms may delay moves and upgrades as economic uncertainty persists (BusinessWire)

Retail

Investors return to U.S. malls as deal activity rebounds into year-end – Altus projects more than 50 single-asset mall sales in 2025, marking one of the strongest years in two decades as occupancy tightens at top-tier centers (Bisnow)

Clarks opens first U.S. 1,255 SF Cloudsteppers store in Corpus Christi, TX - The flip-flop brand debuts at La Palmera mall and plans to reach 12 U.S. locations by the end of 2026 (CoStar)

Starbucks leads NYC chain-store closures as retail footprints shrink – The city lost 112 chain locations YoY or 1.3%, marking the sixth decline in eight years as big brands scale back amid shifting demand (CommercialObserver)

Data Centers

AI boom pushes data center dealmaking to record $61B in 2025 – More than 100 transactions through November already topped last year’s high as hyperscaler demand and private equity capital flood the sector (Reuters)

Google Cloud lands security deal approaching $10B with Palo Alto Networks – The expanded multi-year partnership marks Google Cloud’s largest security contract as AI drives demand for cloud-based cyber defenses (Reuters)

Hospitality

U.S. hotel RevPAR fell 1.1% in the week ending Dec. 13 – Demand declined for a fifth straight week as hurricane-hit markets and Las Vegas drove most of the drop, partially offset by strength in New York City and Baltimore (CoStar)

Financings

Loans

InterVest and Metro Loft secure $867M construction loan for office-to-residential conversion in Manhattan, NY – The financing backs the redevelopment of 111 Wall Street into apartments as one of the largest office conversion loans ever in New York City (CommercialObserver)

Related Ross secures $772M Ares-led construction loan for two office towers in West Palm Beach, FL – The financing backs the 10 and 15 CityPlace development set for 2027 delivery; tenants include ServiceNow, Cleveland Clinic and BDO (Bloomberg)

Refinancings

Carlyle provides $640M refinancing for 88-story mixed-use supertall at 520 Fifth Avenue in New York City, NY – The condo inventory loan backs Rabina’s tower as it transitions from construction to condo sales and office leasing, replacing a $540M construction loan (TheRealDeal)

M&A

Company M&A

Office REIT Paramount Group shareholders approve $1.6B sale but reject $34M exit package – Investors greenlit the merger with Rithm Capital while voting down CEO Albert Behler’s golden parachute amid governance concerns (Bisnow)

Building & Portfolio M&A

Multifamily

Camden Property Trust buys 322-unit Soloya apartment community from Bainbridge in Orlando, FL for $65.9M – The 2018-built property will be rebranded as Camden Lake Buena Vista at just over $200K per unit (ConnectCRE)

Retail

IMC Equity Group buys 150K-SF Doral Square retail center from Terra in Miami, FL for $74M – The nearly fully leased Downtown Doral asset is anchored by Marshalls, Ross Dress for Less, and UFC Gym (ConnectCRE)

CTO Realty Growth buys Publix-anchored 509K-SF shopping center in Pompano Beach, FL for $65M – The retail REIT makes its first South Florida acquisition with the purchase of the 92% leased Pompano Citi Centre from Sterling Organization (TheRealDeal)

Hospitality

Hotel REIT Service Properties Trust sells 66 hotels for $534M – The company offloaded 8,294 keys as part of a broader $859M 2025 disposition push to pay down debt with $5.8B maturing over the next five years (Bisnow)

Service Properties Trust is selling mostly non-core, lower-priority hotels to refocus on full-service, urban and leisure-oriented hotels in strong markets, where higher-end demand and brand strength offer better long-term cash flow durability. The asset sales also serve a balance-sheet imperative, as $5.8B of debt is coming due over the next five years – proceeds are earmarked to pay down notes and reduce refinancing risk. The timing also reflects a tougher 2025 lodging backdrop. Softer consumer spending has pressured midscale and select-service demand, while luxury and destination hotels have held up as the relative safe haven.

Office

Alo Yoga buys 83K-SF Beverly Hills Gateway office from Breevast in Beverly Hills, CA for $90M – The athleisure retailer is expanding its Los Angeles headquarters footprint with one of the area’s priciest office trades this year (CoStar)

Cross Ocean Partners and Lincoln Property Company buy 409K-SF office campus in Needham, MA for $132M – Boston Properties sells the nearly fully leased trophy suburban asset after a $27.8M capital improvement program (IREI)

Institutional Fundraising

UDR expands LaSalle multifamily JV to $850M – The REIT added four properties across Portland, Orlando and Richmond in a $230M upsizing and will receive $200M in cash while retaining a 51% stake in the venture (Bisnow)

PNC closes $175M LIHTC Fund 100 to finance affordable housing nationwide – The multi-investor fund will support nearly 1,500 income-restricted homes across 17 properties in 10 states (ConnectCRE)

Distress Watch

Pimco and Witkoff default on $400M loan for 249-unit multifamily property in Santa Monica, CA – The Park Santa Monica debt has climbed to about $439.5M including interest and late charges after being upsized last year (Bloomberg)

Dornin Investment Group buys $78M nonperforming note on 131-unit multifamily development in Brooklyn, NY – The distressed loan is secured by the in-progress 57 Caton Avenue project in Windsor Terrace (CommercialObserver)

Proptech & Innovation

US lenders are using insurance for AI mortgage screening errors – Banks are buying cover from insurers like Munich Re to backstop AI underwriting mistakes, cut capital requirements, and write more home loans if the models misjudge borrowers (FT)