The Brick Breakdown

Hello Brick Brief readers,

Happy Holidays! Today’s edition is the last one for the week. In recent news, Zillow is forecasting a cooler housing market in 2026, CRE completions are plunging alongside a widening asset and market bifurcation, and renewables are coming under scrutiny for data centers.

🏡 Zillow Sees A Cooler Housing Market In 2026

Zillow expects a slower and more buyer friendly market in 2026 as demand stays soft and leverage shifts back to households. It forecasts home values rising just 1.7% and existing-home sales growing 5.2% YoY as easing mortgage rates gradually unlock activity.

🏢 CRE Supply Drought Favors The Best Assets

CoStar reported U.S. commercial completions falling below 100M SF in Q4 for the first time since 2013, while total supply was down 34% YoY to 486M SF in 2025. Additionally, CoStar is seeing a two-tier market, as premium assets in core markets posted a sixth straight monthly gain, while mom-and-pop owners of older properties in weaker locations see values continue to slide.

⚡ Renewables Under Scrutiny In The AI Buildout

The Trump administration paused offshore wind projects on national security grounds; in response, Dominion warned that the 90-day suspension of its $11.3B Coastal Virginia project threatens grid reliability and power for data centers in NoVa. On the other hand, Alphabet is acquiring solar and storage developer Intersect for $4.75B to vertically integrate power supply, showing that Big Tech still views renewables as critical to scaling AI infrastructure.

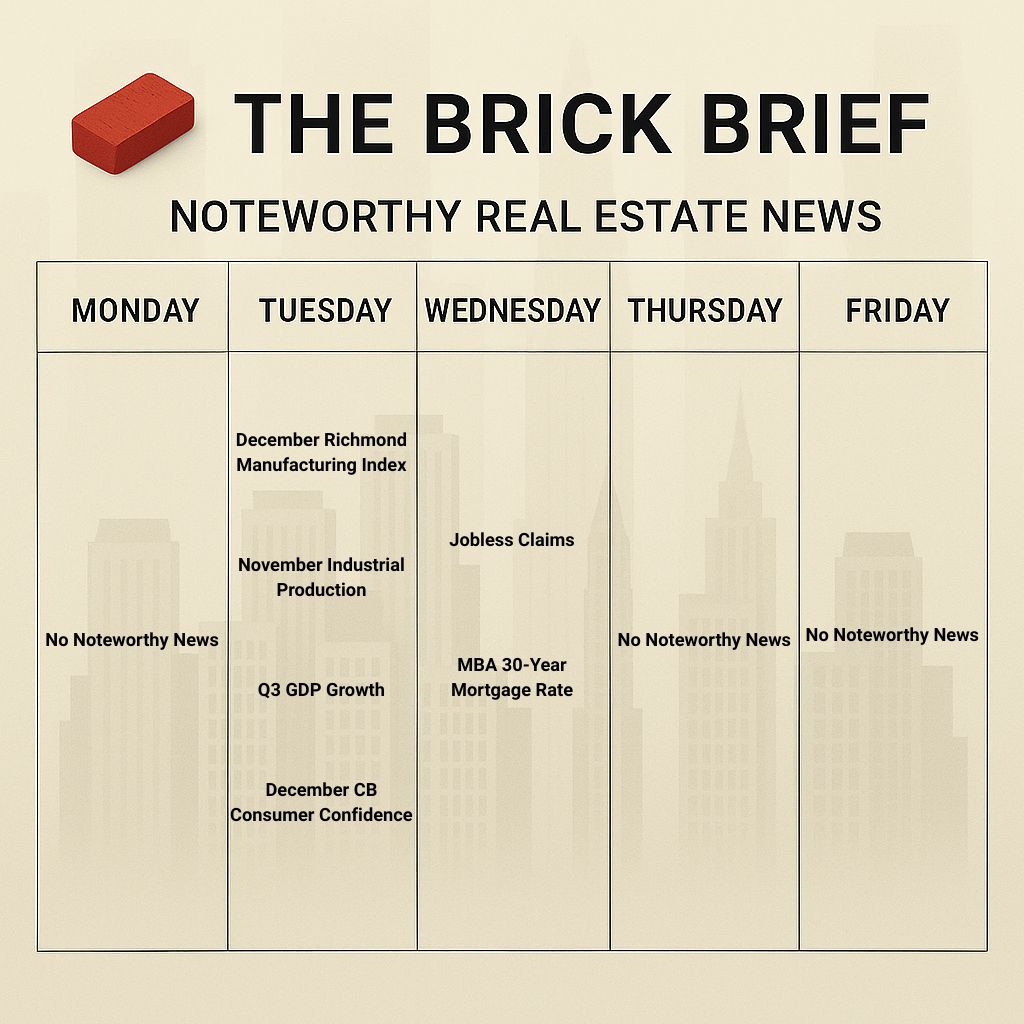

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.24% (-1 bps)

10Y Treasury Yield: 4.16%

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 751.90 (+0.46%)

30-day SOFR Average: 3.88%

Market Pulse & Rate Watch

Unemployment rose to a four-year high in 2025 as jobless rolls rose by 700K to 7.8M – Firms pulled back on hiring and trimmed headcount late in the year (WSJ)

BofA CEO Brian Moynihan sees AI boosting U.S. growth to 2.4% in 2026 - The bank expects a stronger economy next year as AI investment kicks in, with limited risk even if the sector overheats (Bloomberg)

Fed’s Miran warns of recession risk without more rate cuts in 2026 - He says rising unemployment should push the central bank to keep easing, though a half-point cut may no longer be needed (Bloomberg)

Market Mix

U.S. CRE deliveries hit the lowest since 2013 – New supply fell 34% YoY to 486M SF as quarterly deliveries dropped below 100M SF for the first time in over a decade (CoStar)

Prices for premium US properties rise while smaller assets tumble – CoStar data shows a two-tier recovery with core-market values up for a sixth straight month as secondary-market assets slide (CoStar)

Policy & Industry Shifts

Mitt Romney calls to end 1031 exchanges to shore up Social Security – Retired senator argues the tax break lets wealthy real estate investors avoid paying their fair share (NYTimes)

Chicago homeowners face $500M property tax hike as assessments shift burden – New valuations move taxes from downtown commercial properties onto neighborhoods despite the city’s overall take staying flat (WSJ)

Residential

Zillow expects home values to rise just 1.7% in 2026 as demand stays soft – Slower price growth and easing supply should give buyers more leverage next year (Zillow)

Zillow expects existing-home sales to reach 4.3M in 2026 as rates ease – Forecast calls for a 5.2% YoY gain as lower borrowing costs gradually unlock demand (Zillow)

Home sellers retreat as active listings fell 1.4% MoM in November – New listings dropped 2.2% MoM to the lowest level since April 2024 as buyers stayed skittish and sellers cut prices; homes sold 1.6% below list (Redfin)

Office

Leasing

Moody’s inks 460K-SF office lease at Brookfield-owned 200 Liberty Street in New York City, NY – The ratings firm will relocate from 7 World Trade Center in 2027, downsizing from 758K SF as it moves into Brookfield Place (CommercialObserver)

Tokio Marine inks 24K-SF office lease at Durst Organization’s 825 Third Avenue in New York City, NY – The Japanese insurance group is consolidating multiple U.S. units into the Midtown East tower under a 10-year deal (CommercialObserver)

Jay Suites signs 30K SF office lease at 41 Flatbush Avenue in Brooklyn, NY – The coworking operator will open its first Brooklyn location at Quinlan Development Group’s Pioneer Building (TheRealDeal)

Retail

Potbelly Sandwich Works plans to open 50 new stores in 2026 – Expansion includes its first Atlanta location as the RaceTrac-owned chain pushes aggressive growth (CoStar)

Data Centers

Data-center construction set to surpass office as AI boom reshapes CRE – Investors are getting rich on the upside but growing more exposed to a pullback in AI-driven demand (WSJ)

US halts offshore wind projects on national security grounds – Dominion says the 90-day suspension of its $11.3B Coastal Virginia project threatens grid reliability and power for data centers and the AI buildout (FT & DominionEnergy)

Just two weeks ago, a federal judge threw out Trump’s executive order that blocked wind leasing and permitting on federal lands and waters as unlawful and arbitrary, setting a precedent that today’s offshore wind suspensions could face legal challenges.

This time, however, the administration is grounding the pause in national security, claiming offshore turbines could disrupt military radar systems and warrant a 90-day halt. Even so, Alphabet’s recent purchase of renewable developer Intersect (see below) shows that Big Tech still views utility-scale renewables as a core part of the infrastructure stack, alongside natural gas and nuclear, to power the AI buildout.

That framing sits awkwardly with an administration that has otherwise prioritized rapid expansion of the energy and data center infrastructure needed to support the AI race.

Regulated utility Georgia Power wins PSC approval for 10 GW grid expansion – Buildout is aimed at meeting surging data center power demand by 2030 despite public opposition (Bisnow)

Life Sciences

AI-powered biotechs emerge as a path to absorb NYC’s lab glut – With life sciences vacancy near 27%, these tenants lease ~1/3 less space and require costly power and infrastructure upgrades, limiting how much demand they can really add (Bisnow)

Financings

Loans

Affinius Capital provides $250M construction loan for 517-unit multifamily tower in Miami, FL – The financing backs Focus and Group Fox’s Brickell Starlight development in Brickell (CommercialObserver)

BridgeCity Capital provides $72M construction loan for 117-unit multifamily at 236 Gold Street in Brooklyn, NY – The financing backs Southside Units’ 14-story Downtown Brooklyn apartment project, which has 30 affordable units (CommercialObserver)

S3 Capital provides $67M construction loan for Tula Residences condo tower in North Bay Village, FL – The financing backs Vivian Dimond’s revival of the stalled 54-unit project at 7918 West Drive after taking it over from Pacific & Orient Properties (TheRealDeal)

Refinancings

PCCP provides $76M refinancing for 384-unit Overall Creek Apartments in Murfreesboro, TN near Nashville – The loan refinances Denholtz’s 94% occupied multifamily complex (CommercialObserver)

M&A

Company M&A

Alphabet to buy clean energy developer Intersect for $4.75B to power AI data centers – Deal gives Google control over power development as grid constraints tighten; Intersect has ~7.5 GW of solar and storage in operation, with another ~8 GW in its Texas-heavy pipeline (Bloomberg)

Intersect develops utility-scale solar and battery storage in Texas and other data-center hubs. As part of the deal, Alphabet will acquire its power development platform and team, including in-development projects already contracted by Google. Alphabet is moving upstream to bring that expertise in house so it can secure clean capacity faster and manage grid constraints as it scales AI data centers. This vertical integration gives Alphabet tighter control and competency in power, currently the most critical bottleneck for the AI infrastructure buildout.

$3.5B cold storage REIT Americold to review portfolio after activist push – Company will explore asset sales and debt reduction as Ancora presses for strategic alternatives (Bisnow)

Property management platform Oakline acquires Drucker + Falk – Deal lifts its portfolio above 65,000 units nationwide as the Alpine-backed firm accelerates growth (Bisnow)

Cottonwood Communities acquires RealSource’s 3,565-unit apartment portfolio in a ~$500M stock-for-stock merger – The deal lifts the non-traded REIT to ~$2.6B of assets and 11,037 units across 13 states (ConnectCRE)

Building & Portfolio M&A

Hospitality

Slate Property Group and Breaking Ground buy 611-key Stewart Hotel from Sioni Group and Patriarch Equities in Midtown Manhattan, NY for $255M – The buyers plan to convert the shuttered hotel at 371 Seventh Avenue into 579 apartments (CommercialObserver)

Industrial

Samsung Biologics buys 420K-SF biomanufacturing campus at 9911 Belward Campus Drive in Rockville, MD from GSK for $280M – The South Korean drugmaker will establish its first U.S. manufacturing footprint and plans to retain more than 500 employees at the site (Bisnow)

Multifamily

FPA Multifamily buys 263-unit 420 East Ohio Street apartment tower in Chicago, IL for $89M from Green Cities – The Streeterville deal comes weeks after its $175M North Water purchase, doubling down on the submarket at roughly $338K per unit (TheRealDeal)

Institutional Fundraising

S2 Capital and Iron Point Partners form shallow-bay industrial JV - Iron Point will provide LP equity to back S2’s value-add infill acquisition strategy in high-growth U.S. markets (IREI)

The obvious tailwind here for last-mile infill (in growth markets) is e-commerce.

Distress Watch

Luxury retailer Saks mulls Chapter 11 ahead of $100M+ debt payment – Company weighs emergency financing or asset sales as its turnaround strains liquidity (Bloomberg)