The Brick Breakdown

Hello Brick Brief readers,

Thank you for your continued support! In recent news, Trump moved to ban institutional homebuying, affordability is reshaping where Americans are moving, and retail traffic split sharply across shopping center formats.

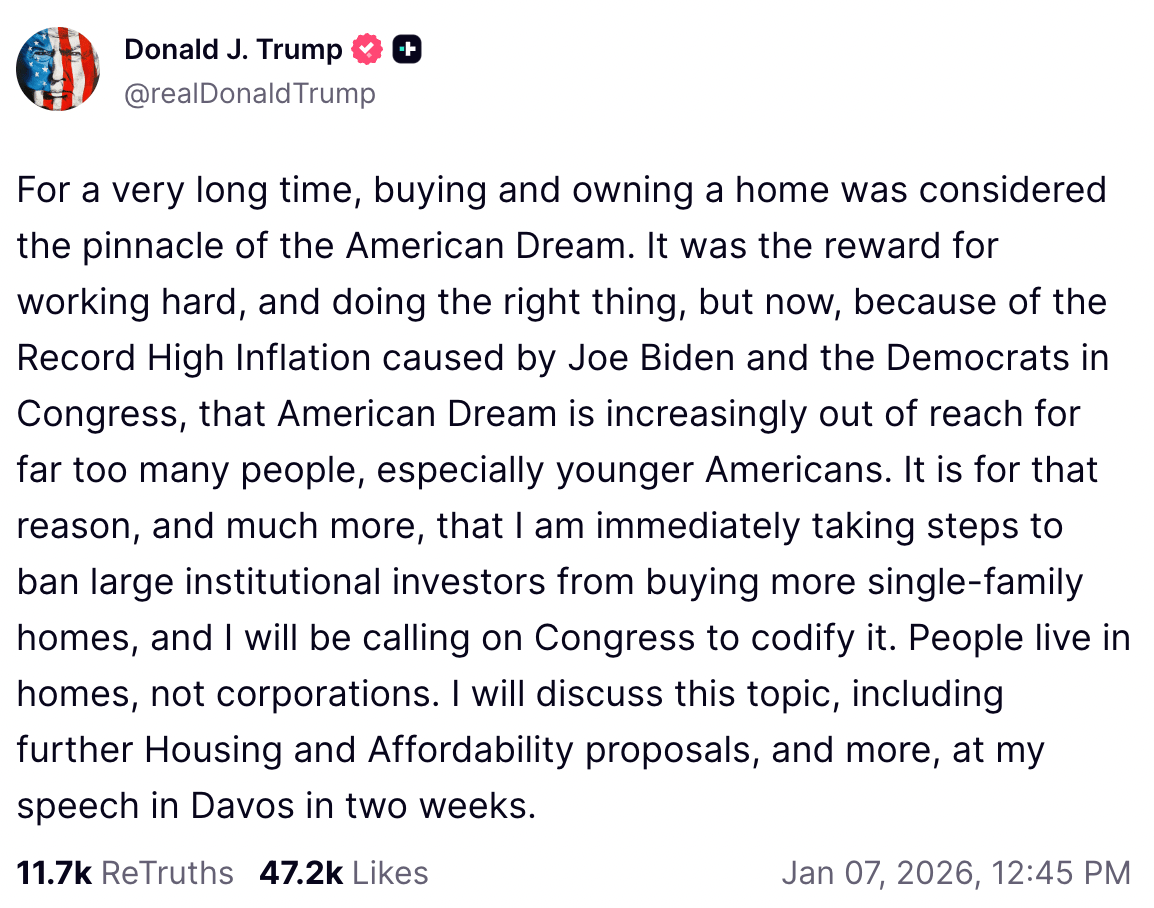

🏠 Institutional Homebuying Faces Political Risk

Trump moved to ban large institutional investors from buying single-family homes to address the housing affordability crisis, despite institutions owning only a small share of total housing supply. Blackstone fell ~6%, Invitation Homes slid ~6%, and American Homes 4 Rent dropped ~4% on fears that a federal ban could pressure the single-family rental model.

🧭 Affordability Is Driving Where Americans Move

According to United Van Lines, affordability and lifestyle overtook jobs as the primary drivers of household moves in 2025; Oregon led inbound migration while flows into Florida and Texas normalized. That same affordability pressure is pushing demand toward Midwest and Northeast metros like Rochester, NY, and Harrisburg, PA, which Realtor.com ranks among the top first-time homebuyer markets due to lower prices, better inventory, and less competition.

🛍️ Retail Traffic Growth Is Splitting By Format

Indoor malls led retail traffic gains in 2025 as the only format to post visit growth in all four quarters. Outlet malls posted annual visit declines despite shoppers’ focus on value, as time costs and e-commerce alternatives reduced the appeal of long destination trips.

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.19%

10Y Treasury Yield: 4.15% (-1 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 751.39 (+0.93%)

30-day SOFR Average: 3.74%

Market Pulse & Rate Watch

U.S. job openings hit 7.15M, lowest level in over a year – JOLTS data show vacancies down from 7.45M in October as hiring slowed across leisure, healthcare, and logistics (Bloomberg)

U.S. private payrolls rose just 41,000 in December – ADP data came in below expectations, pointing to sluggish hiring momentum heading into 2026 despite modest gains in healthcare and leisure (Bloomberg)

U.S. services PMI rose to 54.4 in December, fastest pace in over a year – ISM data showed broad-based expansion led by retail, finance, and hospitality (Bloomberg)

Market Mix

Foreign capital is returning to U.S. CRE in 2026 with a narrower focus – Global investors are targeting data centers, housing, and select office assets while prioritizing basis, submarkets, and replacement-cost discounts over broad sector bets (GlobeSt)

Policy & Industry Shifts

White House moves to ban institutional investors from buying single-family homes – Donald Trump said the administration will block large investors from purchasing additional homes and seek congressional backing (FT)

This news is a big headline, but will a ban on institutional homebuying really have a meaningful impact on housing affordability?

A May 2024 report from the United States Government Accountability Office found that institutional investors, defined as owning more than 1,000 single-family rental homes, tend to concentrate activity in a handful of markets such as Phoenix AZ, Jacksonville FL, and Atlanta GA. Nationally, they own ~3% of the single-family rental stock and less than 1% of total U.S. housing supply - most rental homes are still owned by small mom-and-pop landlords.

And Sun Belt housing markets are actually under pressure from an oversupply driven by elevated builder activity.

That said, the study did find that institutional investment contributed to higher home prices and rents in the short term, particularly in markets with concentrated activity. Over longer periods, however, the research suggests those inflationary effects tend to diminish.

This figure depicts ownership of the single-family rental market, not ownership of all single-family homes in that metro.

Blackstone sinks nearly 6% as Trump targets institutional homebuying – Blackstone fell almost 6% after dropping as much as 9.3%; Invitation Homes slid about 6% and American Homes 4 Rent fell roughly 4% on fears of a ban on institutional single-family home purchases (Bloomberg)

Newsom plans crackdown on corporate homebuying in California – Gavin Newsom will push to restrict private equity and hedge funds from buying single-family homes at scale (Bloomberg)

White House lines up up to $10B in immigration facility development – U.S. Customs and Border Protection issued an IDIQ contract to pre-approve developers for large new builds and major renovations, prioritizing turnkey construction tied to immigration enforcement funding (Bisnow)

Residential

Americans shifted toward smaller markets in 2025 – Migration data from United Van Lines showed affordability and lifestyle overtaking jobs as the main drivers; Oregon led inbound moves while Florida and Texas saw migration normalize (CNBC)

Best first-time homebuyer markets for 2026 skew Midwest and Northeast – Realtor.com ranked Rochester NY, Harrisburg PA, and Granite City IL at the top, driven by affordability and inventory advantages (Realtor.com)

Mortgage rates started 2026 near 6% – The 30-year fixed rate is hovering around 6.0% and is expected to stay rangebound through 2026 as inflation risks limit further declines (Zillow)

Office

Office demand faces less near-term AI risk – Vanguard’s research shows AI-exposed occupations outperformed on job growth and real wages, suggesting productivity gains rather than widespread white-collar job losses so far (GlobeSt)

Leasing

Investment and insurance firm Starr leases 275K SF across 12 floors at 343 Madison Avenue in Midtown Manhattan, NY – The 20-year lease anchors BXP’s 930K-SF office tower, which is set for 2029 delivery (ConnectCRE)

Industrial

Industrial tenants are shifting to regional hub strategies – According to Colliers, companies are moving away from single coastal distribution centers toward smaller regional facilities to improve resilience and speed (GlobeSt)

Amazon has reset our expectations around delivery speed, forcing other e-commerce players to match shorter delivery windows and adopt the same logistics playbook. As a result, e-com increasingly prioritizes speed, compressing fulfillment timelines and pushing tenants toward smaller, last-mile infill locations that are closer to end consumers.

Power is becoming a primary site selector for logistics real estate – According to Prologis, grid constraints and rising energy needs are pushing tenants to prioritize facilities with on-site generation, microgrids, and scalable power over traditional location advantages alone (GlobeSt)

U.S. factory orders fell 1.3% in October – The drop was driven by a sharp decline in aircraft orders, while orders for core capital goods excluding aircraft rose 0.5% (Reuters)

Retail

U.S. online holiday spending hit a record $257.8B in 2025 – Adobe Analytics data showed sales rose 6.8% YoY despite slower growth, driven by deep discounts and $20B in buy-now-pay-later usage (Reuters)

Indoor malls posted full-year visit gains in 2025 – The only mall format to grow traffic in all four quarters, signaling a shift from recovery into sustained growth (Placerai)

Open-air shopping centers led during the holidays – Q4 visits rose 2.0% YoY and December traffic increased 1.5% as dining and convenience drove seasonal trips (Placerai)

Outlet malls lagged all formats in 2025 – Annual visits declined, including a 1.1% drop during the holiday season, as time costs outweighed discounted pricing for value-seeking shoppers (Placerai)

Healthcare

$11.8B REIT Healthpeak plans senior housing REIT spin-off – Healthpeak Properties will create Janus Living, which will own 34 communities totaling 10,422 units; Healthpeak will retain a controlling stake (Bisnow)

Financings

Loans

Wells Fargo, JPMorgan Chase, and Bank of America provide $480M acquisition loan for Park Avenue Tower office building in Manhattan, NY – SL Green is funding the remaining $270M of the $730M purchase with equity (TheRealDeal)

Apollo provides $245M construction loan for a 43-story office tower in Charlotte, NC – The financing backs phase two of Riverside Investment & Development’s Queensbridge Collective project alongside $105M of structured equity from RXR, One Investment Management, and Liberty Mutual Investments (CommercialObserver)

Bayview Commercial Mortgage Finance provides $200M construction loan for Okan Tower condo-hotel project in Downtown Miami, FL – The C-PACE financing marks the first construction loan for Okan Group’s 72-story mixed-use tower (CommercialObserver)

Santander Bank provides $88M construction loan for a 120-unit multifamily project in Greenwich, CT – The financing backs Lonicera Partners’ Benedict Court development (CommercialObserver)

Structured Finance

Selig Enterprises and Florida State Board of Administration secure a $245M floating-rate CMBS loan from Bank of America to refinance 1105 West Peachtree office tower in Atlanta, GA – The 653K SF Midtown asset is 95% leased and anchored by Google (Bisnow)

M&A

Building & Portfolio M&A

Multifamily

JRK Property Holdings buys a three-property multifamily portfolio spanning Los Angeles, Seattle, and Hoboken, NJ for $400M from Equity Residential – The 803-unit deal caps a record $1.3B acquisition year for JRK as the firm scales core-plus and value-add exposure across major coastal markets (CommercialObserver)

Olen Properties buys Magnolia at Milton multifamily community in Milton, GA for $179.7M from IMT Residential – The 300+ unit deal prices near $600K per unit and expands Olen’s metro Atlanta apartment footprint (ConnectCRE)

The Carlyle Group and Z+G Property Group buy a 132-unit apartment building in Gowanus, Brooklyn, NY for $105M from a JV of Joyland Management, Meral Property Group, and Loketch Group – The newly completed 13-story asset includes ground-floor retail and amenities; pricing near $795K per unit (TheRealDeal)

Industrial

PGIM Real Estate buys 214K SF Class A warehouse in Newark, CA for $78M from Los Angeles County Employees Retirement Association – The single-building acquisition is part of the 367K SF Newark Distribution Center (TheRealDeal)

Office

Lone Star Funds buys Alhambra office complex in Coral Gables, FL for $119.6M from DWS Group and RREEF, affiliates of Deutsche Bank – The sale marks an exit near prior cost after more than a decade of ownership (CommercialObserver)

DivcoWest partners with Grove Real Estate Partners to buy Campus at Trimble office and R&D complex in San Jose, CA for $63.6M – The off-market deal marks a steep discount to prior pricing and extends DivcoWest’s strategy of acquiring Silicon Valley office assets at reset valuations (CoStar)

Retail

REIT W.P. Carey buys a national portfolio of 10 Life Time fitness properties across major U.S. metros for about $300M from TPG Angelo Gordon – The net-lease deal expands W.P. Carey’s retail exposure and keeps all locations occupied by Life Time under long-term leases (CoStar)

Land

Fulltime Management and Montgomery Street Partners buy FiDi development site in Manhattan, NY for $53M from Lexin Capital – The transaction transfers one of the neighborhood’s last large-scale residential development opportunities (CommercialObserver)

Proptech & Innovation

Rithm Capital’s Newrez invests in HomeVision to expand AI underwriting – The platform is automating income, asset, and credit analysis across a $878B servicing book (Inman)