The Brick Breakdown

🌐 Tariff relief lifts markets, but China faces higher costs

Trump paused tariff hikes for most countries for 90 days, triggering a stock market rally, but raised tariffs on Chinese goods to 125 percent, escalating trade pressure on Beijing. While the pause offers short-term relief to global supply chains, businesses remain on edge as tariff-driven price hikes could begin by June.

🏠 Home affordability squeezed by rising costs

Affordability challenges are deepening as construction costs climb by $12,800 per home due to new tariffs, while down payments surged 14.4 percent year-over-year to $30,250. Buyers are adapting by opting for smaller homes, averaging just 1,800 square feet, even as mortgage applications jump on a dip in rates to 6.61 percent.

🏢 Office markets diverge as coastal metros surge

Manhattan and San Francisco posted their strongest office leasing quarters in years, with tech and professional services leading activity and pushing down availability rates. But construction has slowed sharply nationwide, with under-construction office volume hitting a new low of 20.7 million square feet as preleasing lags in markets like Dallas and South Florida.

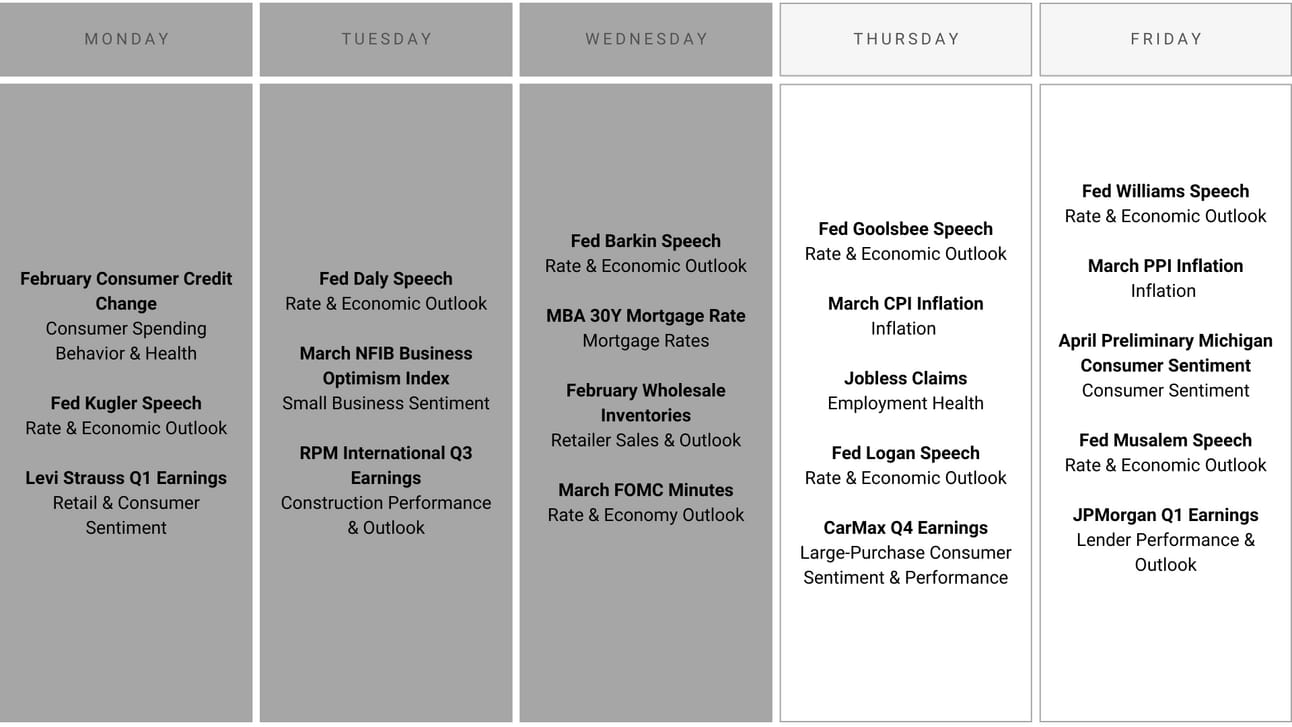

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 7.00% (+15 bps)

10Y Treasury Yield: 4.28% (-13 bps)

FTSE NAREIT Index: 725.78 (+5.88%)

30-day SOFR Average: 4.34%

Market Pulse

Markets rallied after Trump paused tariff hikes for most countries, but uncertainty remains as China faces steeper 125% duties and Fed officials warn that price increases from tariffs may begin as early as June

Trump pauses tariff hikes for 90 days on most countries and raises China tariffs to 125% – U.S. stock market rallies as President announces temporary relief for other nations (Bloomberg)

Richmond Fed’s Tom Barkin says tariff-driven price hikes may start by June – Businesses face uncertainty, with rising costs as pre-tariff inventories deplete (Axios)

Residential

Affordability challenges are reshaping the housing market as tariffs add $12,800 to homebuilding costs and the average home size shrinks to 1,800 square feet. While high-end homes remain resilient and mortgage applications surged on lower rates, rising down payments continue to squeeze entry-level buyers.

Tariffs to increase homebuilding costs – New tariffs expected to raise single-family home construction costs by $12,800, adding pressure to small builders (Bloomberg)

Home sizes shrink as affordability challenges rise – Average home size falls to 1,800 sqft in March, down 7% since 2020, with higher prices and mortgage rates pushing buyers toward smaller homes (FT)

Down payments hit new high – National median up 14.4% to $30,250 in Q4 2024, driven by rising home prices, with sharp regional differences as Northeast sees increases and South sees declines (Realtor.com)

High-end homes outperform – $1M+ homes now make up 7.6% of sales, driven by buyers with strong equity, while time on market for luxury properties remains steady (Realtor.com)

Mortgage applications jump 20% week-over-week – Refinance applications soar 35% as rates dip to 6.61%, the lowest since October 2024, driving purchase activity (MBA)

Office

Office leasing is rebounding in key markets like Manhattan and San Francisco, where activity hit multi-year highs and availability rates declined. But with just 20.7 million square feet under construction nationwide, future supply may lag if demand continues to build.

Office construction falls to new lows in top U.S. markets – 20.7M SF under construction at Q1 2025, down from 24.8M SF at 2024’s end, with slow starts and limited preleases, especially in South Florida and Dallas (Bisnow)

Manhattan office leasing surges 11.6% in Q1 2025 – Strongest quarterly leasing since Q4 2019, with availability rate dropping to 16.1%, lowest since February 2021, and asking rents up 1.5% to $74.53/SF (Colliers)

Tech deals drive San Francisco office leasing to 10-year high – Leasing activity hits 3.4M SF in Q1 2025, with availability rate dropping 100 bps to 35.6% (GlobeSt)

Industrial

Amazon announced a $15 billion expansion plan for 80 new warehouse facilities, while new 25% tariffs on steel and aluminum threaten to raise construction costs and slow broader industrial development

Amazon plans $15B warehouse expansion – 80 new facilities including delivery hubs and robotic fulfillment centers, signaling recovery from post-pandemic slowdown despite tariff uncertainties (Bloomberg)

Tariffs hike industrial construction costs – New 25% steel and aluminum duties, along with rising materials costs, threaten to further slow industrial development already at decade-low levels (CoStar)

Market Mix

NOI growth strong for high-demand medical outpatient spaces – Rent growth varies from 2.5% in Portland to 11% in Northern New Jersey, with premium properties outpacing mid-tier spaces (GlobeSt)

Financings

Chartres Lodging lines up $300M CMBS loan to refinance Sheraton Dallas – Loan backed by Goldman Sachs and J.P. Morgan, with Driftwood Capital providing $35M in mezzanine debt (Bisnow)

TS Communities lands $166M for 244-unit NYC affordable housing – 18-story Queens building will include supportive housing and amenities (REBusinessOnline)

Former WeWork founder Adam Neumann secures $155M financing for Miami condo project – Flow House, a 40-story tower with 466 units, to be completed by Q4 2025 (CommercialObserver)

Citigroup refinances Brooklyn apartments with $88M loan – 138-unit development at 828 Metropolitan Avenue features affordable housing and commercial space (Commercial Observer)

Affinius Capital lends $74M for Eastport Logistics in Boise, Idago – 682K SF industrial project near Micron Technology (CommercialObserver)

Octagon Finance lends $68M for Richmond, VA office-to-residential conversion – Kalyan Hospitality and RPC Capital to transform office building into 301 apartments with retail space (CommercialObserver)

Lynd Living secures $58.75M refinance for Potranco Commons in San Antonio, Texas – 360-unit mixed-income development refinanced with Ladder Capital to navigate market conditions (BizJournals)

M&A

Company M&A

Bain Capital buys Sizzling Platter for over $1B – Restaurant-chain operator, with franchises like Dunkin’ and Wingstop, sold by CapitalSpring despite tariff uncertainties (Bloomberg)

Building & Portfolio M&A

365 Nicollet apartment tower in Minneapolis, Minnesota for sale – The 370-unit, 30-story tower in Minneapolis is priced below replacement cost, with an estimated market value of $105.5M (BizJournals)

Roxborough Group buys 243-unit Union Flats in Union City, California for $81.6M – 20% below appraised value, marking its first Northern California multifamily acquisition (BizJournals)

Distress Watch

Harwood International loses Dallas office tower to foreclosure – Spear Street Capital acquires Harwood No. 4 after $80M loan default (BizJournals)

Proptech & Innovation

Real estate brokerage Douglas Elliman launches AI-powered website – Features home search tool, agent-client collaboration, and lifestyle hub (Inman)