The Brick Breakdown

Hello Brick Brief readers,

Happy Friday! Today we’re seeing national homebuilders come under fire from Trump, retail hold steady with tight supply, and data center demand outpace capacity despite a record $400B buildout.

🏠 Builders Under Fire

Trump’s attack on “Big Builders” and FHFA’s looming disclosure rules wiped about $19.5B from public homebuilders’ market value. Although the housing affordability crisis is very real, it can be attributed to a variety of factors such as rising labor and material costs, higher mortgage rates, and restrictive zoning, just to name a few.

🛍️ Retail Holds Firm

Retail vacancies stayed flat at 4.3% in Q3 as steady mall absorption offset slower leasing. Limited speculative development and solid occupancy gains kept availability tight and supported rent growth heading into the holiday season.

💻 Data Center Crunch Deepens

Microsoft expects cloud capacity shortages through mid-2026 as AI demand outpaces the record $400B data center construction underway in 2025. Power constraints and zoning delays are slowing deliveries, keeping major hubs like Northern Virginia and Phoenix undersupplied despite massive ongoing buildouts.

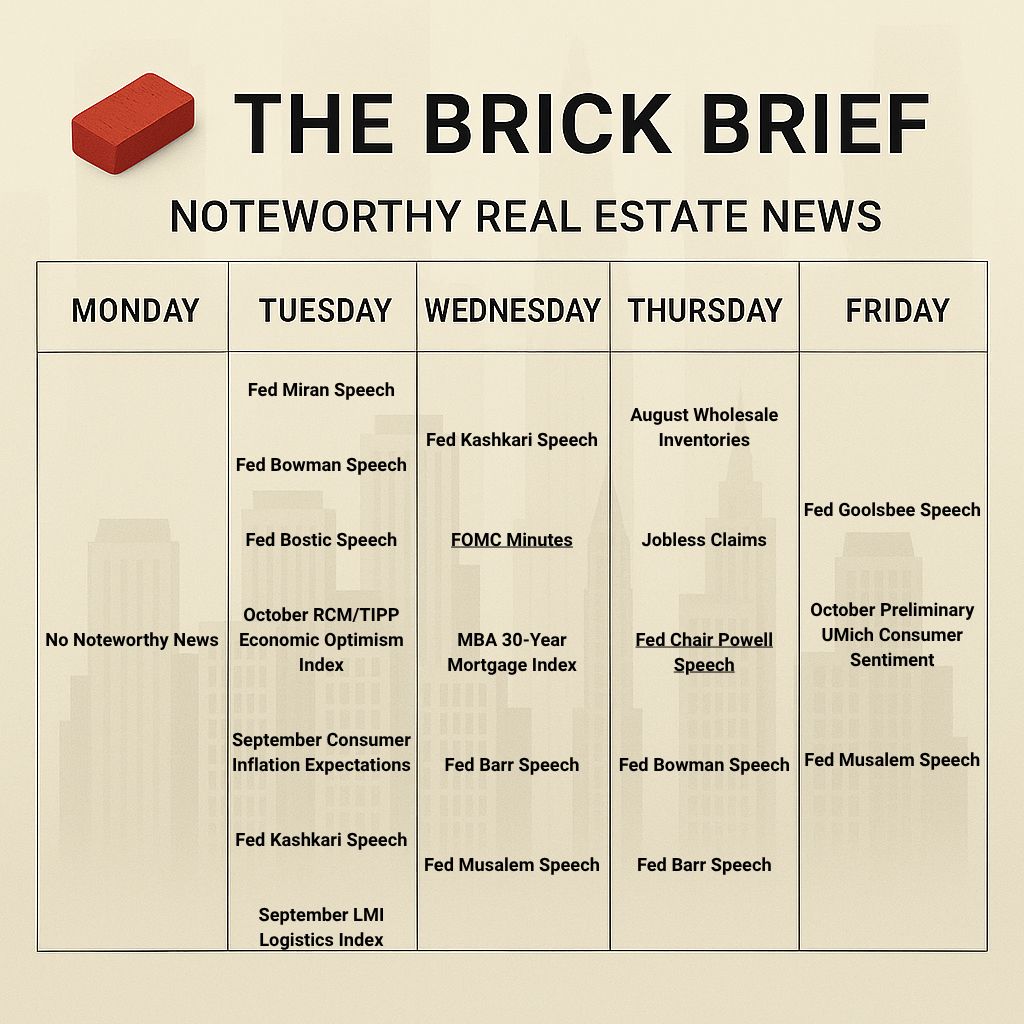

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.38% (+2 bps)

10Y Treasury Yield: 4.14% (+3 bps)

WSJ Prime Rate: 7.25%

FTSE NAREIT Index: 759.80 (-0.54%)

30-day SOFR Average: 4.24%

Market Pulse & Rate Watch

Cooling job growth and early layoffs strengthen the case for rate cuts in 2025, although a minority of Fed officials warn that tariff-driven price pressures could keep inflation sticky

Jobless claims rise to 235K amid shutdown – JPMorgan estimates filings increased for a second week as early layoffs linked to the federal shutdown emerge and hiring remains muted in a “no firing, no hiring” labor market (Reuters)

Fed’s Williams backs more rate cuts in 2025 – The New York Fed chief sees room for additional easing to support a cooling labor market while keeping inflation near 3%, saying tariffs have added only modest price pressure (Reuters)

Fed Governor Michael Barr warns tariffs could unmoor inflation expectations – Barr said price pass-throughs may keep inflation elevated and force higher rates, diverging from colleagues focused on labor market risks (NationalMortgageNews)

🧱 The Brick Lens🔎

Key Themes Today

The Fed is caught between tariff-driven inflation and a weakening labor market. Whichever force proves stronger will shape the path of interests rates.

Affordability remains a challenge for homebuyers, with the housing market slowing and Sunbelt markets seeing the steepest pullback as inventory climbs.

Hyperscalers are fueling a $400B data center buildout in 2025 that is straining power grids, reshaping energy demand, and leaving utilities to consolidate through M&A.

Residential

Zillow expects mortgage rates to end 2025 in the mid-6% range – The forecast reflects steady rates amid limited economic data during the government shutdown, with slower listings giving buyers more negotiating power (Zillow)

Mortgage rates fell for the first time in three weeks to 6.3% – Buyers gain slight relief but remain cautious as high prices, economic uncertainty, and a government shutdown weigh on confidence (Bloomberg)

Fall housing markets heat up as rates near 12-month lows – Buyer demand and listings are rising in cities like Chicago and San Francisco, while agents in Los Angeles and other metros say uncertainty still limits activity (Homes.com)

Home listings rose 2.3% YoY through Oct. 5 as buyers stayed sidelined – Pending sales fell 1.3% as many waited for lower mortgage rates and clearer economic signals (Redfin)

Insight: At first glance these two reports seem to tell opposite stories, one painting a picture of a housing market heating up while the other shows buyers retreating. In reality both reflect the same trend, where select metros are seeing renewed activity as rates ease but the broader market remains constrained by high prices and cautious sentiment.

Trump and FHFA chief Bill Pulte spark $19.5B homebuilder selloff – Stocks tumble as new criticism of “Big Builders” and looming disclosure rules compound margin pressure, tariffs, and rising inventories (Bloomberg)

Insight: Trump accused major builders of sitting on millions of empty lots and urged them to start building homes, blaming them for a significant part of the affordability crisis. The problem is very real, with housing prices up about 40% in the past five years, but is there one clear cause behind it? We can look to a variety of factors, such as rising labor and material costs, higher financing expenses, and restrictive zoning and regulations in cities that need new housing most. In the Sunbelt, where national homebuilders were most active and profitable in recent years, prices are now falling as new-home supply and housing inventory has outpaced demand.

Individual investors made 59% of all investor home purchases in 2024, the highest on record – Realtor.com data shows small landlords bought 361,900 homes as tech tools lowered barriers to entry and affordability pressures sidelined traditional buyers (CommercialObserver)

Government shutdown halts flood insurance program – Lapse in NFIP prevents new and renewed policies, stalling up to 1,400 home sales a day and leaving flood-zone buyers without coverage during hurricane season (Bloomberg)

U.S. apartment rents fall $6 in September to $1,750 – National rents turned negative for the first time since 2022 as annual growth slipped to 0.6%, with weakness in oversupplied Sun Belt metros offset by gains in coastal cities (ConnectCRE)

Office

BGO Head of Research Ryan Severino expresses cautious optimism on office real estate – He notes the sector remains complex and misunderstood after pandemic-era shifts but sees signs of gradual stabilization ahead (IREI)

Leasing

Scale AI subleases 80K-SF office at One World Trade Center in New York, NY – The San Francisco-based AI firm took two floors from Wunderkind at $65 per SF, expanding its NYC operations through 2030 (CommercialObserver)

FlightWave Aerospace leases 51K-SF industrial and office space at 2660 Columbia Street in Torrance, CA – The Red Cat Holdings subsidiary tripled its footprint in a $5.4M, five-year deal with landlord First Industrial Realty Trust (TheRealDeal)

Industrial

Smaller tenants now drive U.S. industrial leasing – Activity from 50K–100K SF users and regional manufacturers is rising 50% YoY as large occupiers stay sidelined amid trade and economic uncertainty (GlobeSt)

U.S. container imports fell 8.4% YoY in September – Shipments from China plunged 23% as Trump’s escalating tariffs disrupted trade flows and pushed retailers to frontload goods (Reuters)

Imports from China plunged 22.9% YoY in September – Tariffs drove sharp declines across aluminum, footwear, and machinery (FreightWaves)

Retail

Retail vacancies held steady at 4.3% in Q3 – Mall vacancies fell 30 bps while shopping center rates were unchanged (Colliers)

Retail construction totaled 50.8M SF in Q3 – Limited speculative projects and 7.7M SF of deliveries are keeping supply tight and supporting rent growth (Colliers)

Retail absorption reached 4.6M SF in Q3 despite an 8.6% leasing drop – Both malls and shopping centers added over 1M SF of occupancy, keeping availability near historic lows ahead of the holidays (Colliers)

Data Centers

Microsoft forecasts data center shortages through mid-2026 – Internal projections show Azure capacity constrained in major U.S. hubs as AI-driven demand outstrips supply, extending the company’s cloud crunch beyond earlier expectations (Bloomberg)

Market Mix

$100M+ single-asset deals hit record highs – Capital floods into logistics, multifamily, and retail while portfolio sales and office stay 20% below 2019 levels (GlobeSt)

Life Sciences

Life science vacancies climb to 33% in Greater Boston – Overbuilding in Somerville and Watertown and weak VC funding leave more than half of suburban lab space empty (Bisnow)

Healthcare

Clarion Partners plans to invest up to $1B annually in senior housing – The $73B asset manager made its first purchase in Mechanicsville, VA as aging boomers and limited new supply drive 90%+ occupancy across top-tier communities (Bisnow)

Financings

Loans

Invictus Real Estate provides $60M construction loan for 266-unit multifamily project in Plainfield, NJ – Ramani Group secured the financing arranged by Cushman & Wakefield for a transit-adjacent development with 10K SF of retail (CommercialObserver)

Refinancings

Morgan Stanley provides $1B loan to refinance 14M-SF industrial portfolio across multiple U.S. markets – Investcorp secured the balance sheet financing for four portfolios spanning 130+ assets in Phoenix, Orlando, and other metros (CommercialObserver)

Structured Finance

BXP secures $465M green bond financing for The Hub on Causeway in Boston, MA – Wells Fargo, Morgan Stanley, and Bank of America provided the 5.5-year fixed-rate loan to refinance $490M in existing debt on the mixed-use complex (ConnectCRE)

NGP Group extends $660M loan to 2027 for 2.6M-SF federal office portfolio across 19 states – U.S. Bank approved the extension after NGP added equity for leasing and capital needs (CommercialObserver)

M&A

Building & Portfolio M&A

Office

Drawbridge Realty acquires 190K-SF The Hive office campus in Costa Mesa, CA for $78M – Invesco sold the 14-acre property at a discount from its 2018 purchase price of $84M (CommercialObserver)

CrossHarbor Capital Partners acquires 380K-SF office complex in Reston, VA for $53M – Brookfield sold One and Two Halley Rise as part of its broader repositioning of the Halley Rise mixed-use district (Bisnow)

Industrial

Terreno Realty sells 603K-SF warehouse at 130 Interstate Blvd in South Brunswick, NJ for $144M – The REIT bought the property for $22.5M in 2010 and achieved a 13.4% IRR; O’Neill Logistics remains the sole tenant (TheRealDeal)

Multifamily

AEW Capital Management acquires 369-unit The Ovelo apartments in Hollywood, CA for $159M – Cal-Coast Development and Encore Capital’s Rescore REIT sold the 7-story property for about $431K per unit (TheRealDeal)

Distress Watch

U.S. foreclosures rise 17% YoY in Q3 – 101,513 properties received filings as repossessions climbed 33% and average completion times fell to their shortest since 2020 (HousingWire)

Proptech & Innovation

82% of Americans now use AI for housing insights – Realtor.com survey finds ChatGPT and Gemini leading adoption, though agents remain the most trusted and accurate market source (Realtor.com)

Insight: ChatGPT recently integrated with Zillow, letting users search listings and access housing insights directly within the platform. As these capabilities expand, we can expect reliance on AI tools to (obviously) continue growing across the real estate market.

90% of institutional real estate firms have AI teams or plans in place, yet 93% cite adoption barriers – Dealpath’s survey highlights challenges from limited expertise, compliance hurdles, and data fragmentation despite accelerating AI adoption (IREI)