The Brick Breakdown

Hello Brick Brief readers,

Happy Friday. Today we’re seeing expected 2026 housing affordability gains, TSMC undercut the AI bubble narrative, and industrial demand bifurcate

🏡 Housing Activity Remains Supply-Constrained

December pending home sales slid to a near-record low, while December new home purchase demand rose 2.5% YoY; the weakness in pending sales reflects an inventory shortfall, as new listings fell 4.9% YoY to a two-year low and active listings declined 1.1% MoM. Monthly housing payments, however, have fallen to a ~2-year low, and Zillow expects housing affordability to continue to improve in 2026 as mortgage rates drift toward ~6%.

🤖 TSMC Undercuts The AI Bubble Narrative

Taiwan Semiconductor Manufacturing Co. pushed back on AI bubble fears by lifting its 2026 capex outlook to $52–$56B, a ≥25% YoY increase despite chips being highly cyclical and prone to oversupply-driven margin pressure. TSMC is historically conservative with capital, and CEO C.C. Wei went directly to Nvidia’s hyperscaler customers to validate that AI is producing real use cases and measurable financial returns to ensure demand was credible and not driven by speculative spending.

🏭 Industrial Demand Rebounds With Clear Bifurcation

U.S. industrial demand rebounded in 2025 as leasing grew 11% YoY, with large users favoring newer automation-ready facilities. The industrial market is becoming more bifurcated, with Class A logistics assets trading at ~4.5%–6.5% cap rates versus ~7%–8% for secondary, older assets.

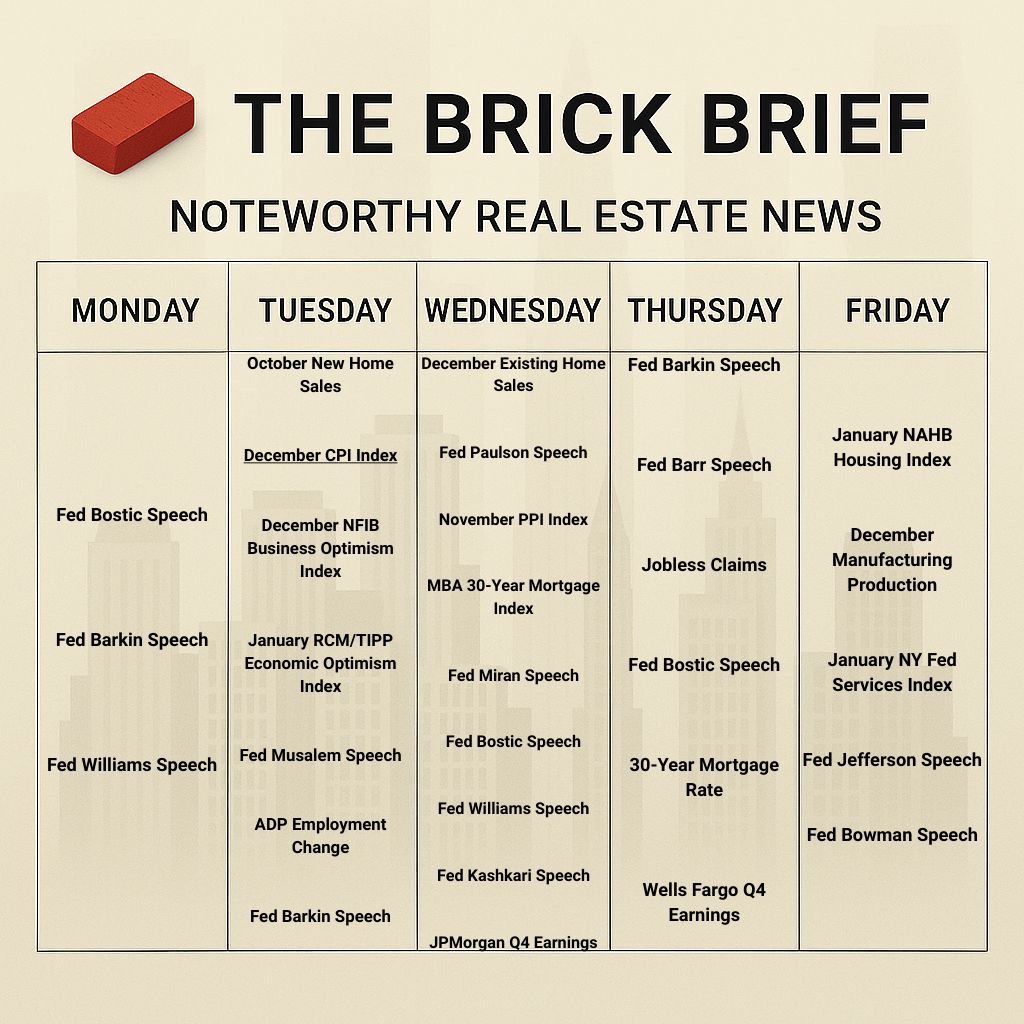

This Week in Real Estate: Key Events & Data

Quick Markets

30Y Mortgage: 6.04% (-3 bps)

10Y Treasury Yield: 4.17% (+3 bps)

WSJ Prime Rate: 6.75%

FTSE NAREIT Index: 777.75 (+0.55%)

30-day SOFR Average: 3.70%

Market Pulse & Rate Watch

Weekly US jobless claims fall to 198K – The decline reflects seasonal noise as the labor market remains low-hire low-fire with limited job creation and cautious employer demand (Reuters)

Fed’s Goolsbee says inflation must fall before further rate cuts – He said the labor market looks stable but emphasized the Fed needs clear evidence inflation is moving back toward 2% before easing policy (Reuters)

Fed’s Paulson says rate cuts can wait – She said policy is well positioned and signaled no urgency to lower rates (WSJ)

Fed’s Daly says policy is in a good place – She signaled comfort holding rates steady at 3.50%–3.75% while the Fed calibrates policy deliberately amid stabilizing growth and labor markets (Reuters)

Market Mix

CRE dealmaking fell 10% YoY in November – Transaction volume dropped to ~1,800 deals as capital concentrated in $100M+ Class A assets led by multifamily, medical office, and data centers (CNBC)

US construction labor shortage set to worsen as data centers expand – The industry needs ~349K workers in 2026 and ~456K in 2027 as AI-driven data center builds collide with retirements and tighter immigration enforcement (Bisnow)

CREFC January 2026 sends a clear signal – CRE finance has moved past crisis management and into a capital deployment phase despite lingering risk (Trepp)

NYC commercial property values rise 4.3% YoY to ~$350B – Gains are being driven by leasing strength in trophy offices while lower-quality buildings continue to lag (Bloomberg)

BREIT posts 8.1% gain in 2025, its best performance in three years – Blackstone’s flagship real estate fund benefited from AI-driven data center demand; QTS growth lifted data centers to ~21% of the portfolio and pushed assets above $54B (Bisnow)

Policy & Industry Shifts

Ohio lawmakers push senior foreclosure protections – House Bill 443 would block property tax foreclosures on owner-occupied homes of residents 65+ who make monthly payments (HousingWire)

Residential

US 30-year mortgage rate drops to 6.06%, near ~3.5-year low – Rates fell after FHFA began mortgage bond purchases, offering modest relief but still well above levels needed to unlock housing turnover (Reuters)

New home purchase mortgage demand rose 2.5% YoY in December – Applications fell 3% MoM, but builder incentives and available inventory kept new homes attractive despite an annualized sales pace of 640K units (HousingWire)

Single-family rent growth stalled in 2025 below 0.25% – Elevated vacancies near ~6% and affordability pressure kept median three-bedroom rents flat at ~$2,100, pushing investors toward smaller suburban markets while renter purchasing power improved (GlobeSt)

Pending home sales slid to a near-record low in December 2025 as rates stayed above 6% – Sales fell 5.9% MoM and buyers remained cautious despite modest price concessions (Redfin)

Low pending home sales in December were driven by an inventory shortfall. New listings were down 4.9% YoY to a two-year low, and active listings declined 1.1% MoM, leaving buyers with little to transact despite mortgage rates in the low-6% range.

Monthly housing payments fell to a ~2-year low as mortgage rates briefly dipped below 6% – The median payment dropped 5.5% YoY to $2,413, lifting buyer purchasing power even as prices stayed slightly higher (Redfin)

Housing affordability should improve in 2026 as mortgage rates drift toward ~6% – Zillow expects 20 of the 50 largest metros to become affordable again, with mortgage payments taking a smaller share of income even as home prices keep rising modestly (Zillow)

Buyer confidence is returning as the housing market stabilizes – Homes.com economist Brad Case points to a 5.1% December jump in resales and mortgage rates near ~6.2% as signs the market feels balanced again (Homes.com)

Rent compression defined the December rental market – National rents kept falling YoY but the lowest-priced units saw the strongest long-term growth, concentrating affordability pressure on lower-income renters even as top-end rents softened (Realtor.com)

Office

Miami office leasing jumped 36% YoY in 2025, but cracks emerge – Leasing hit 5.0M SF and asking rents rose to ~$63/SF; concessions and subleasing also increased despite strong headline demand (CommercialObserver)

Washington, DC office leasing stabilizes heading into 2026 – Q4 leasing totaled 1.9M SF and annual volume held at 7.2M SF, as tenant losses have largely level off (CommercialObserver)

Leasing

webAI leases 40K SF at 515 Congress Avenue in Austin, TX – KBS Realty Advisors expanded the AI startup across multiple floors and added rooftop signage as the company scales its downtown headquarters (TheRealDeal)

Industrial

U.S. industrial demand rebounded in 2025 with 176.8M SF of net absorption and 11% YoY leasing growth – Large users favored newer, automation-ready facilities as construction slowed, vacancy held near ~7%, and supply-demand conditions tightened into 2026 (GlobeSt)

Industrial investment sales hit $68.4B in 2025 – Class A logistics trade at ~4.5%–6.5% cap rates versus 7%–8% for secondary assets, highlighting a sharp quality split as the market normalizes (GlobeSt)

E-commerce distribution center traffic stayed positive YoY throughout 2025 – Consistent foot traffic pointed to durable logistics demand driven by omnichannel fulfillment and faster delivery expectations (Placerai)

Manufacturing foot traffic rebounded in December after a volatile 2025 – The year-end uptick signaled stabilization as factories operated leaner amid automation and demand uncertainty (Placerai)

Inland Empire East industrial posted 2.1M SF of positive absorption in Q4 2025 – Build-to-suit and 3PL deals drove demand as vacancy stabilized at ~8.2% (GlobeSt)

Retail

Brick-and-mortar retail traffic rose 2.4% YoY in Q4 2025 – Physical stores closed the year with their strongest gains as in-person shopping complemented e-commerce during the holiday season (Placerai)

Data Centers

TSMC lifts 2026 capex outlook to $52–$56B – The spending plan implies a ≥25% YoY increase as AI-driven data center demand stays strong (YahooFinance)

Chips are cyclical and prone to long periods of over- and undersupply, which makes capex discipline critical for protecting margins. In the AI stack, Nvidia designs the chips, TSMC manufactures them, and hyperscalers drive end demand. That is why CEO C.C. Wei went directly to Nvidia’s customers to validate that AI is delivering real use cases and clear financial returns. Given TSMC’s long history of conservative capex decisions to avoid oversupply, a meaningful lift in 2026 spending is a strong signal that management sees AI demand as durable and structural.

AI hyperscalers set to drive higher US corporate bond issuance in 2026 – Barclays forecasts $2.46T of supply as the Big Five hyperscalers ramp borrowing to ~$140B per year to fund data center and AI infrastructure buildouts (Reuters)

Trump moves to force data centers to fund new power generation via PJM emergency auction – A one-time 15-year reliability auction could back ~$15B of new plants, pushing grid and generation costs onto hyperscalers instead of households (Bloomberg)

AI data centers push into rural US markets – Tech giants are siting massive campuses in places like Idaho, Louisiana, Texas, Ohio, and the Midwest to secure cheaper land, power, and water (CoStar)

PJM states are planning to cap power prices and shift grid costs to data centers – Governors and the White House are set to agree on a two-year price cap for future PJM auctions while requiring new data center operators to fund a larger share of grid expansion (Reuters)

Miner Rio Tinto to supply copper to Amazon for AI data centers – A two-year deal will feed copper from Rio’s Arizona leaching program into AWS data center builds amid tightening AI-driven supply (Reuters)

Copper prices recently hit fresh all-time highs

Financings

Loans

Centennial Bank and Lionheart Strategic Management provide $174M construction loan for Blosser Ranch multifamily project in Santa Maria, CA – The financing backs Canfield Development’s 302-unit first phase and recapitalizes the site for future phases (CommercialObserver)

Structured Finance

Bank of America originates $245M CMBS refinancing for 1105 West Peachtree office tower in Atlanta, GA – The single-asset loan refinances existing debt and adds fresh equity at the Google-anchored Midtown trophy asset owned by Selig Enterprises and Florida’s State Board of Administration (TheRealDeal)

M&A

Building & Portfolio M&A

BXP offloads $1B of noncore assets outside its premier CBD portfolio – The sales span suburban land, multifamily, office, and life sciences properties across Boston, MA; San Francisco, CA; Washington, DC; Reston, VA; and Needham, MA (Bisnow)

Healthcare

StepStone Group buys North Shore Place assisted living and memory care facility from Blue Moon Capital Partners in Northbrook, IL for $144M – The sale marks a 32% gain on Blue Moon’s 2017 purchase; ~$94M Freddie Mac acquisition financing via CBRE (TheRealDeal)

Office

Four Corners Properties sells 46K SF office property at 1540 El Camino Real in Menlo Park, CA to undisclosed buyer for ~$104M – The off-market deal marks a ~350% gain on the firm’s 2022 purchase and prices the asset at ~$2,270 per SF (TheRealDeal)

Distress Watch

CMBS special servicing eased in December – Office and lodging stress pulled the overall rate down to 10.71% even as retail drove nearly half of new loan transfers (Trepp)

Unknown firm wins $1B bankruptcy auction for Genesis HealthCare – 101 West State Street LLC topped the stalking horse with a cash-and-liabilities bid as the operator restructures over $1.5B of debt (Bisnow)

Amazon says $475M minority equity stake in Saks is now worthless after bankruptcy filing – The investment backed Saks’ $2.7B Neiman Marcus acquisition; the stake was tied to a strategic commerce and logistics partnership that Amazon argues is impaired under the Chapter 11 financing (CNBC)

Jamison’s $55M CMBS loan tied to retail center in Koreatown, Los Angeles moves to special servicing after maturity default – The borrower calls the transfer a strategic move to secure an extension while pursuing a refinance; the loan carries a ~$51M current balance and 76% occupancy (TheRealDeal)

Proptech & Innovation

Texas homebuilder Megatel launches crypto rewards after SEC no-action letter – The company will issue a payments-only token that buyers and renters can spend via a digital wallet and card (Reuters)